Disney Stock Drops as Investors Brace for a Prolonged Battle With YouTube TV

Disney shares took a sharp hit this week as investors digested a blend of encouraging operational results and unsettling industry headwinds. The stock slid about 8% following the company’s latest quarterly earnings report, closing near $109, after Disney posted roughly $22.5 billion in fiscal fourth-quarter revenue—essentially flat year-over-year and slightly below Wall Street’s expectations of about $22.75 billion. While adjusted earnings of $1.11 per share surpassed analyst forecasts, the revenue miss reinforced concerns that strength in streaming and theme parks is still struggling to fully counterbalance the ongoing decline in Disney’s traditional television business.

Adding to market jitters, Disney cautioned that its escalating carriage dispute with YouTube TV could extend well beyond the short term. The blackout, which began on October 30, has already left millions of subscribers without access to ABC, ESPN, and other Disney networks. On the company’s earnings call, CFO Hugh Johnston warned that negotiations could be “a challenging battle” and emphasized that Disney had built a financial “hedge” into its outlook to account for a prolonged standoff. With the dispute dragging into its third week—and with analysts estimating tens of millions in lost revenue for Disney each week—the conflict has become a fresh pressure point for a company navigating a rapidly shifting media landscape.

Streaming and Parks Power Results

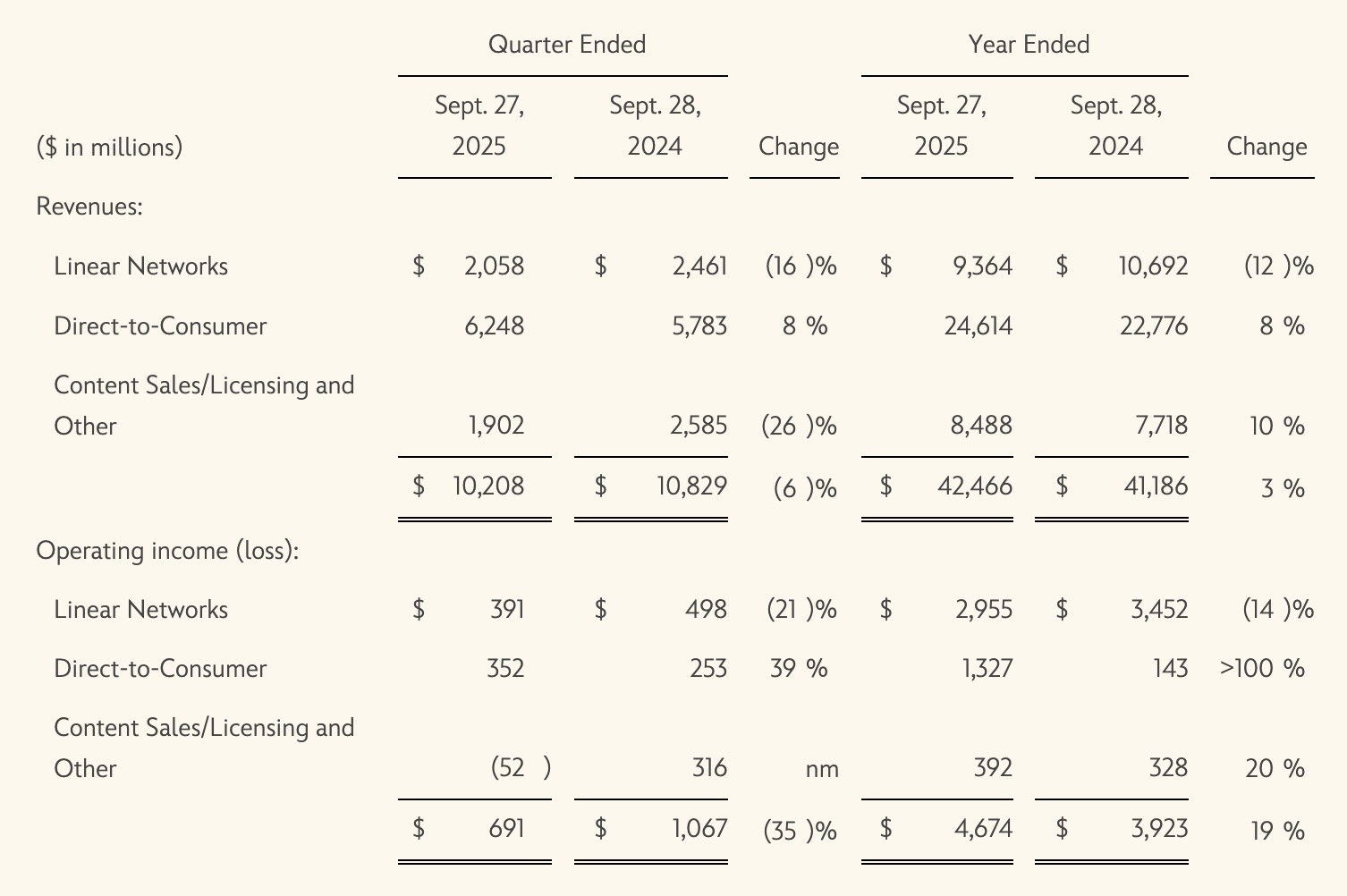

Despite the market’s reaction to the revenue miss, Disney’s latest earnings report highlighted two bright spots: the company’s fast-growing streaming division and its resilient parks and experiences business. Streaming revenue—driven by Disney+, Hulu, and ESPN+—rose about 8% in the quarter, with operating income surging 39% year-over-year to $352 million. The company added roughly 12.5 million new subscribers across Disney+ and Hulu, bringing its combined total to about 196 million. Executives credited the gains to improved content performance, pricing adjustments, and increased traction for ad-supported tiers, which are becoming an important profitability lever as streaming matures.

Disney’s parks, experiences, and products segment delivered another strong showing as well. Operating income climbed to a record $1.88 billion, up 13% from the prior year, buoyed by higher attendance at domestic parks, robust demand at international resorts, and strong bookings across Disney’s expanded cruise line. Management pointed to continued investment in new attractions, upgraded park experiences, and recently launched cruise ships as contributors to the segment’s sustained momentum. With parks generating some of the company’s highest margins, Disney sees this division as a foundational pillar of its post-pandemic growth strategy—one capable of offsetting other areas of weakness within the broader portfolio.

Cable-TV Unit Under Pressure

While streaming and theme parks continue to energize Disney’s long-term growth narrative, the company’s traditional television business once again weighed on quarterly performance. Operating income for Disney’s linear networks—its broadcast and cable channels, including ABC and ESPN—fell sharply, with the unit generating just $391 million in profit for the quarter, down 21% from a year earlier. Lower advertising revenue, declining pay-TV subscribers, and fewer marquee sporting events compared with the prior year all contributed to the downturn. The entertainment segment more broadly, which includes Disney’s cable networks and television studios, saw operating income fall more than a third to $691 million, as the studio division struggled against lighter licensing revenue and the absence of last year’s blockbuster film releases.

Executives were candid that these legacy headwinds are likely to persist. Industry-wide declines in cable subscriptions, coupled with weaker political advertising, continue to erode the economics of traditional TV. Analysts have noted that while Disney’s streaming gains help close the gap, the shift from linear to digital revenue is not yet dollar-for-dollar. Until the company’s streaming businesses achieve higher average revenue per user and ESPN’s transition to direct-to-consumer distribution becomes more mature, linear TV remains a drag on overall revenue growth. For investors, the challenge is clear: Disney is successfully building its future, but the past is still catching up with the present.

Prolonged YouTube TV Carriage Fight

The dispute with YouTube TV has quickly become one of Disney’s most pressing operational challenges, adding a layer of uncertainty at a time when the company is already grappling with shifting media economics. The blackout began on October 30, when YouTube TV removed Disney-owned channels—including ABC, FX, National Geographic, and ESPN—after negotiations over carriage fees broke down. Since then, more than 10 million YouTube TV subscribers have been without access to Disney content, a disruption that analysts warn could meaningfully impact both advertising revenue and subscriber-based fees if the stalemate extends deeper into the quarter.

Disney executives signaled during the earnings call that the company is prepared for a long fight. CFO Hugh Johnston characterized the negotiations as “a challenging battle” and said Disney had “built a hedge” into its outlook to account for the possibility that the blackout continues for “a little while.” He also emphasized that Disney is “ready to go as long as [YouTube TV] wants,” suggesting that the company has little intention of conceding on pricing. CEO Bob Iger later reinforced that message, saying Disney is standing firm to ensure its programming is valued on par with agreements it maintains with other distributors.

Analysts estimate that the dispute may already be costing Disney $10 millions per week, particularly because ESPN’s sports rights, news programming, and prime-time ABC content are traditionally high-value assets for distributors. Some estimates suggest a two-week blackout could reduce Disney’s revenue by as much as $60 million, depending on the timing of major sports events. For YouTube TV, the absence of ESPN and ABC during peak sports season presents real retention risks, but Google has maintained that it is seeking only “fair market pricing” in line with other recent deals.

As the blackout moves into its third week, both companies appear entrenched. Disney is aiming to protect the long-term economics of its linear network portfolio, while YouTube TV is pushing back against rising sports and cable fees that have made virtual pay-TV bundles increasingly costly. For investors, the standoff heightens short-term uncertainty and adds pressure to an already fragile segment of Disney’s business at a critical moment in its transformation.

Analyst Outlook and Market Reaction

Analysts and investors have responded to Disney’s latest earnings with a mix of caution and longer-term optimism. While the company delivered an earnings beat and showcased strong growth in streaming and parks, Wall Street zeroed in on the revenue shortfall and the unpredictable nature of the YouTube TV dispute. Several analysts noted that the flat $22.46 billion in quarterly revenue—just under the $22.75 billion forecast—suggests that Disney’s high-growth segments are not yet fully compensating for the erosion of its linear television business. The result: a market narrative still centered around transition-driven volatility rather than stabilized momentum.

Industry analysts highlighted the potential financial impact of the YouTube TV blackout as a key risk factor. Ross Benes, senior analyst at eMarketer, said the absence of Disney networks from one of the nation’s largest digital TV distributors represents “a meaningful hole for sports fans and advertisers alike,” pointing specifically to ESPN’s role in driving subscriber engagement. Morgan Stanley estimated that the dispute could reduce Disney’s revenue by as much as $60 million over a two-week blackout, depending on advertiser flight and timing of major sports events. Though these figures represent temporary pressures, analysts say prolonged uncertainty could weigh on forward estimates for the first half of 2026.

Where opinions diverge is on the stock’s long-term trajectory. Several analysts cited in recent investor notes remain constructive, pointing to Disney’s robust free cash flow, improving streaming economics, and parks profitability. Consensus price targets hover around $134, representing potential upside of more than 14% from the stock’s post-earnings dip near $109. Many view the share decline as a valuation reset rather than a sign of fundamental deterioration. The company’s reaffirmed outlook—calling for double-digit adjusted EPS growth in fiscal 2026—also helped reassure investors that management sees clear earnings visibility once near-term disruptions ease.

Still, sentiment is far from euphoric. Wall Street is increasingly focused on the pace at which Disney can scale its direct-to-consumer margins and how quickly the company can stabilize its linear TV revenues as the industry transitions. As one portfolio manager put it, “Disney is executing the right strategy, but the timing is the market’s biggest question.” For now, the stock’s latest slide reflects a market balancing act: weighing short-term turbulence against signs of a stronger, more economically diversified Disney emerging over the next several quarters.

Stronger Shareholder Returns Offset Near-Term Uncertainty

Amid the volatility surrounding its earnings and the YouTube TV dispute, Disney moved to reinforce investor confidence by boosting its shareholder returns. The company announced a 50% increase in its annual dividend, raising the payout to $1.50 per share for fiscal 2026, split into two installments. In addition, management doubled its share repurchase authorization to $7 billion, underscoring its commitment to deploying excess cash toward shareholders even as certain parts of the business face structural headwinds. These actions were enabled by Disney’s strong free cash flow generation, which exceeded $19 billion in fiscal 2025, and a healthier balance sheet supported by stable park revenues and improving streaming profitability.

Executives positioned the enhanced capital return program as a signal of long-term confidence rather than a defensive gesture. CFO Hugh Johnston emphasized that Disney’s cash generation is robust enough to sustain elevated dividends and buybacks while still funding major investments in content, theme park expansions, and the company’s expanding cruise line portfolio. For many investors, the increased shareholder payout serves as a stabilizing force at a time when uncertainty around the linear TV business and the YouTube TV blackout is dragging on the stock.

Still, analysts cautioned that higher dividends and buybacks alone won’t drive a sustained recovery unless Disney makes continued progress scaling its streaming margins and navigating the broader transition away from traditional cable. Nevertheless, the capital return enhancements add a meaningful cushion for shareholders as the company works through short-term challenges. Combined with Disney’s reaffirmed outlook for double-digit adjusted EPS growth in fiscal 2026, the upgraded payout structure gives investors a clearer picture of how management intends to balance growth initiatives with steady returns—even as negotiations with YouTube TV remain unresolved.

Conclusion

Disney’s latest earnings underscore a company navigating a complex transition: accelerating growth in streaming and theme parks on one side, and a shrinking linear television ecosystem on the other. The revenue miss this quarter—despite strong operating performance in key segments—reinforced how challenging that balancing act remains. At the same time, the ongoing YouTube TV blackout has added a new layer of uncertainty, with millions of subscribers cut off from Disney’s channels and a negotiation timeline that appears increasingly undefined.

Yet the company’s actions suggest management is confident in the broader trajectory. With a strengthened dividend, an expanded buyback program, and guidance pointing to double-digit earnings growth in fiscal 2026, Disney is signaling that its cash flow engines remain intact. Streaming profitability is improving, parks are hitting record highs, and the company appears committed to protecting the long-term economics of its content distribution—even if that means enduring short-term turbulence.

For investors, the road ahead is likely to be bumpy, but not without opportunity. Disney’s transformation continues, and while the company works through the last mile of legacy-TV challenges and the YouTube TV dispute, the foundation for future growth looks increasingly well defined.

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.