Ethereum Price Prediction for August 2025: Bullish or Bearish Outlook?

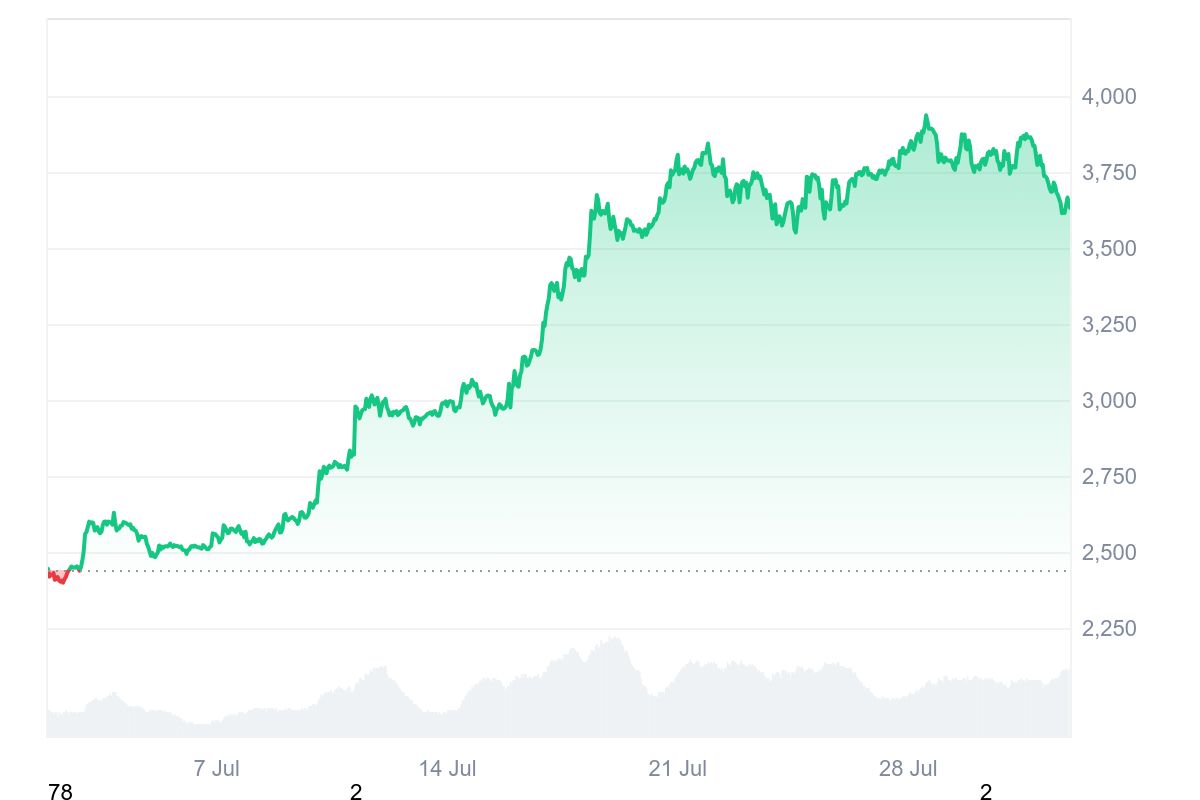

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, enters August 2025 at a pivotal moment. Over the past month, ETH has staged a powerful rally—surging more than 50% in July and briefly approaching the $4,000 mark for the first time in over half a year. This momentum arrives just as Ethereum celebrates its 10-year anniversary, underscoring its evolution from a pioneering smart contract platform into a foundational pillar of decentralized finance (DeFi), NFTs, and tokenized assets.

For investors, August 2025 raises an important question: can Ethereum maintain its bullish run, or is a correction on the horizon? With strong technical signals, growing institutional demand through spot ETH ETFs, and macroeconomic factors like U.S. Federal Reserve policy influencing market sentiment, the coming weeks could set the tone for the rest of the year.

Technical Outlook: Where Ethereum Could Head Next

ETH Price

Source: CoinmarketCap

Ethereum’s price action in late July and early August 2025 reflects a strong bullish structure. On the daily chart, ETH is trading well above its 20-, 50-, 100-, and 200-day moving averages, signaling that the broader trend remains firmly upward. The rally in July pushed ETH to a high of around $3,940, just shy of the psychologically important $4,000 level. This zone now represents the immediate resistance to watch.

Momentum indicators reinforce the positive sentiment. The Relative Strength Index (RSI) recently reached the low-80s, suggesting overbought conditions—but in a strong uptrend, such readings can persist for extended periods. The Moving Average Convergence Divergence (MACD) remains in bullish territory, with the MACD line well above the signal line, indicating sustained upward momentum. Trading volumes have been elevated compared to earlier in the year, underscoring heightened market participation.

Key support levels lie at $3,600 and $3,300. The $3,600 zone has been tested multiple times and has so far held as a solid base after short-term pullbacks. A breakdown below this could open the door to $3,300—an area that coincides with a prior breakout level from early July. On the upside, a decisive daily close above $4,000 would likely pave the way for a move toward $4,400–$4,500, a range that marks the upper boundary of the consolidation Ethereum has been stuck in for much of the past 18 months.

Ethereum Forecasts: Optimism with Caution

Analysts generally view Ethereum’s recent momentum as a sign that the uptrend could continue into August, though opinions differ on the scale of potential gains. Bullish projections point to the possibility of ETH surpassing $4,000 in the short term, which could open the door to further advances toward the mid-$4,000 range before year-end. These outlooks are grounded in Ethereum’s strong technical setup, increased institutional inflows, and the growing adoption of its network for DeFi, NFTs, and tokenized assets.

More cautious forecasts highlight the risks of a near-term pullback following July’s 50% surge. Elevated volatility, profit-taking by traders, and lingering macroeconomic uncertainties could limit upside in the weeks ahead. Options market positioning suggests some larger players are preparing for potential downside, even as the broader sentiment remains positive. In this view, August is likely to be a month of testing critical price levels, with a sustained move above $4,000 needed to confirm renewed bullish momentum.

Historical August Performance: Bull vs. Bear Trends

August has historically been a volatile month for Ethereum, with outcomes heavily influenced by the broader market cycle. In bull market years, ETH has posted exceptional gains—most notably in August 2017, when it surged over 90% as the crypto market experienced explosive growth. Post-halving years, such as 2017 and 2021, have been particularly strong, with average August returns significantly outperforming the long-term monthly average. This seasonal boost is often attributed to renewed market optimism following Bitcoin’s halving, which tends to lift the entire crypto sector.

However, August has also delivered some of Ethereum’s sharpest declines during bear phases. In 2018, for example, ETH dropped by more than 30% as the market corrected from the ICO bubble. Historical data shows that in more than half of past Augusts, ETH has closed the month in the red, with median returns slightly negative. This mixed track record suggests that while August can deliver outsized gains in the right conditions, it can just as easily serve as a month of consolidation or correction if momentum falters.

Macroeconomic and Crypto-Specific Catalysts

Several macroeconomic and sector-specific factors could influence Ethereum’s price trajectory in August 2025. On the macro side, the U.S. Federal Reserve’s interest rate policy remains a critical driver of risk asset sentiment. The Fed’s decision to keep rates steady in late July tempered expectations for imminent cuts, which briefly weighed on crypto markets. Broader geopolitical developments, such as recent trade tensions and tariff announcements, have also introduced short-term volatility, prompting swift market sell-offs followed by rapid rebounds as dip buyers stepped in.

Within the crypto space, institutional demand continues to play a major role in supporting Ethereum’s price. Spot ETH exchange-traded funds have seen sustained inflows over the past month, with billions of dollars in net purchases reducing available supply on exchanges. This growing participation from large-scale investors has coincided with a steady rise in staking activity, further locking up ETH and tightening market liquidity. Additionally, Ethereum’s upcoming “Dencun” upgrade—expected to significantly reduce Layer-2 transaction fees—could enhance network efficiency and attract greater user adoption. Together, these factors create a supportive backdrop for price appreciation, even as macro uncertainties keep volatility elevated.

Conclusion

As August 2025 unfolds, Ethereum stands at a technical and psychological crossroads. On the bullish side, the price structure remains favorable—ETH is trading well above major support zones, momentum indicators still lean positive, and institutional inflows through spot ETFs continue to tighten supply. Upcoming network improvements could further enhance Ethereum’s utility and adoption, while the historical tendency for strong post-halving performance provides additional optimism. A decisive break and sustained close above the $4,000 resistance could act as a catalyst for another leg higher, potentially targeting the $4,400–$4,500 range before the month ends.

On the bearish side, the rapid gains from July leave Ethereum vulnerable to short-term pullbacks. Overbought technical readings, profit-taking by traders, and external macroeconomic shocks—such as rate policy shifts or geopolitical tensions—could trigger sharp corrections. A drop below $3,600 would weaken the bullish case and increase the risk of a retest of the $3,300 zone. For now, the balance of evidence tilts toward continued strength, but investors should remain alert to both the upside potential and the risks that could quickly shift market sentiment.

Register now and explore the wonderful crypto world at Bitget!

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.