Solana Price Prediction August 2025: How Far Is Solana Price from the Bottom?

With August 2025 here, Solana (SOL) is back in the spotlight after a rollercoaster of rallies and corrections that have kept even seasoned investors on their toes. Right now, the crypto world is asking: is Solana price about to find a new bottom, or are we on the edge of another breakout this month?

In this article, we’ll explore an up-to-date Solana price prediction for August, taking into account recent price movements, on-chain trends, whale activity, developments across the Solana ecosystem, and the latest ETF news. Whether you’re planning your next trade or keeping tabs on the “Solana price prediction August” buzz, this guide covers what you need to know.

Source: CoinMarketCap

On-Chain Analysis: Gauging Solana’s Price Floor in August 2025

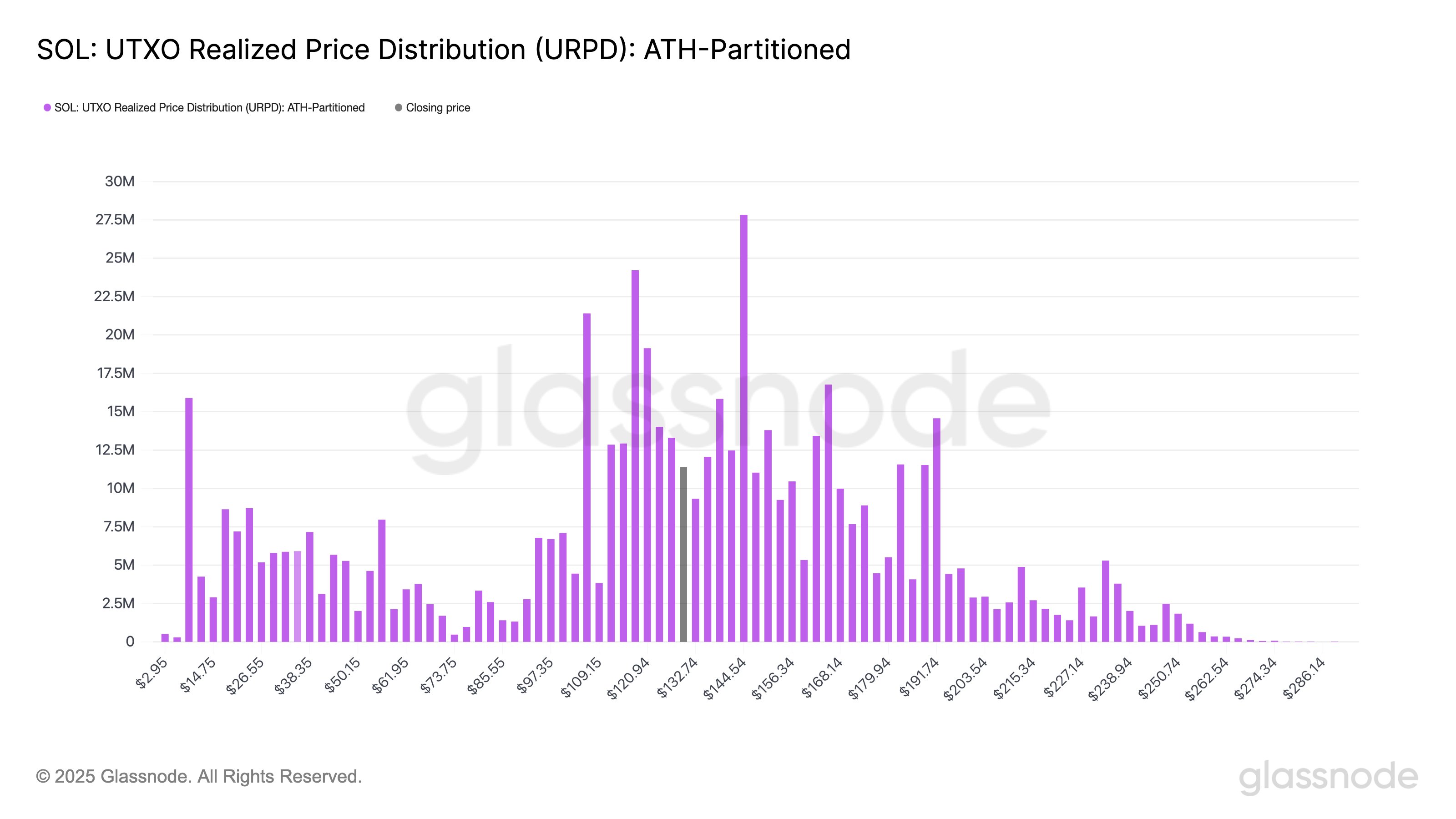

On-chain analytics are vital when formulating an accurate Solana price prediction. As of early August 2025, data shows that 43% of SOL holders are now at an unrealized loss, a drastic shift from late July when the vast majority were in profit. In crypto markets, bottoms are often formed when at least 30-50% of holders are underwater, as selling pressure tends to fade and “weak hands” capitulate.

A closer look at Solana’s on-chain data reveals much of this loss concentration is now clustered around the $165 level. The volume of SOL accumulated between $160 and $170 has grown sharply, with more than 41 million SOL now held at these prices. This signals the emergence of a strong support base and may mark an important inflection point for price action.

Source: Glassnode

Historical analysis shows that Solana price typically stabilizes when such on-chain support clusters form, especially if transactional activity remains high. Thus, for anyone seeking a data-driven Solana price prediction August, the current zone presents both risk and opportunity.

What Can We Learn from Solana Whales?

Whale activity provides another crucial piece of the Solana price puzzle. In recent weeks, on-chain trackers have observed significant flows of SOL from centralized exchanges to private wallets, with over $52 million withdrawn in a handful of days. When whales move large quantities of tokens off exchanges, it usually indicates a desire for long-term holding rather than imminent selling, reducing circulating supply.

Such accumulation phases have historically preceded sharp Solana price increases. In previous cycles, whale accumulation at key support zones has often signaled confidence in a trend reversal.

While not all whale moves foreshadow immediate price surges, the scale and timing of these recent transactions give added weight to a bullish Solana price prediction for August. Market participants closely watch these addresses as sentiment indicators for the broader trend.

Solana Ecosystem: Bullish Fundamentals and Meme Coin Momentum

The Solana ecosystem is thriving, even amidst recent price fluctuations. July saw all-time highs in daily active addresses and wallet creations, with Solana’s DeFi and NFT sectors further expanding the network’s allure. The activity surge has supported ongoing strength in the Solana price.

A key highlight has been the meteoric rise of Solana-based meme coins like BONK, PENGU, and FARTCOIN. These tokens have attracted swathes of new users and boosted on-chain revenue. Of particular note, Canary Capital’s progress toward receiving ETF approval for PENGU catalyzed a fierce rally across Solana meme coins, directly contributing to bullish sentiment and reinforcing the Solana price floor.

This steady expansion in on-chain innovation, user engagement, and trading volumes continues to reinforce positive Solana price prediction scenarios, giving the Solana ecosystem a strong foundation for future growth.

Anticipated Solana ETF: Institutional Interest at New Highs

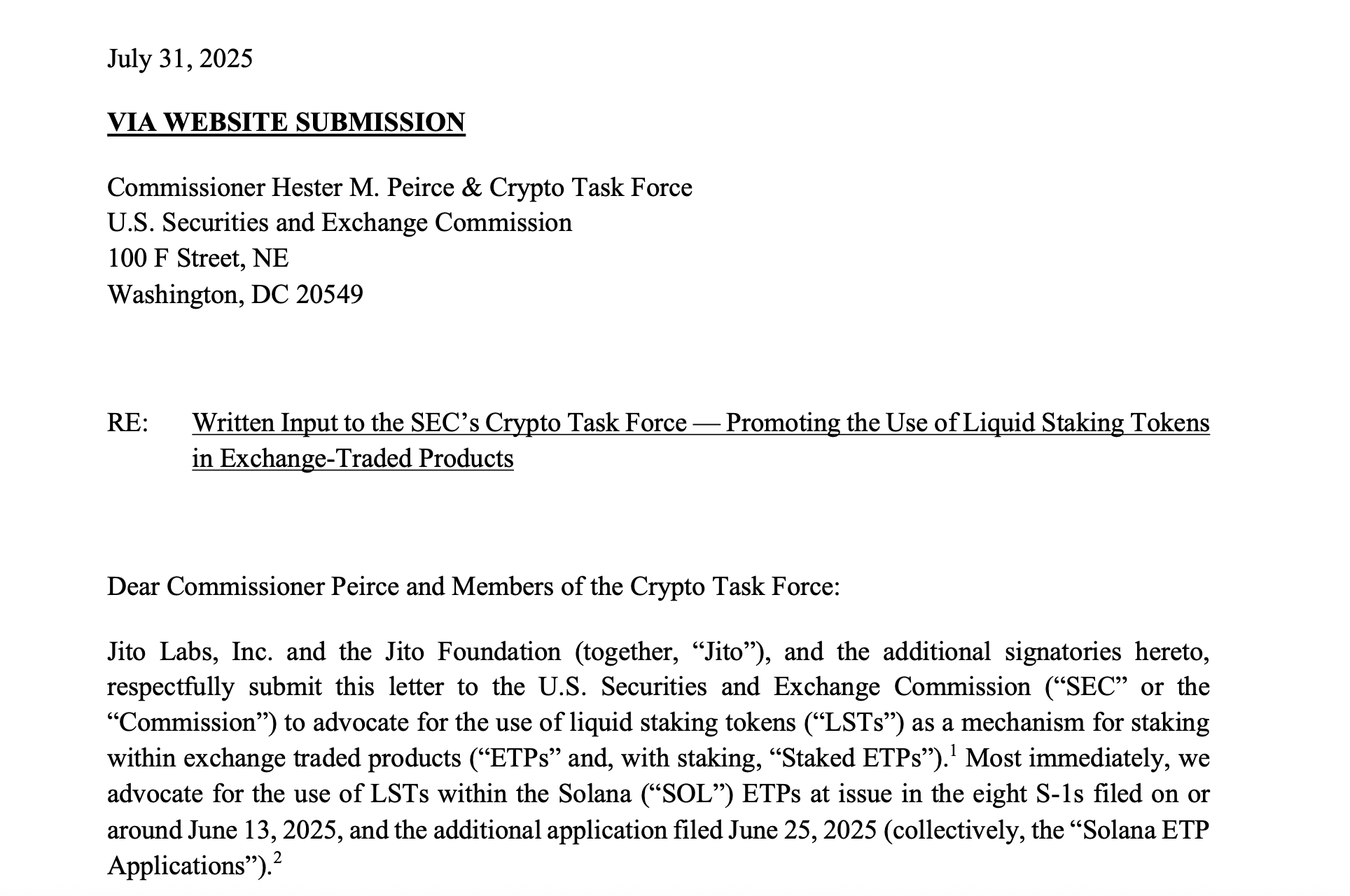

Institutional demand is becoming a major driver in any robust Solana price prediction. Several top investment firms have filed for U.S.-based Solana ETFs, with major names like VanEck and Bitwise leading the way. If approved, these Solana ETFs would unlock a new stream of institutional capital, potentially transforming the price landscape.

Source: SEC

Additionally, there is growing advocacy for liquid staking integration within these ETF products. This would allow institutional investors to earn staking rewards without locking up their SOL, adding another layer of yield and utility for Solana price bulls.

This wave of institutional anticipation is already reflected on the CME, where Solana futures open interest jumped to a staggering $800 million in August. Such momentum bodes well for Solana price prediction August updates and could act as a strong catalyst if ETF approvals materialize.

Solana Price Technical Analysis and August 2025 Prediction

Technical analysis of the Solana price chart supports cautious optimism as we progress through August 2025. SOL rebounded powerfully from the $156 level, a support zone heavily reinforced by on-chain accumulation and oversold readings on the RSI indicator.

Source: TradingView

If SOL maintains support above the $160-$170 range, technical setups suggest a move back toward the $200-$220 resistance zone could play out, especially if ETF speculation ramps up and network growth persists. Should bearish pressure resurface, the $140-$150 levels represent a logical area for capitulation and swift reversal, potentially marking a final bottom for the current cycle.

Conversely, a positive regulatory surprise or continued meme coin enthusiasm could ignite a rally above $250, eclipsing the all-time high. Overall, the technical and fundamental landscape leans toward a bullish Solana price prediction for August, supported by strong on-chain and institutional factors.

Conclusion: Solana Price Prediction August 2025 Outlook

In conclusion, Solana price prediction August analysis signals an exciting period ahead for SOL. The combination of fierce volatility, substantial on-chain accumulation, whale withdrawal activity, ecosystem expansion, and ETF momentum sets the stage for renewed Solana price growth.

While short-term fluctuations may persist, the evidence increasingly points toward a maturing bottom with significant upside potential as new catalysts—institutional or retail—appear. For traders and long-term investors alike, monitoring support zones, whale moves, and regulatory headlines remains essential for an informed Solana price prediction strategy as August 2025 unfolds.