World Liberty Financial(WLFI) price outlook: Why analysts see a path to $1 after TGE

Analysts increasingly argue that World Liberty Financial could approach the $1 milestone after its Token Generation Event, citing brand visibility, early demand signals, and a policy-led approach to liquidity. Pre-market indications once clustered near $0.23, and renewed attention to World Liberty’s treasury design has kept World Liberty Financial in focus heading into its next phase.

This article explains how World Liberty’s treasury is structured, how WLFI functions in the ecosystem, which whales and funding events shape early liquidity, and why the corporate “treasury company” boom in Bitcoin and Ethereum offers a useful template for understanding the World Liberty Financial price dynamics.

What is the proposal of a WLFI treasury

World Liberty’s treasury is conceived as a capital base to finance liquidity, incentives, and ecosystem growth around USD1 and related DeFi products. The goal is to turn headline attention into durable utility by seeding market-making, rewarding stakers and builders, and underwriting integrations that improve usability.

Governance is central. WLFI holders can direct allocations and risk parameters, aligning the deployment of World Liberty’s treasury with community priorities. A rules-based framework also aims to reduce short-termism, giving the protocol a clearer runway for product delivery.

As traders evaluate the World Liberty Financial price, the credibility and pace of treasury deployment will matter. A well-capitalized pool that deepens liquidity at launch and funds usage incentives can help stabilize early trading and support a more resilient market structure.

What is WLFI coin and how does it work?

WLFI is the governance and DeFi coordination token of World Liberty Financial. Holders can propose and vote on protocol changes, stake for rewards that scale with adoption, and participate in programs tied to USD1’s growth. Advocates position WLFI as a utility-first asset rather than a purely narrative-driven token.

Two public sale stages established an early cost basis—one priced at $0.015 and the next at $0.05. Community signaling later favored enabling secondary trading after TGE, creating a bridge between early funding and broader market participation.

Pre-listing quotes previously circulated around $0.23 in gray and OTC venues. Those indications set expectations for the World Liberty Financial price, but actual price discovery will depend on circulating supply at launch, treasury backstops, and the cadence of new product releases.

WLFI big whales behind it

World Liberty Financial has drawn unusually high-profile attention and meaningful whale interest. The project’s association with prominent political figures expanded its reach beyond crypto-native circles, increasing top-of-funnel demand.

The funding arc is equally important. World Liberty Financial opened a token sale on Oct. 15 targeting $300 million at a $1.5 billion fully diluted valuation, but momentum slowed after roughly $12 million in the first day. On Oct. 30, the team filed with the U.S. Securities and Exchange Commission to cut the target to $30 million, aligning the raise with observable demand.

Before Justin Sun’s investment, buyers had taken down about $22 million in tokens. Sun’s participation added fresh capital and a recognizable backer, reinforcing the idea that large holders are positioning for post-sale liquidity. In parallel, the team stated plans to deploy an instance of Aave v3, signaling that lending markets could be part of the first wave of utility.

Governance and token mechanics shape whale influence. WLFI governance tokens will be non-transferable for 12 months, and any single holder is capped at mobilizing up to 5% of the total supply for voting. Sale access is limited to accredited U.S. investors and non-U.S. persons, concentrating allocations among compliant, larger buyers during the raise.

Supply mechanics also matter for the World Liberty Financial price. The total supply is fixed at 100 billion WLFI, with 35% for public sales, 32.5% for community growth and incentives, 30% for initial supporters, and 2.5% for the team and advisors. This distribution provides ample ammunition for World Liberty’s treasury programs while making early supporters and whales critical to initial liquidity—both a strength and a source of potential volatility.

Why WLFI can hit $1 after the treasury

The $1 thesis is a function of branding, liquidity design, and launch mechanics. A large audience and persistent social coverage can drive day-one demand, elevating the opening prints for the World Liberty Financial price. If World Liberty’s treasury promptly funds liquidity and targeted incentives, usage can follow attention, improving order book depth and reducing slippage.

Float and flow are equally influential. With pre-launch quotes near $0.23, a constrained circulating supply at TGE, and high-profile backers, a move toward the $0.50–$1.50 zone is plausible in a bullish tape. The caveat is straightforward: presale entries at $0.015–$0.05 create strong incentives to take profits, and if products lag or incentives are misallocated, the World Liberty Financial price could retrace meaningfully before finding equilibrium.

What is a treasury company

A crypto treasury company accumulates digital assets as balance-sheet reserves—an approach similar to holding cash, bonds, or gold. The strategy is often framed as a hedge against monetary debasement and a long-term bet on digital scarcity.

For investors constrained by brokerage rules, treasury companies can function as proxies, allowing them to gain price exposure via equities rather than direct token custody. In bull cycles, that extra channel of demand has historically fed back into spot markets.

The boom of treasury companies

The modern playbook was defined by MicroStrategy—rebranded as Strategy—which began buying Bitcoin in 2020. By early April 2025, Strategy controlled roughly 555,450 BTC, or about 2.6% of circulating supply, translating to more than $72 billion of Bitcoin on its balance sheet. The market capitalized this exposure aggressively, pushing the company toward a ~$113 billion valuation even as quarterly revenue hovered around $115 million in Q2 2025.

The approach spread internationally. In the UK, The Smarter Web Company listed on AQSE, embedded a Digital Asset Treasury Policy, and accepted BTC, with the share price rising over 1,200% in the weeks following its IPO as the firm disclosed active treasury accumulation. Japanese firms such as Metaplanet and others in Europe and India adopted variations of the strategy, broadening access for traditional investors.

Jurisdictions differed on oversight, but in many cases existing listing and disclosure rules accommodated treasury strategies without bespoke crypto-treasury licensing. That regulatory posture allowed the theme to scale quickly—widening participation but also introducing new forms of risk.

How Bitcoin and Ethereum prices were pushed up by the treasury companies

Corporate accumulation tightened available supply and heightened positive reflexivity during uptrends. Publicized Bitcoin buys by Strategy often coincided with stronger sentiment and incremental inflows, turning the company’s stock into a widely traded proxy and drawing even more capital into BTC itself.

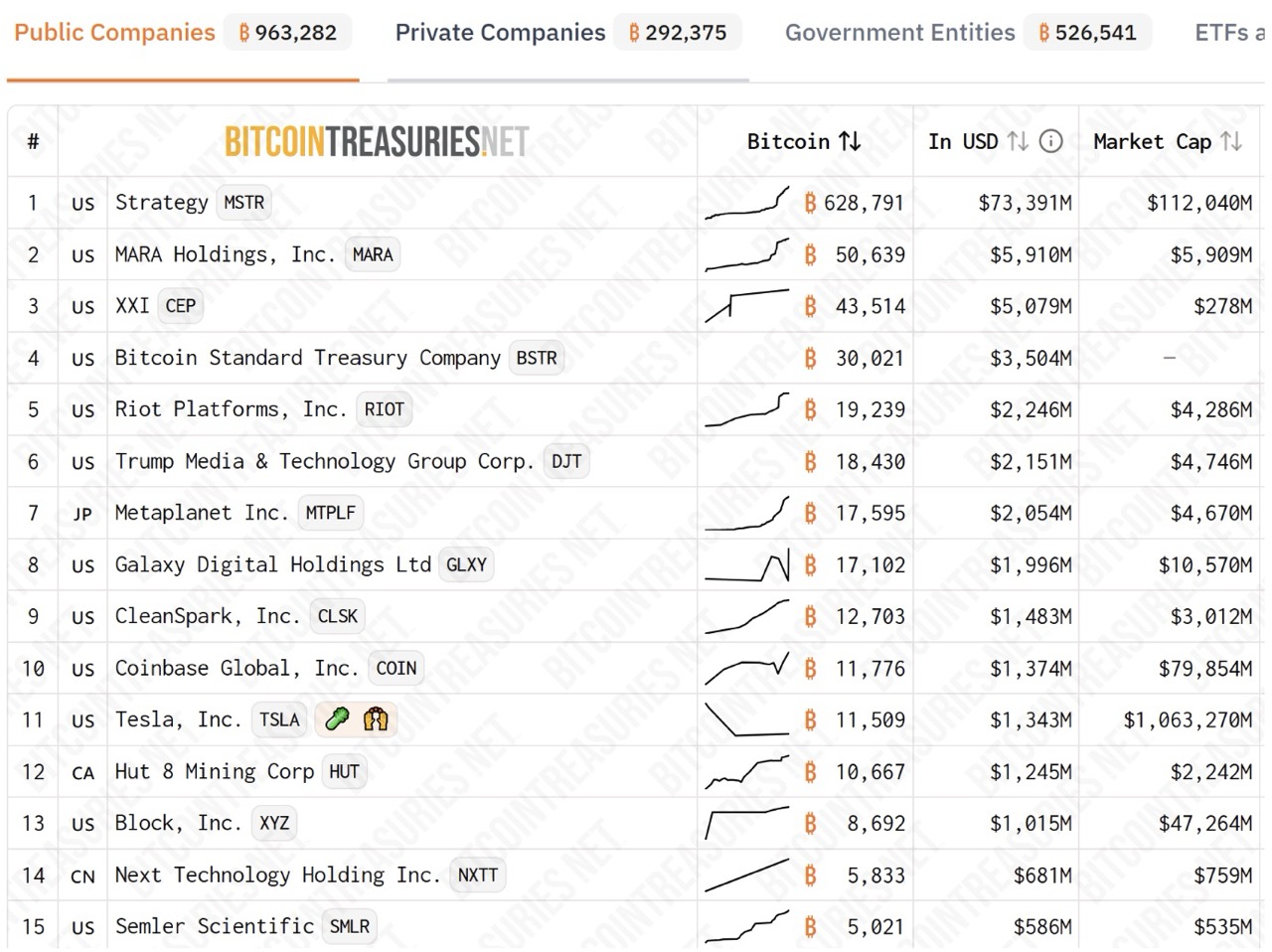

Top 15 Bitcoin treasury firms

Source: BitcoinTreasuries.net

A similar dynamic emerged in Ethereum. In mid-2025, BitMine acquired 208,137 ETH in one purchase, lifting its holdings to 833,100 ETH—valued around $3.58 billion with ETH near $4,300. SharpLink added 83,562 ETH to reach 521,900 ETH, taking its treasury north of $2.23 billion at comparable prices, while Strategic ETH Reserve data showed roughly $671 million in unrealized gains on SharpLink’s position. The Ether Machine bought 15,000 ETH on Aug. 3, Ethereum’s 10th anniversary, and another 10,600 ETH days later, bringing its holdings to 345,362 ETH worth nearly $1.5 billion.

These steps created a feedback loop: as the market rose, treasury balances marked higher, reinforcing the narrative for additional corporate accumulation. For World Liberty Financial, the lesson is clear. If World Liberty’s treasury deploys capital to deepen liquidity and stimulate real activity around USD1 and lending via Aave v3, and if large holders steadily add, the World Liberty Financial price stands a better chance of sustaining gains beyond an initial listing spike.

Conclusion

World Liberty Financial enters its post-sale window with a recognizable brand, visible whale participation, and a governance-led plan to invest in liquidity and usage. The pathway to a $1 print is credible if treasury deployment, float management, and product execution converge quickly. The risks are equally visible: concentrated presale gains, the potential for early profit-taking, and the need to prove utility at pace.

For investors tracking the World Liberty Financial price, the next phase will be defined by how effectively World Liberty’s treasury can convert attention into adoption and whether lending, staking, and integrations arrive in time to anchor the market.

Disclaimer: This article is informational and not financial advice. Digital assets are volatile and carry risk. Conduct independent research and consider your risk tolerance before investing.