Bitget Research: Ethereum ETFs Expected to be Approved by Summer, CRV Rebounds Over 20% After Liquidation

Bitget Research2024/06/14 06:43

By:John & Victoria

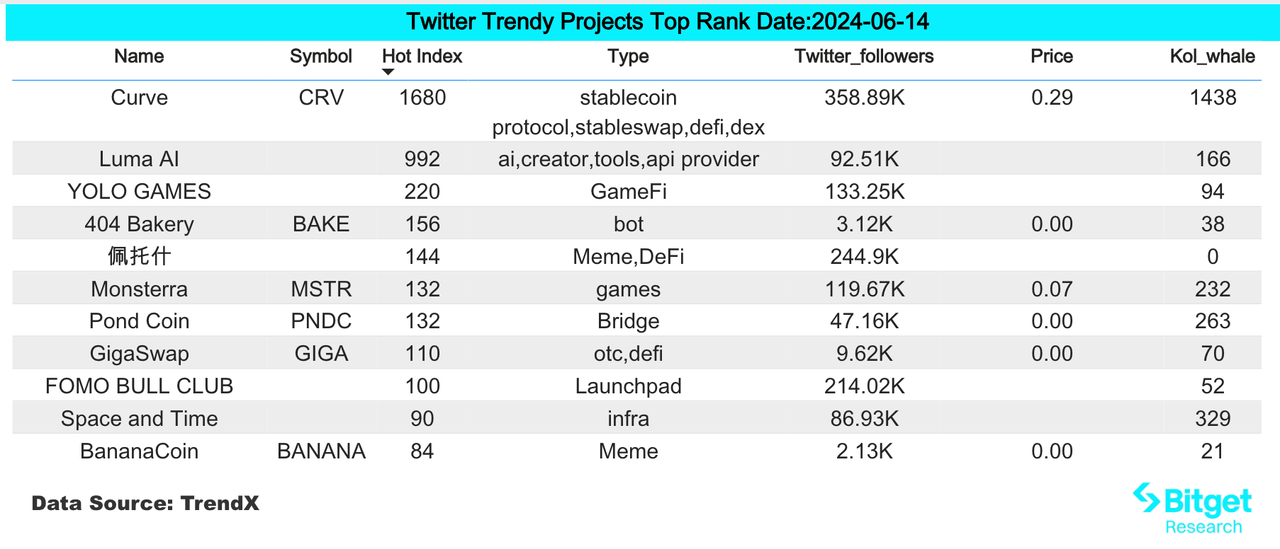

In the past 24 hours, many new popular tokens and topics have emerged in the market, which are likely to be the next wealth creation opportunities.

Overview

The

cryptocurrency market remains under pressure today. U.S. Securities and Exchange Commission Chairman Gary Gensler testified at a Senate hearing that a spot

Ethereum ETF is expected to receive the agency's full approval by the end of the summer. The highlights are as follows:

-

Sectors with strong wealth creation effects: ETH ecosystem projects and TON ecosystem tokens.

-

Top searched tokens and topics: Daddy, RWA Crypto.

-

Potential airdrop opportunities: Zircuit and MYX Finance.

Data collection time: June 14, 2024, 4:00 AM (UTC)

1. Market Environment

The cryptocurrency market remains under pressure today, continuing the pullback that began the day before after the Fed signaled that it expected only one rate cut this year. U.S. Securities and Exchange Commission Chairman Gary Gensler testified at a Senate hearing that a spot Ethereum ETF is expected to receive the agency's full approval by the end of the summer. Following the announcement, Ethereum quickly experienced a sell-off after some quick gains, correcting to below $3500. Following the announcement of the outcome of the Fed's policy meeting, the market began to experience a full decline on Wednesday afternoon. The Fed maintains its Fed Funds Target Rate steady at 5.25%–5.50%, but according to the latest projections from the dot plot, only one 25 basis point cut is expected in 2024. Prices are currently being determined by the future outcome of rate cuts.

Arkham announces that the price of CRV has fallen below the liquidation price of Curve's founder, Michael Egorov, and that all of his nine-figure loan positions across five protocols have been liquidated. As of today, the price of CRV has risen by over 20% after the liquidation.

2. Wealth Creation Sectors

2.1 Sectors to Focus on Next — ETH Ecosystem Projects

Primary reason: U.S. Securities and Exchange Commission Chairman Gary Gensler testified at a Senate hearing that a spot Ethereum ETF is expected to receive the agency's full approval by the end of the summer.

Specific tokens:

-

ETHFI: The forms related to Ethereum ETFs state that while the Ethereum coin is allowed, staking is not. This restriction significantly reduces the appeal of the Ethereum ETF to investors, which is why the Ethereum restaking sector is expected to benefit materially.

-

LDO: A leading LSD project within the ETH ecosystem. It has a TVL of $34.4 billion but is relatively undervalued at just under $2 billion.

-

SSV: The SSV Network is a decentralized staking infrastructure that enables easy and scalable access to decentralized ETH staking for everyone. Currently, the project's website shows that its total TVL has surpassed $600 million, with over 150,000 ETH staked.

2.2 Sector Movements — TON ecosystem tokens (TON and FISH)

Primary reason: Driven by Telegram's 900 million-strong user base, the TON ecosystem has quietly grown, surpassing Ethereum by daily active addresses. Additionally, TON has announced plans to launch an enhanced pool on ston_fi and dedust_io with rewards exceeding $1.8 million. The ecosystem rewards and user growth have contributed to the project's recent success.

Gainers: TON has risen by 4.42% and FISH by 7.02% in the last 24 hours.

Factors affecting future market conditions:

-

Future trading activity: Currently, a major shortcoming in the Ton ecosystem is the relatively fewer active traders compared to other chains, which results in significantly lower trading volumes. If ecosystem rewards stimulate trading activity, there is potential for the price and liquidity to continue to rise.

-

Future support from Pantera for the Ton ecosystem: Dan Morehead, founder of Pantera Capital, mentioned on social media that Pantera recently made its largest investment in the Telegram TON blockchain project, increasing attention to the Ton ecosystem. If project financing and product launches can be implemented promptly, the prosperity of the Ton ecosystem could arrive sooner.

3. Top Searches

3.1 Popular DApps

Orderly Network

Orderly Network, a NEAR ecosystem trading protocol, announced on X that it will airdrop 10% of the total supply (100 million tokens) to early users. NEAR traders must bind their wallets before June 27. Users can now check the airdrop allocation and bind their wallets through the dedicated airdrop webpage. Orderly Network is the omnichain liquidity layer that aggregates derivatives liquidity across all chains, facilitating the liquidity and settlement of assets on any public chain for a wide range of products.

3.2 X (former Twitter)

Curve

According to Arkham Intelligence, Curve founder Michael Egorov faced liquidations totaling $140 million in CRV. The price of CRV fell below Egorov's liquidation threshold yesterday morning, leading to the liquidation of his entire nine-figure lending position across five protocols. Egorov addressed the issue on X, stating, "The Curve Finance team and I have been working to solve the liquidation risk issue which happened today. Many of you are aware that I had all my loans liquidated. Size of my positions was too large for markets to handle and caused 10M of bad debt. Only CRV market on lend.curve.fi (where the position was the biggest) was affected. I have already repaid 93%, and I intend to repay the rest very shortly." The incident is still trending on X.

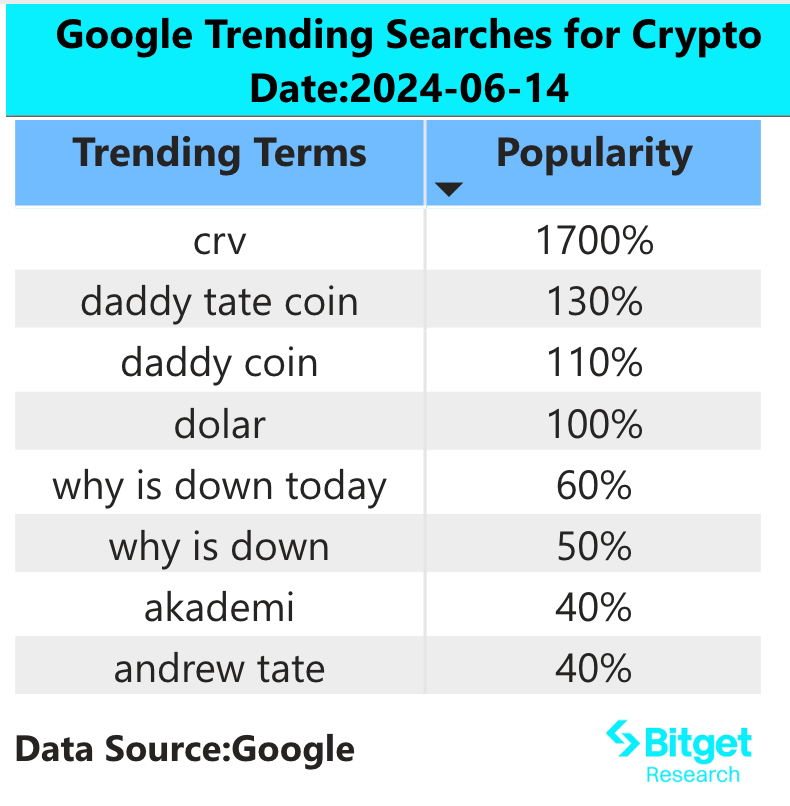

3.3 Google Search (Global and Regional)

Global focus:

Daddy: Blockchain data visuals provider Bubblemaps reported on X that insiders bought 30% of DADDY's supply at launch, before Andrew Tate began promoting it on X. These insiders currently hold over $45 million worth of DADDY tokens. The hype surrounding DADDY is fueled by the feud between Andrew Tate and Ansem, both issuers of Daddy tokens, drawing significant attention on X.

Regional focus:

(1) In Asia, the term "RWA Crypto" is trending prominently due to simultaneous releases of FOMC and CPI data, heightening risk aversion, and market pressure prior to the data release.

(2) In Europe and the USA, there is significant interest in

memecoin projects, primarily focusing on FLOKI. Memecoins have stood out as notable wealth generators and discussion topics amidst the recent bearish market conditions.

(3) The CIS region displays a broad range of interests, including projects like Taiko, Aevo, and Uniswap.

4. Potential Airdrop Opportunities

Zircuit

Backed by Pantera and Dragonfly, Zircuit is a Layer 2 ZK-rollup with parallel sequencers and AI-based security. The project's TVL has surpassed $1.1 billion. Zircuit's ecosystem has evolved to include features such as staking, cross-chain bridges, and an explorer. Users can receive airdrops by participating in ecosystem development and community interaction.

How to participate: 1. Go to the staking page (https://stake.zircuit.com/) and stake to earn points; 2. Deploy nodes to earn points (https://build.zircuit.com/build).

MYX Finance

MYX Finance is a decentralized derivatives exchange operating on an MPM model, incubated by D11 Labs. It uses smart rates and risk-hedging mechanisms to ensure protocol stability and sustain high returns.

In November 2023, MYX announced the completion of a $5 million seed round funding at a $50 million valuation, led by HongShan (formerly Sequoia China), with participation from Consensys, Hack VC, OKX Ventures, Foresight Ventures, Redpoint China, HashKey Capital, GSR Markets, Alti5, Leland Ventures, Cypher Capital, Bing Ventures, Lecca Ventures, among others.

On the user level, MYX Finance operates similarly to other derivative decentralized exchanges (DEXs). Users can engage in trading, provide liquidity, and more. Currently, MYX Finance is integrated with Linea and Arbitrum. Increased activity on the Linea chain may result in future Linea airdrops.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Galaxy Digital’s Head of Research Explains Why Bitcoin’s Outlook in 2026 Is So Uncertain

AIcoin•2025/12/22 00:01

Crypto Coins Surge: Major Unlocks Impact Short-Term Market Dynamics

Cointurk•2025/12/21 23:51

Revealing Insight: How Differing Views Shape Bitcoin Price Predictions at Fundstrat

Bitcoinworld•2025/12/21 23:27