Popular Bobo market research analysis

Bitget2024/06/28 09:57

By:远山洞见

I. Project introduction

Bobo is a bear-themed Meme token based on the popular Bobo character design. The design of the Bobo character is inspired by Apu Apustaja and sometimes also refers to Pepe the Frog. The name Bobo was chosen in June 2018 and became the official name. The Bobo character is widely used on platforms such as Twitter and 4chan's /biz section to satirize poor investment choices and express pessimism towards Financial Marekt.

In addition, the Bobo project has launched Bobo NFTs (Bobo Council) with a total supply of 2222, further expanding its ecosystem. The Bobo the Bear token aims to attract the attention of the crypto community through community building and cultural dissemination, and establish a solid influence in the market.

*

Narrative Description

The story behind the Bobo token is full of humor and irony. Bobo is a popular meme character in bear markets, inspired by Apu Apustaja and Pepe the Frog. It was named in June 2018 and quickly became popular on social media. Bobo represents investors' negative emotions during market downturns, making it a cultural phenomenon by mocking poor investment decisions and pessimistic expectations of Financial Marekt.

The Bobo character is created and operated by "rekt_teka $hi" and other OG Bobo Meme artists who have been dedicated to creating content related to Bobo. The Bobo the Bear project is not just a token, but also a cultural symbol that has an impact of dissemination in the cryptocurrency market through the power of community and art.

The uniqueness of Bobo the Bear lies in its use of humor and satire to transform negative market sentiment into community interaction and cultural identity, attracting a lot of attention and supporters.

III. Market value expectations

As of now, the narrative expression of the Bobo project is clear, the community support is strong, and the project team actively promotes various work. Bobo not only has its unique Meme culture, but also has a high level of community activity and transparent operation of the project team. As more investors recognize the value of Bobo, especially when it is widely spread on social media platforms, the market demand for Bobo may further increase.

The rapid spread of the Internet and the rise of Meme culture have given projects like Bobo broader development space. Bobo's story and character design not only attract a large number of market investors, but also young people who are passionate about Financial Marekt. This unique Market Positioning and cultural identity increase Bobo's potential in future markets.

Despite the current circulating market capitalization of about $100 million, combined with current market trends and optimistic expectations for the future, Bobo is expected to continue its upward momentum.

IV. Economic models and on-chain chip analysis

The total supply of Bobo tokens is 69 trillion, and contract permissions have been waived, ensuring the transparency and decentralization of the project. Currently, the on-chain liquidity pool has locked in 4.85 million USD, providing stable liquidity guarantee. The 24-hour trading volume of Bobo tokens has reached millions, indicating strong demand and active level of market funds for tokens.

Currently, the number of addresses holding Bobo tokens has exceeded 20,000, reflecting extensive community support. In addition, there were over 500 transactions within 24 hours, and tokens are frequently traded in daily life. These data not only demonstrate the popularity of Bobo in the market, but also show that Bobo has a strong market activity level and community support while maintaining high transparency and stable liquidity.

V. Risk Warning

1. It has the characteristics of community dependence. The success of Bobo highly depends on the active level and participation of its community.

2. As a Meme token, the price of Bobo may experience drastic fluctuations.

VI. Official links

Website:

https://bobothebear.io/

Twitter:

https://x.com/bobocoineth

Telegram:

https://t.me/bobocoineth

1

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

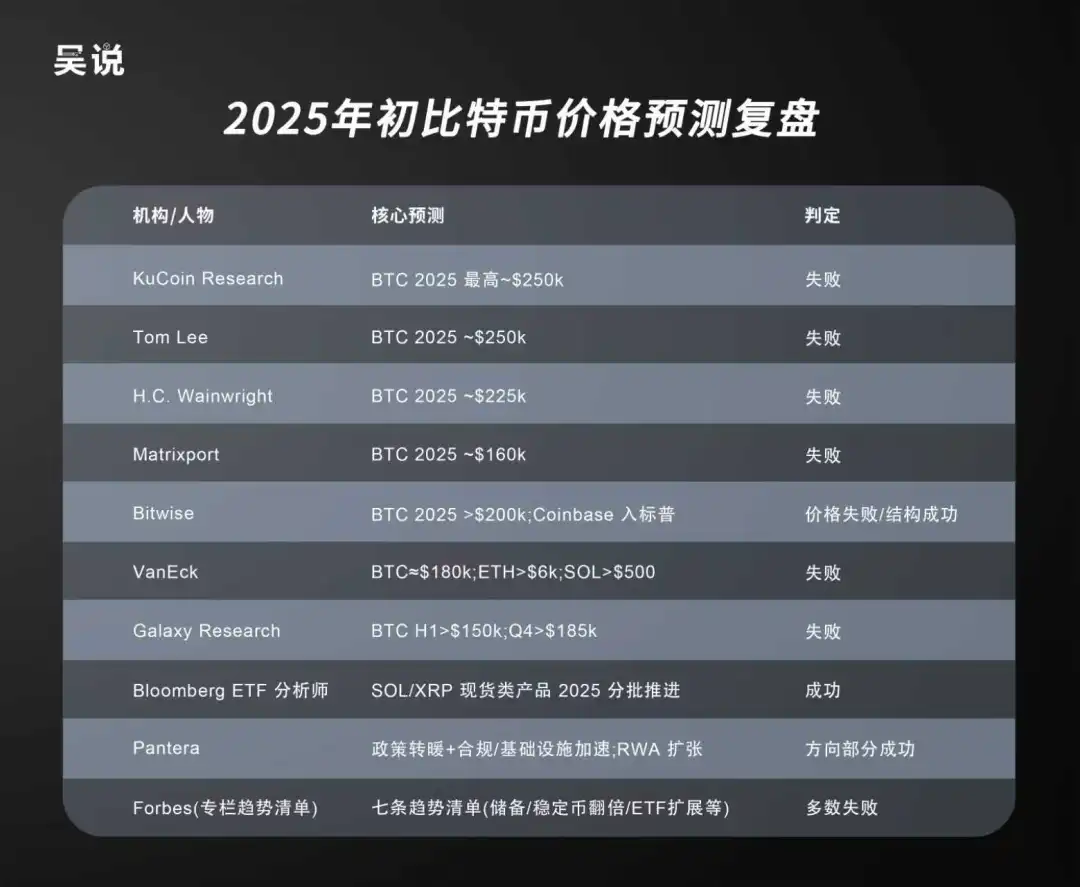

Galaxy Digital’s Head of Research Explains Why Bitcoin’s Outlook in 2026 Is So Uncertain

AIcoin•2025/12/22 00:01

Crypto Coins Surge: Major Unlocks Impact Short-Term Market Dynamics

Cointurk•2025/12/21 23:51

Revealing Insight: How Differing Views Shape Bitcoin Price Predictions at Fundstrat

Bitcoinworld•2025/12/21 23:27