Layer3 Foundation: Introducing $L3

Layer3 Foundation2024/06/29 07:13

By:Layer3 Foundation

Layer3 is a first-of-its-kind protocol focused on unlocking the $1T attention economy. It aims to create the first liquid

market for the internet's most valuable resource – attention – powered by novel identity and incentives infrastructure. It is the only attention infrastructure across the EVM,

Solana, and Cosmos. In the brief time since launch, Layer3 has facilitated over 96M interactions across 545 ecosystems by users in over 150 countries.

Layer3 is excited to announce the L3 protocol governance and utility token. L3 holders will be able to participate in governance regarding certain aspects of the protocol, as well as staking to access enhanced utility across products built atop the protocol, including incentives, in eligible situations.

The opportunity to enable cryptonative attention infrastructure is expansive. Layer3's identity and token distribution protocol is positioned to become the global system powering identity and earning infrastructure for both humans and AI agents as millions of ecosystems adopt token-based distribution models.

The airdrop mechanism is designed to ensure that the most active members earn the most tokens. Our initial airdrop is our token of gratitude to users who made Layer3 what it is today –– thank you. This is the beginning of the journey with Layer3, and our goal is to foster long term alignment between users and ecosystems within Layer3.

Distribution Details

-

When: Summer 2024

-

Total Supply: 300,000,000

-

Initial Airdrop: 5% of total supply

-

Total Community Allocation: 51% of total supply

The Layer3 Foundation will distribute detailed tokenomics and timeline for allocation checker in the coming weeks.

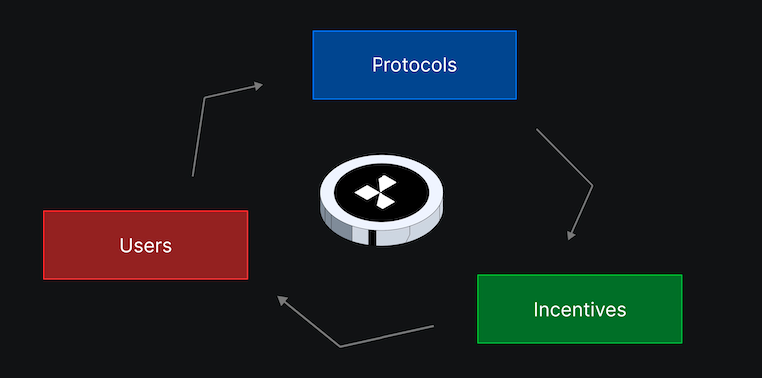

Proposed Token Utility

-

Access: Holders may stake or redeem to access incentives and multipliers (ex. rewards), tiered experiences, and launchpad projects, where eligible

-

Ecosystem Gating: Burn L3 to create advanced onchain experiences for the community using Layer3

-

Governance: Govern certain aspects of the Layer3 protocol and decentralized application

Additional Airdrop Information

-

51% of the supply of $L3 is designated to the community.

-

There will be multiple airdrops to foster long term alignment between users and ecosystems within Layer3.

-

Genesis Airdrop (5% of total supply): Early users and Season 1 participants (through May 10th, 2024).

-

The Genesis airdrop snapshot has been taken for early users and season 1 participants as of May 10th, 2024 2:00PM UTC.

We have not publicized an explicit formula for genesis airdrop allocations to prevent gaming the system. Factors influencing genesis airdrop allocations:

-

Higher level, early user status, gm streak and achievements

-

More quests completed ecosystems participated in

-

More CUBE credentials minted

-

Higher bridge and swap volume

-

More active user referrals

You can view your cumulative

activity here.

TGE will be happening this summer. You can still take part in a host of Layer3 campaigns and initiatives to earn rewards from the largest protocols in crypto. Visit

app.layer3.xyz/ to get started and join our community.

The $L3 token is the beginning of our journey to decentralize the $1 trillion attention market. With each interaction, you're shaping the future of digital identity and incentives. Join us as we unlock unprecedented opportunities across the ecosystem.

Supplementary Terms Disclaimer

Eligibility verification for L3 token claimants will be available on the Layer3 Foundation's

official website. Users will be notified when the allocation checker and claim submission tools are live. Community members should remain vigilant against potential scams. Ensure that any Layer3 Foundation-related web pages have a domain ending in "

layer3foundation.org" or “

layer3.xyz”. No Layer3 Foundation or community representative will contact you unsolicited or request personal information.

1

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

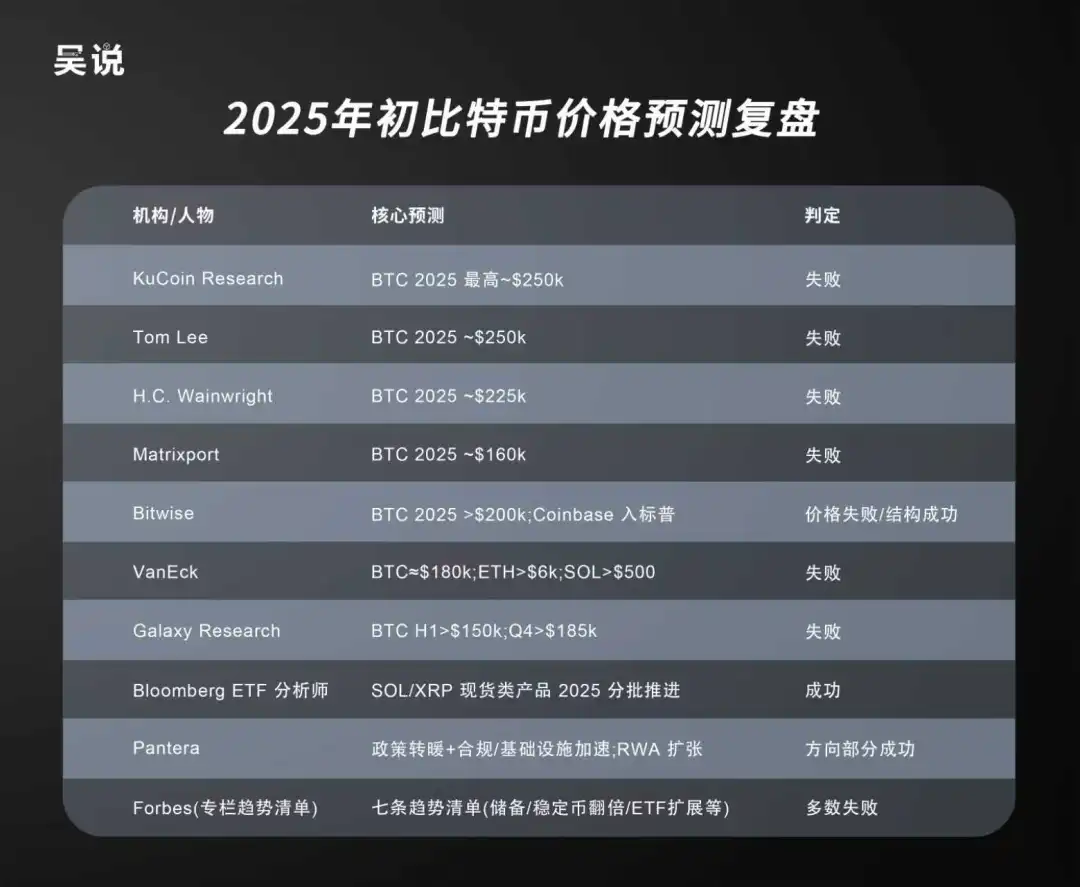

Galaxy Digital’s Head of Research Explains Why Bitcoin’s Outlook in 2026 Is So Uncertain

AIcoin•2025/12/22 00:01

Crypto Coins Surge: Major Unlocks Impact Short-Term Market Dynamics

Cointurk•2025/12/21 23:51

Revealing Insight: How Differing Views Shape Bitcoin Price Predictions at Fundstrat

Bitcoinworld•2025/12/21 23:27