Well-known analyst CryptoChan: Bitcoin five-line chart upgraded again, top forecast impact 140,000 dollars

CryptoChan2024/09/25 06:44

By:CryptoChan

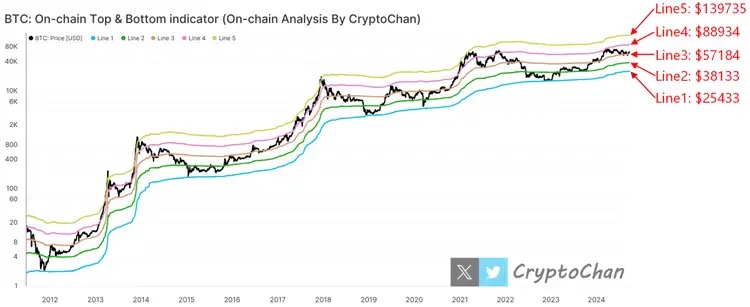

Famous crypto analyst CryptoChan recently released the latest five-line chart of Bitcoin, pointing out that the model indicates that the peak of the bull market may approach $140,000. According to him, the construction of the five-line chart is based on a series of on-chain data such as Coin Days Destroyed, Liquid Supply, and Realized Price. The current five key lines show:

- Line 5: $139,735

- Line 4: $88,934

- Line 3: $57,184

- Line 2: $38,133

- Line 1: $25,433

CryptoChan believes that using these historical price clues can help investors evaluate long-term trends in the Bitcoin market, providing strategic guidance for future bull markets. He suggests that investors closely monitor these data to seize upcoming market opportunities.

0

1

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ark of Panda Collaborates with Duck Chain to Boost Network Scalability, Connect RWAs To Cross-Chain Ecosystems

BlockchainReporter•2025/12/21 19:12

Crypto market’s weekly winners and losers – CC, UNI, HYPE, M

AMBCrypto•2025/12/21 19:03

Former BlackRock Vice President Discusses XRP ETF

TimesTabloid•2025/12/21 19:03

Bitwise CIO Just Said It Out Loud: XRP Was Better Received Than Ethereum

TimesTabloid•2025/12/21 18:03