BTC Cycle Cycle: Long-term holders' chip floating profit ratio surges, a huge pit is coming?

CryptoChan2024/11/18 10:27

By:CryptoChan

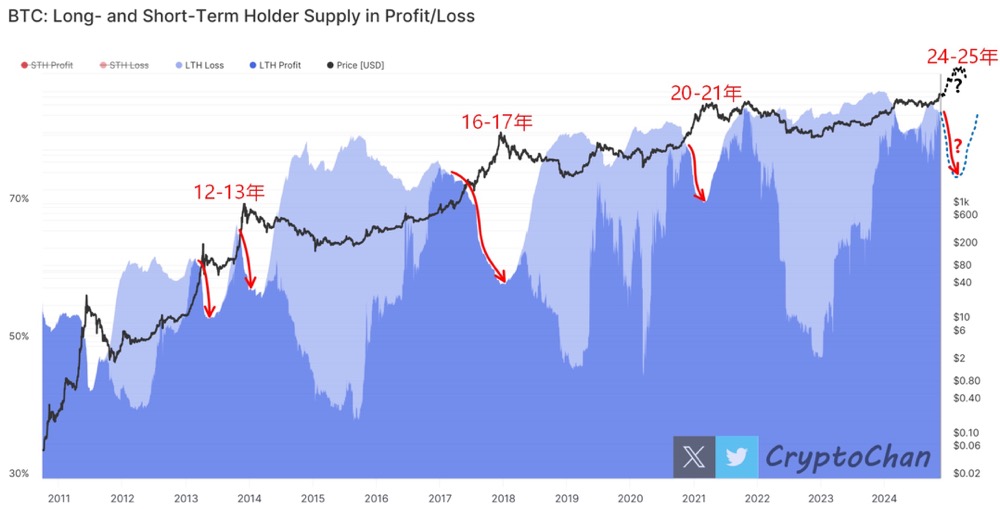

From the on-chain data, the high point of #BTC's price is closely related to the distribution of floating profit chips by long-term holders (holding coins for more than 155 days without movement). The chart shows that during the historical bull market (such as 2012-2013, 2016-2017, and 2020-2021), the floating profit ratio increased significantly, and a "huge pit" formed after the price peaked (indicated by the red arrow). Currently, as the cycle of 24-25 years approaches, the floating profit chip ratio has risen again. Does this indicate a new round of distribution and market adjustment? Pay attention to the on-chain trends, history may be repeating itself!

0

1

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Tom Lee is Bullish on Bitcoin, While His Firm Fundstrat Makes Bearish Statements – Company Issues Clarification

BitcoinSistemi•2025/12/21 17:33

Dogecoin Might Add Extra Zero if This Crucial Support Gives Way

UToday•2025/12/21 17:24

Zcash Founder Reveals Biggest Reason Why He’s Bearish on Bitcoin

UToday•2025/12/21 17:24

Selling Bitcoin (BTC) in January May Be Bad Idea, Price History Warns

UToday•2025/12/21 17:24