This trading pair will be delisted on 24 May 2025, 10:00 (UTC), please be aware of the potential risks when trading

Each digital asset we list is regularly reviewed for quality assurance to ensure it adheres to our platform standards.

In addition to the security and stability of the digital asset’s network, we consider numerous other factors in our evaluation process, including:

-

Trading volume and liquidity

-

Team involvement in the project

-

Development of the project

-

Network or smart contract stability

-

Activeness of the community

-

Responsiveness of the project

-

Negligence or unethical conduct

In light of a recent periodic review, Bitget is delisting a total of 28 trading pairs on 24 May 2025, 10:00 (UTC). Details are as follows:

ASI/USDT, ASTO/USDT, BOX/USDT, BROCK/USDT, CATGOLD/USDT, CEEK/USDT, CWIF/USDT, FITFI/USDT, FUD/USDT, GEAR/USDT, GOATS/USDT, LSD/USDT, MODE/USDT, MON/USDT, NPT/USDT, SERSH/USDT, STNK/USDT, TRIAS/USDT, XCAD/USDT, XRD/USDT, SAUCE/USDT, SHIDO/USDT, BUBBLE/USDT, ZBU/USDT, CLAY/USDT, MOODENGETH/USDT, RTF/USDT, MRSOON/USDT

Users are advised to note that:

-

Deposit services for the delisting pair are now suspended.

-

Withdrawals will remain open for users until 24 August 2025, 10:00 (UTC)

-

Please note that all pending trade orders for the mentioned pair will automatically be cancelled.

-

Bitget Earn will delist the ASTO Savings product on 23 May 2025, 8:00 (UTC). Following the delisting, the assets held in the ASTO savings product will automatically be returned to the spot account. You can view the details on your Bitget spot account. Before this occurs, you can redeem your investment amount at any time. Please make the necessary fund arrangements based on your needs.

-

The following trading pairs will be removed from Bitget spot trading bots on 24 May 2025, 10:00 (UTC): ASTO/USDT, BROCK/USDT, CEEK/USDT, FITFI/USDT, GEAR/USDT, NPT/USDT, TRIAS/USDT, XCAD/USDT, XRD/USDT

-

After removal, the system will automatically cancel any pending orders and return the relevant assets to your account.

-

Users will be unable to create any new bots with the delisted trading pairs.

-

Users will no longer be able to publish running bots with the delisted trading pairs to the Recommended section of the bot copy trading page. Bots with the delisted trading pairs that are listed in the Recommended section of the bot copy trading page will be removed.

-

Users are strongly advised to terminate bots with this active trading pair to avoid any potential losses. Thank you for your support and understanding!

Disclaimer

Cryptocurrencies are subjected to high market risk and volatility despite high growth potential. Users are strongly advised to do their research and invest at their own risk.

Join Bitget, the World's Leading Crypto Exchange and Web 3 Company

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CPI Day Volatility Play: 5 Altcoins to Watch as Inflation Data Sparks Sharp Market Moves

XRP and TRON Surge, But Apeing Takes the Lead as the Top Upcoming Crypto Nearing $0.0001

Here’s how Euro stablecoins hit $1B despite weak hype

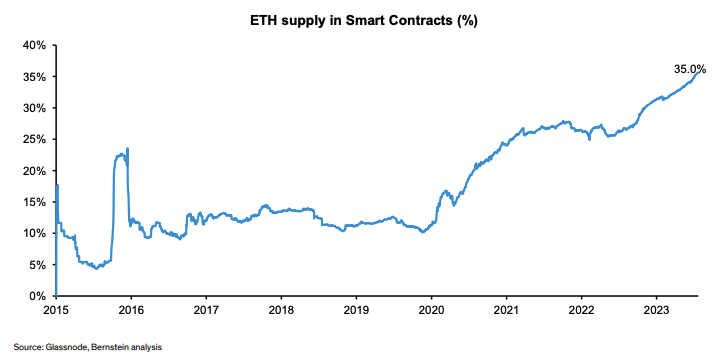

Prospect of spot ETFs not behind ether’s break above $3,000: Bernstein