deBridge adds support for Tron, linking USDT-heavy network to its interoperability protocol

Quick Take deBridge has integrated Tron, enabling real-time, MEV-protected swaps between Tron, Ethereum, Solana, and 25+ chains to deepen DeFi transaction options.

deBridge, a multichain interoperability protocol, has integrated Tron, allowing users to swap assets in real time between Justin Sun’s blockchain, Ethereum, Solana, and more than two dozen other blockchains, the project said on Tuesday.

The rollout brings Tron's high-throughput network, which hosts almost half of all Tether’s USDT stablecoin in circulation, into deBridge’s routing system for low-slippage, MEV-protected transfers. According to The Block’s data dashboard, an estimated 81.4 billion USDT out of 167.2 billion sits on Tron.

deBridge said the integration brings “full-stack interoperability,” positioning Tron as composable with leading ecosystems and enabling complex cross-chain interactions to settle in a single transaction for users.

For builders, the link turns Tron into a “liquidity gateway” to and from other networks, a notable step given the chain’s role in emerging markets. Mobile-friendly wallets and stablecoin rails have driven more than 100 million total accounts and over four million daily active users to the Sun-founded blockchain, according to the announcement. Users can now route assets across Tron and 25+ chains through deBridge’s interface and APIs.

The integration follows a broader push to deepen DeFi liquidity and product utility. deBridge is a protocol that links networks such as Solana, Ethereum, and BNB Chain. Unlike many bridges, it doesn’t lock funds and mint wrapped tokens, a model that has been a frequent target of hacks.

The Block has previously reported on the launch of deBridge’s DBR token via Jupiter and subsequent buyback initiatives . Launched in 2022, the protocol has raised $5.5 million from investors like Animoca Brands.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

‘It felt so wrong’: Colin Angle on iRobot, the FTC, and the Amazon deal that never was

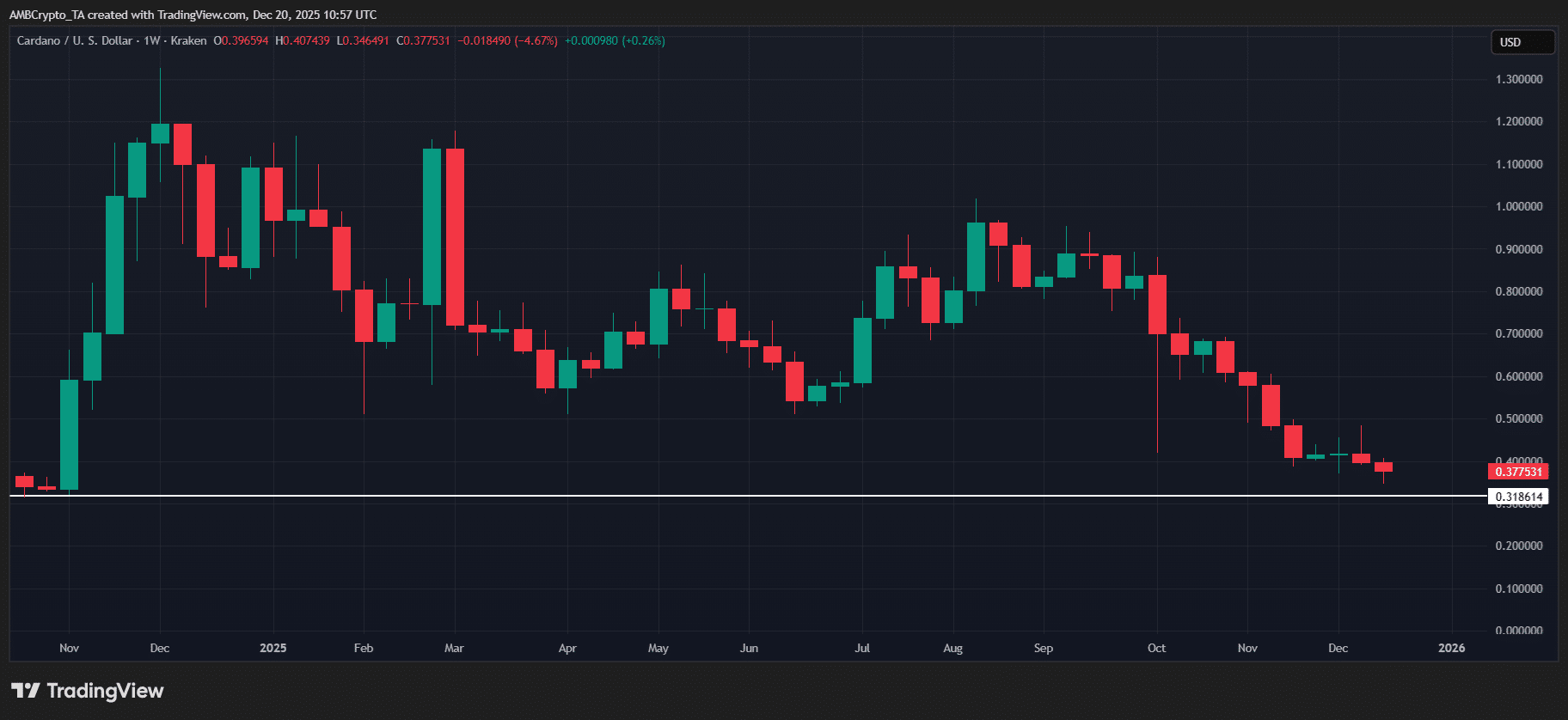

Cardano erases 100% of election rally gains – Can ADA hold top 10?

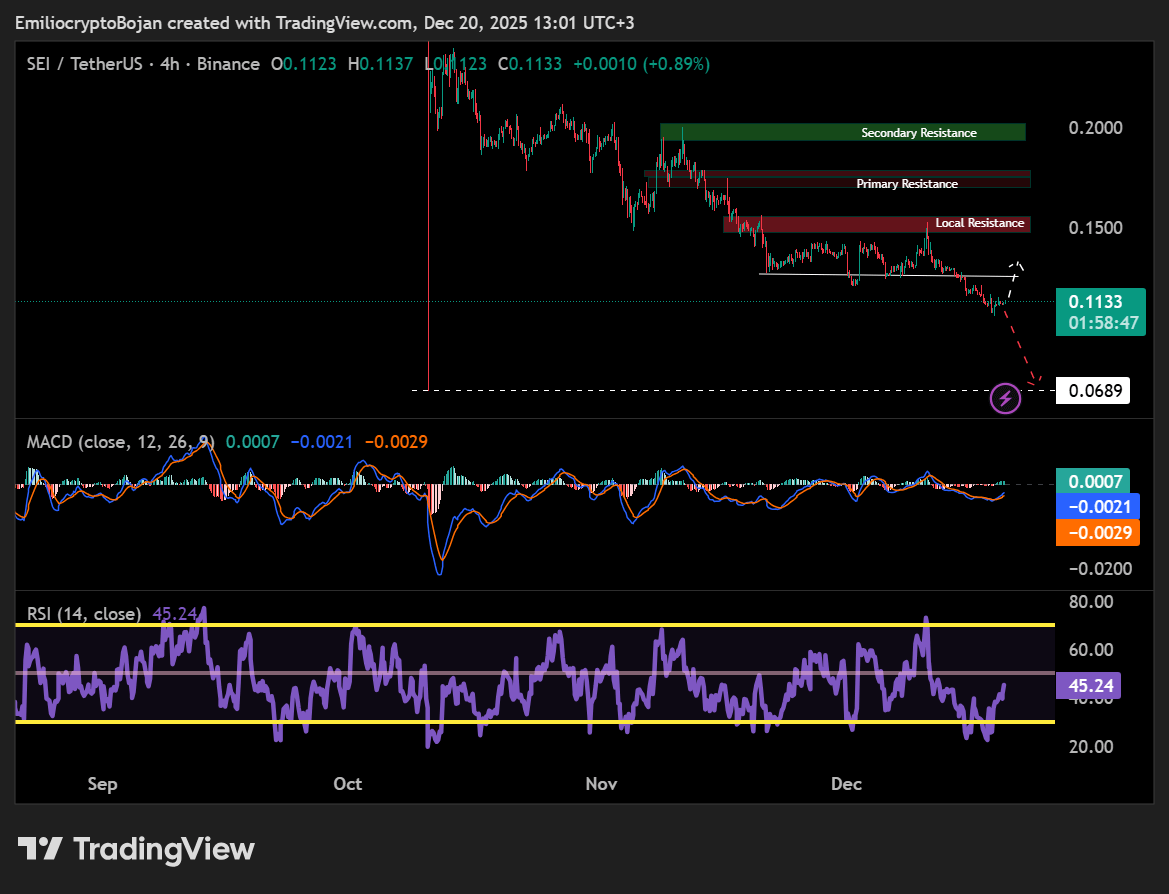

Why SEI must reclaim KEY support to avoid drop below $0.07