Solana emerges as institutional hub for RWAs: RedStone Report

A report by RedStone highlights how Solana is becoming the backbone of the blockchain infrastructure for capital markets.

- Solana holds $700 million in RWAs and $13.5 billion including stablecoins

- Network performance is a key driver of Solana’s growing dominance in the sector

- BlackRock, Apollo Global, Janus Henderson, and VanEck are among the big-name adopters

Solana ( SOL ) is emerging as the blockchain backbone of capital markets, capturing a major share of real-world asset tokenization. On Monday, September 29, blockchain oracle network RedStone published a report detailing Solana’s increasing dominance in RWAs.

According to the report, Solana hosts $700 million in RWA assets, and over $13.5 billion if including stablecoins. The RWA figure grew by more than 500% year over year, making Solana one of the largest networks for tokenized assets.

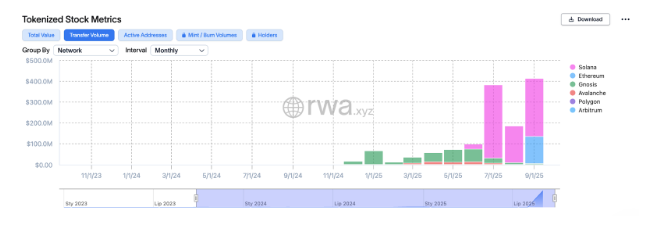

Tokenized stock transfer volumes on Solana compared to other major chains | Source: rwa.xyz

Tokenized stock transfer volumes on Solana compared to other major chains | Source: rwa.xyz

For instance, following the xStocks integration with the network, Solana (SOL) trading volumes for tokenized equities quickly surpassed those for Ethereum. This acceleration benefited from partnerships with exchanges such as Kraken , which aim to enable fast and low-cost transfers for their users.

Solana dominates through performance

RedStone’s report highlights Solana’s performance as one of the main reasons for its dominance in asset tokenization. According to the report, institutional investors rely on high throughput for their RWA applications. Solana, which boasts a capacity to handle up to 100,000 TPS, is a natural choice for many.

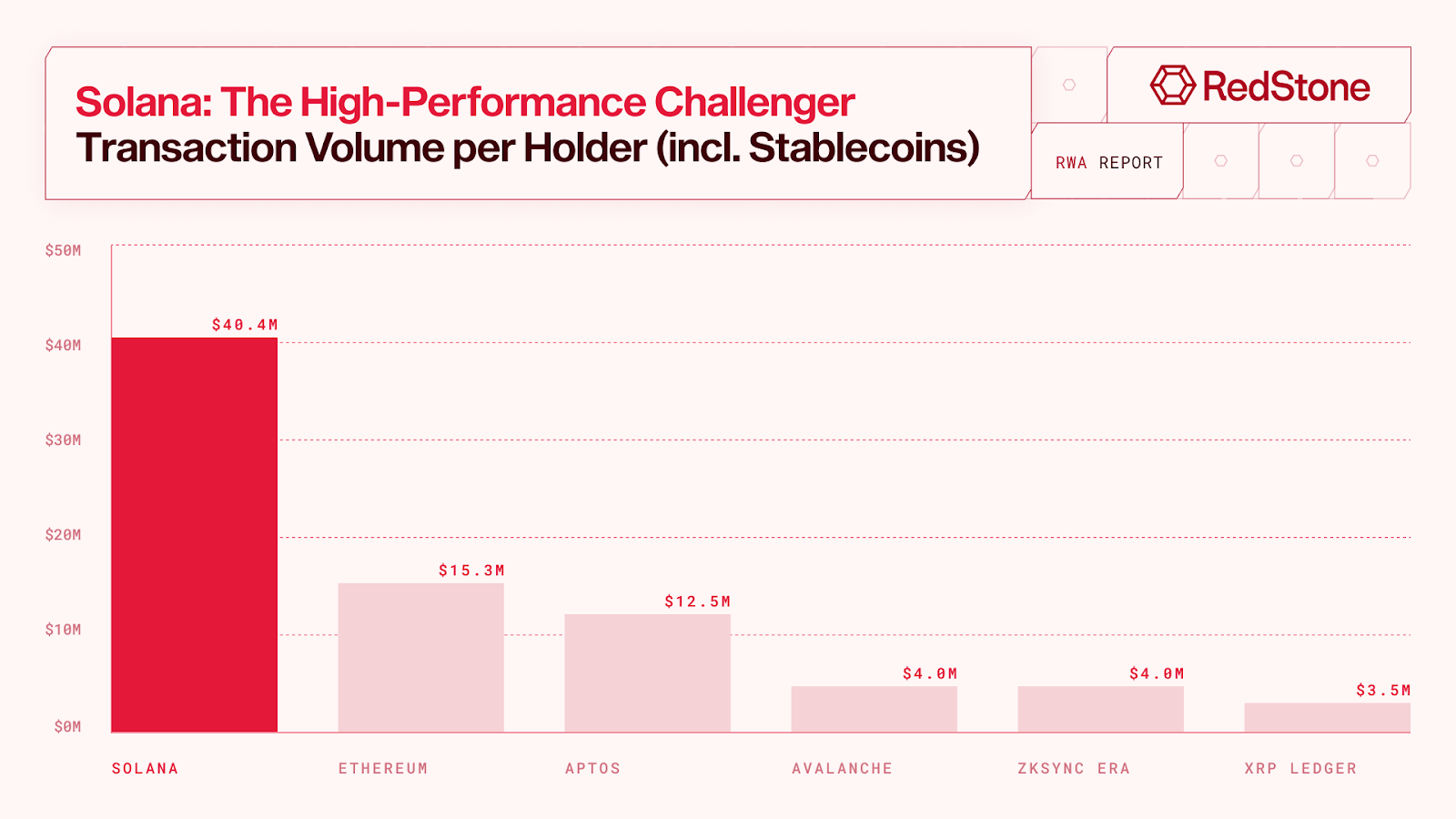

Transaction volume per RWA address on major chains as of June 2025 | Source: RedStone

Transaction volume per RWA address on major chains as of June 2025 | Source: RedStone

“For RWAs, there are really only 2 places: It’s either Ethereum or Solana,” said Robert Leshner, CEO of the tokenization platforms Superstate.

This performance has attracted big names to the network, including BlackRock, Apollo Global, Janus Henderson, and VanEck. Moreover, Solana also hosts popular applications like Phantom, Raydium, Jupiter, and Pump.fun, demonstrating its appeal among retail users.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Pundit Breaks Down Ripple’s XRP Escrow: Why Is It Important?

TROLL Power Moves: Support Defends $0.03224, Bulls Eye Resistance

Forget Ripple (XRP), Analysts Say GeeFi’s (GEE) Potential Can Make Its Early Investors the Next Millionaires