Aethir Unveils $344M Treasury to Bridge Wall Street and Decentralized AI Compute

The Aethir Ecosystem, the decentralized network for GPU infrastructure, has unveiled a groundbreaking Digital Asset Treasury of $344 million. This initiative represents a remarkable historic milestone in the history of artificial intelligence (AI) computing. According to a tweet by Aethir ecosystem, Predictive Oncology, a Nasdaq-listed company, has unleashed a cutting-edge treasury in the AI compute vertical.

Introducing the $344 Million Aethir Digital Asset Treasury 🏦

— Aethir Ecosystem (@AethirEco) October 4, 2025

This is the first time a Nasdaq-listed company, Predictive Oncology, has launched a treasury in the AI compute vertical.

This treasury directly links institutional capital with @AethirCloud’s global GPU… pic.twitter.com/obyCqUc18S

Through this initiative, the company aims to set a new precedent for the direct interaction between institutional capital and decentralized infrastructure. This step aims to create a link between traditional finance and the rapidly evolving field of blockchain technology.

AI and Blockchain at the Edge of a Historic Move

Through the launch of Aethir Digital Asset Treasury, Aethir is set to highlight the blending of artificial intelligence, institutional investment, and decentralized computing. The initiative aims to combine the efforts of Predictive Oncology with the growing GPU infrastructure of Aethir.

With this, the groundbreaking step offers effortless exposure to investors so that they can experience decentralized physical infrastructure networks (DePIN). This collaboration represents a remarkable step forward to align real-world institutional capital with blockchain-powered AI computation.

Aethir Ecosystem Expands Its Reach Worldwide

The launch of the treasury improves Aehir Ecosystem’s position as a leader in decentralized GPU computing. This advanced step leverages a blockchain-driven process to introduce a scalable AI power to institutional and retail participants alike. The AI landscape i expanding day by day, with this, the demand for GPUs goes higher than ever.

Aethir, through this treasury, is poised to cement its reputation as a vital force accelerating global capital markets and the future of compute infrastructure. It enhances adoption while encouraging decentralized computing as a sustainable landscape for investment.

Aethir, with this treasury of $344 million, is poised to intersect AI, DePIN, and institutional finance. In this way, the platform accelerates the next age of decentralized computing.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CPI Day Volatility Play: 5 Altcoins to Watch as Inflation Data Sparks Sharp Market Moves

XRP and TRON Surge, But Apeing Takes the Lead as the Top Upcoming Crypto Nearing $0.0001

Here’s how Euro stablecoins hit $1B despite weak hype

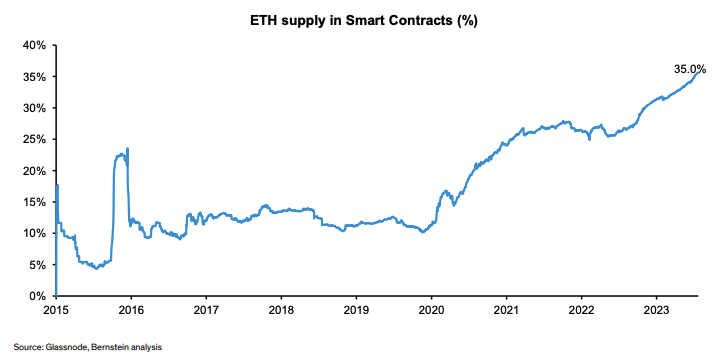

Prospect of spot ETFs not behind ether’s break above $3,000: Bernstein