2025 Midpoint Turning Point: Stablecoins, AI, DOT Branding and Treasury Mechanisms—Which Direction Should Polkadot Take?

2025 is already halfway through, and the crypto industry is at a crucial turning point. Whether it’s the accelerated implementation of global stablecoin regulation, the deep integration of AI tools in Web3 development, or the evolution of Polkadot’s ecosystem architecture and governance mechanisms, all these signal that new directions are taking shape.

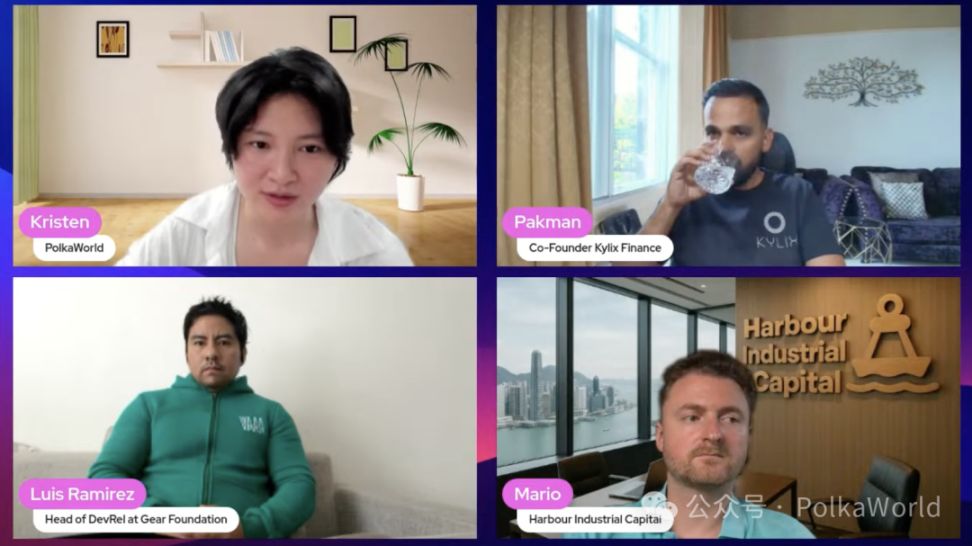

This episode of the PolkaWorld Roundtable livestream invites three core builders from different perspectives—Pakman, Co-founder of Kylix Finance; Luis, Head of Technology at Gear Foundation; and Mario, Co-founder of Harbor Industrial Capital—for an in-depth discussion around the theme of “Turning Point.”

They will provide frontline observations and forward-looking judgments from multiple dimensions, including the disconnect between market and narrative, AI-driven innovation in development tools, transformative opportunities brought by stablecoin regulation, the logic of treasury fund usage and VC collaboration, and whether DOT needs to rebrand.

This is a systematic scan of the industry’s halftime situation, as well as a public discussion on “Where does Polkadot go next?”

Due to the length of the content, we will share it in two parts! This article is the first half, mainly covering:

- VCs, Developers, and Builders: The Web3 Halftime Turning Point from Three Perspectives

- Bringing VCs and the Community “to the Same Table”: How Does HIC Redefine Ecosystem Participation?

- The Treasury Is Not an ATM: The Logic of Treasury Fund Usage from a VC Perspective

- Generate Smart Contracts in One Sentence? Vara Uses AI to Reshape the Web3 Development Experience

- Kylix Mainnet Expected to Launch in September—Will You Also Apply for Treasury Incentives?

Keep reading! Get all the information!

Kristen: Hello everyone, welcome to this episode of the PolkaWorld livestream. I’m Kristen, and joining me today are three guests: Pakman, Mario, and Luis. Hello everyone, welcome!

I chose “Turning Point” as the theme for this episode because it’s now June, a key moment transitioning from the first half to the second half of the year. I feel that whether it’s the overall market atmosphere, the latest stablecoin policies, or the Polkadot ecosystem itself, we are all at an important turning point.

So, looking back at this moment and preparing for the next six months is very meaningful. Let’s first have our three guests briefly introduce themselves. Pakman, why don’t you start?

Pakman: Sure, I think most friends in the Polkadot community already know me. Kristin and I have done many livestreams together before—she’s a very good friend of mine.

Currently, I mainly work on marketing and community building in the Polkadot ecosystem. I’ve participated in many projects before, such as Aventus Network, Mandala Chain, etc. I am also the co-founder of Kylix Finance.

Kylix is a DeFi protocol focused on lending across multiple chains, with many interesting features such as self-repaying loans and a liquidity marketplace.

The most unique aspect of Kylix is that it doesn’t rely on cross-chain bridges—you can lend and borrow native assets directly. We’ve also deployed our own liquidity pools on different chains, which we can discuss in detail later.

I co-founded this project with Gianluigi, a graduate of the Polkadot Blockchain Academy. We’ve been developing for over a year, and the project is nearing completion. I’m very excited about the developments in the second half of the year.

Kristen: That’s great, glad you could join. I know you’re usually very busy, running your own media company and being the founder of Kylix, so I’m really happy you could be here today. Next, let’s welcome Luis!

Luis: Hello everyone! I think this is my first time joining a PolkaWorld livestream via video, but I’ve actually interacted with you before, since our Vara Network is a core part of Polkadot’s technology stack.

I’ll introduce myself in more detail later. I’m Luis Ramirez, currently the core development lead at Gear Foundation. Gear is a non-profit organization and the team behind Vara Network. Vara is a powerful Web3 application platform that allows developers to write smart contracts in Rust, enabling parallel processing in blockchain systems.

Kristen: Welcome, Luis! We’re very much looking forward to hearing about the latest progress from Vara Network, especially since you haven’t been visible in the community for a while. Now, let’s welcome Mario.

Mario: Hi, my name is Mario Altenböger, co-founder and CIO (Chief Investment Officer) of Harbor Industrial Capital. We are a venture capital fund focused on the Polkadot ecosystem, currently operating two funds, both focused on Polkadot projects.

VCs, Developers, and Builders: The Web3 Halftime Turning Point from Three Perspectives

Kristen: Awesome! We’ve always wanted to hear the VC perspective, so I’m glad you could join us today. Now that all three guests are here, please start discussing today’s theme.

Let’s start with a light topic: In the past period, what has been the most important “turning point” for you personally or for your project?

Pakman: I wouldn’t say it’s a “light” question (laughs). Actually, how you define a “turning point” varies—it could be personal experience or project development. But there have indeed been many turning points recently.

If we take Kylix Finance or the entire crypto industry as an example, the biggest turning point is undoubtedly the dramatic change in the market environment—especially regulatory trends and Trump’s dominant role in the market.

This really made me realize that all the knowledge you’ve learned about markets, crypto, and marketing over the years can suddenly become irrelevant at key moments. One person winning an election or launching a meme coin can push the market cap to billions of dollars in seconds—all your proud marketing logic and strategies become useless.

This was a shocking “cognitive turning point” for me: It’s not always “the more you know, the more advantage you have”—more often, it depends on how much “influence” you have.

Kristen: Yes, I totally agree! Many of my friends have been in marketing for years, but recently they suddenly feel like they don’t know what to do anymore.

Pakman: Exactly. And ironically, many of us initially hoped Trump would win, but now most people in crypto are disappointed in him—because he’s made everything too “personal.”

Of course, maybe this is just a temporary low point. Hopefully things will get back on track as everyone expects.

Kristen: Yeah, it’s not just the crypto space—people in other circles also have a lot of negative feelings about him. Thanks for sharing; this is indeed a very representative “2024 turning point.” Luis, do you have any particularly important turning points for you or your project?

Luis: I’d say that in the Vara Network ecosystem, one of the most important turning points and “milestones” in the past few months has been our breakthrough in AI.

Previously, we provided developers with many contract templates so they could create various Web3 applications based on them. But we also found that for the Polkadot tech stack, learning new languages like Rust and Ink is indeed a high barrier, and development efficiency wasn’t that fast.

So we built a new tool: the AI Contract Generator (AI Generator Tool).

We fine-tuned a model by feeding it a large number of smart contract templates from the foundation, so now developers only need to enter a prompt, and it can automatically generate Rust smart contract code compatible with WebAssembly.

This greatly improves prototyping efficiency. Even if you don’t know Rust, you can start building your own smart contracts on Vara.

This is a very important leap for us, especially for developers who want to quickly validate ideas—the barrier has been significantly lowered.

Now, even if you don’t know Rust, you can create smart contracts and start interacting with the Vara Network ecosystem. It’s great. Not just smart contracts, but for frontend and even backend development, we also provide corresponding tools to help developers attract users and build complete applications.

I think this is very meaningful for the Vara Network community, especially for developers. I also hope more and more developers will use this new technology in the future.

Kristen: That’s great, glad to hear about this progress. Do you think AI will become a turning point for the crypto industry?

Luis: I think it will have an accelerating effect. Indeed, AI plays a huge role in different application scenarios across all industries. Our team now uses AI in almost every aspect, such as writing code, auditing code, creating frontend interfaces, and so on.

For example, we’ve also deployed an AI bot in our Telegram community to help users learn about blockchain, understand the Vara ecosystem and various technical concepts, and earn rewards by participating in interactions.

So I do think AI is helping us. For now, I don’t think AI will replace us—we just need to learn how to use it correctly. Of course, no one knows what the future holds; I just hope we don’t see something like Skynet (the AI from Terminator) happen too soon. But for now, we should make good use of existing AI tools and build our future together.

Kristen: You’re definitely leading the trend in this field—great job! Mario, what do you think?

Mario: I’d like to continue on the topic Pakman mentioned. At the beginning of this year, all of us were very optimistic.

Looking at the market performance since the start of the year, both valuations and overall sentiment were pretty good at first. But I remain optimistic. Although there’s still much room for improvement in policy implementation and communication, if some of these policy outcomes are truly realized, it would be a strong boost not only for the crypto industry but also for the entire macroeconomy.

Also, it’s worth noting that he (referring to the former US president) is now putting pressure on the Federal Reserve, and I personally think the Fed should resume rate cuts.

If you look at other central banks around the world, such as the European Central Bank, Bank of Japan, and Swiss National Bank, they’ve all started cutting rates—Switzerland even cut rates to zero. So I think the market now is like reopening the “floodgates”—because there’s a clear imbalance: stock market valuations are at historic highs, but other risk asset classes like crypto assets, venture capital assets, and real estate are still in a “suppressed” state. So I think this is the economic sector most likely to see a major turning point in the future.

For us, one of the most important milestones this year was completing the setup of our second fund at the beginning of the year.

And just a few weeks ago, we brought in our first institutional investor—the Web3 Foundation. We’re very happy to have them join and to have completed this process smoothly.

This further demonstrates that within the Polkadot ecosystem, it’s not just about collaboration between projects—the entire ecosystem has a genuine spirit of cooperation and forward momentum. This positive atmosphere is not accidental; the Web3 Foundation and ecosystem leadership teams are also continuously supporting and driving this development behind the scenes.

Bringing VCs and the Community “to the Same Table”: How Does HIC Redefine Ecosystem Participation?

Kristen: Absolutely, this is a macroeconomic turning point that will affect the entire crypto industry and the ecosystem we’re in. Speaking of your recently announced advisory committee, can you tell us more about it? What’s the strategy or thinking behind it?

Mario: Yes, we’ve now completed the fund setup and brought in our first investor, and we’ve officially announced the advisory committee members for Harbor Industrial Capital Fund 2.

The original intention of setting up this committee was to further strengthen our connection with the community and allow people from different fields in the ecosystem to participate representatively.

For example, we invited:

- Angie Dalton (from Signum Growth and Topplay)—she’s a co-investor;

- Active governance members from the community, such as PakMan—he not only actively participates in governance but also represents an important project, Kylix Finance, which we believe has the potential to take DeFi on Polkadot to a new level;

- Representatives from other projects, such as Michael from the Mandala project—we’re also very happy to have him join;

- Governance representatives, such as Tommy (Alice und Bob)—he has been deeply involved in Polkadot governance for many years and is a very strong voice;

- Also Xiaojie from PolkaWorld and you—we’re very happy to invite you both because we believe the Chinese community is also very important to the entire ecosystem. At Harbor Industrial Capital, Max and I are usually based in Hong Kong, where we work and live a lot, and both of us speak fluent Mandarin, so we hope you can help us connect more with the Chinese community.

- We also invited Paulina (from BBA), because we believe that bringing in new projects, developers, and founders is key to the ecosystem’s development. We want to maintain close cooperation with BBA. We’ll also actively participate in and promote cooperation at the upcoming Bali PBA event in August.

So what is the core purpose of this advisory committee? Simply put, it’s to:

- Make our connection with the community closer;

- Cover different “touchpoints” and representative groups in the ecosystem;

- Better “listen to the ecosystem” and understand community dynamics;

- Also to better coordinate external communication and the work we do in the ecosystem.

The Treasury Is Not an ATM: The Logic of Treasury Fund Usage from a VC Perspective

Kristen: That’s great, and there are two advisory committee members in today’s conversation: Pakman and PolkaWorld. I hope we can work together to spread HIC’s message and promote the growth of the entire ecosystem.

Speaking of the VC perspective, ordinary investors and the broader audience actually value the VC viewpoint a lot. So I especially want to hear your thoughts on the use of OpenGov treasury funds.

We often see proposals hoping to apply for funds from the OpenGov treasury, but they’re not “public good” type projects. HIC once proposed a viewpoint: OpenGov should operate like a VC, with a VC mindset—when a project takes funds from the treasury, it should “give back” to the ecosystem in some form.

But some projects, especially startups, argue that if a project can use treasury funds to attract more users to the ecosystem, that itself is already a positive return for Polkadot.

What do you think? Do you think the treasury should operate like a VC and expect “returns”? Or do you think unconditional grants are more beneficial for ecosystem growth?

Mario: Thank you for the question. I do believe that there is currently insufficient capital supply within the ecosystem, and we do need to provide more funding support for ecosystem projects. But the key question is: Where should these funds come from?

On one hand, we have Gavin, Parity, and other core development teams focusing on advancing the underlying architecture. The original intention of the Web3 Foundation was to support ecosystem development and clearly distinguish their respective roles.

I think this is the first important step: the foundation is responsible for supporting the ecosystem but does not invest directly; investment should be done through funds like ours. As I understand it, the Web3 Foundation’s investment in the ecosystem is done through ecosystem funds like ours. That is, the foundation provides funds to these ecosystem funds, and we then deploy them to the market.

Why does the foundation invest through funds rather than directly in projects? There are two reasons:

First, regulatory considerations.

You may remember the SEC’s (U.S. Securities and Exchange Commission) debate about “whether it constitutes a security”—this is very critical. Polkadot has always actively communicated with the SEC, striving to maintain its legal status as “software” rather than a “security”—because once defined as a security, it could have a series of negative consequences. So that’s the primary reason.

Second, for professionalism and efficiency.

The foundation supports multiple ecosystem funds and outsources project due diligence. Each fund may have a different focus, for example:

- Signum focuses more on gaming;

- Cytale has been deeply involved in the ecosystem for many years;

- And us (Harbor Industrial Capital).

Each fund reviews projects from its own perspective, and they can share due diligence notes and even co-invest. So having multiple parties active in due diligence is beneficial for the ecosystem.

This is the current foundation + ecosystem fund operating model.

As for other VCs, of course, we’d like to see more traditional or external VCs participate in the Polkadot ecosystem, such as well-known names like Arrington Capital. Unfortunately, they’re not very active at the moment.

Now let’s look at another question: What role should the Treasury play?

Of course, different people have different views on this, and I won’t go deep into those differences, but fundamentally, the Treasury’s task is to support the development of the entire ecosystem.

This raises a key question: How should funds be allocated? For example:

- How much should be allocated to marketing?

- How much should be allocated to grants?

Grants are certainly reasonable, especially for “public goods” type projects such as infrastructure, documentation, governance mechanisms, etc. These may not have direct economic returns but are indispensable for ecosystem development.

For example, an offline event or expo—like when we participated in Consensus or other conferences in Hong Kong and Polkadot had a booth—how do you measure the value of such activities? What “return” do they bring to the ecosystem? It’s hard to measure directly in dollars. So for these activities, it’s acceptable to use treasury support, which can be set as a bounty or a dedicated budget allocation.

But if we allocate funds to entities that are themselves economic entities (i.e., have a business model and aim for profit), that’s different. According to basic Economics 101:

The purpose of a company’s existence is to make a profit (unless it’s a non-profit or public project).

Given that, whether a project is supported by our fund or by the treasury, if it can be profitable in the future, the supporter should also receive a certain proportion of the returns—that’s a very simple and direct logic.

So, as I mentioned earlier:

- The foundation supports projects through ecosystem funds;

- The treasury allocates grants to public goods.

As for whether the treasury should “invest directly” in projects—this again raises regulatory risks. For example, the SEC might say: “Wait, is this an investment? Does this constitute a security?”

We must avoid this situation.

The second question is: How can the treasury actually “invest” at the execution level?

For example, if a proposal says “let’s invest $1 million in this project,” how should these funds be allocated? How should they be managed? Should an equity structure be set up? How to ensure regulatory compliance? All of these are very complex without a mature intermediary structure.

So what should be done?

I think there should still be some kind of intermediary mechanism, such as a dedicated committee or some kind of fund allocation mechanism, to be responsible for distributing these funds. Because if the treasury directly invests in projects, it’s easy to touch the regulatory red line again.

So the key issue is not “whether to invest,” but how to use treasury funds to support projects in a compliant way, while ensuring the treasury can get returns. This is not only a reasonable requirement but must also be executed in a compliant way, with proper due diligence and legal processes.

So, when we consider how to allocate treasury funds to projects, all of the above are very important considerations.

Kristen: You have a clear and precise understanding of the use of treasury funds, and I completely agree with your view: we do need to distinguish between the roles of VCs and the treasury, and also recognize that the treasury’s function is not just to fund projects—it has other responsibilities. So we need to handle these issues very precisely. I also hope to see more people participate in such discussions and promote progress in this area in the future.

Generate Smart Contracts in One Sentence? Vara Uses AI to Reshape the Web3 Development Experience

Alright, let’s talk about Luis. We’ve seen Vara actively promoting the concept of AI smart contracts, and you mentioned this is an AI-driven turning point for the crypto industry. Can you tell us specifically: how are AI and smart contracts combined?

Luis: Of course, I think this is not only important for our Vara Network ecosystem but also a key topic for the entire industry.

At first, we were connecting with developers about their ideas, such as building a DEX (decentralized exchange), a marketplace, or supply chain applications. Our website provides many smart contract templates, and developers can quickly start projects by modifying only a small part of the code, without having to start from scratch.

But now we’ve gone further. Now, you don’t even need to know anything—just enter a sentence like: “Create a smart contract with a complete supply chain structure, including these stages, these users, and these interaction logics.” Then AI will call our supply chain contract template and generate the complete logic for the developer.

I think this is very important because it means we can greatly accelerate the output speed of MVPs (minimum viable products) and early-stage projects, allowing them to build applications on Vara faster.

This is also a tool we actively promote at meetups and workshops, and developer feedback has been very positive.

Everyone is already used to using prompts in daily life, such as with ChatGPT, Claude, Qwen, and other AI tools to speed up daily tasks. The same applies in development.

Personally, I like this approach, but I’m not particularly fond of byte-coding (visual programming with bytecode) itself. Byte-coding is indeed suitable for rapid prototyping, but once you want to do complex logic or advanced customization, you still need a strong programming background to know how to modify and extend the code.

So I think the best approach now is a combination of “AI + programming basics,” plus the official development support we provide at Vara.

This is the most effective combination we’ve explored so far. In the coming months, we can see together whether this approach can really speed up the output of new projects—I’m very much looking forward to it.

Kristen: Yes, everyone knows AI is very dependent on computing resources and requires a lot of computing power. But as we all know, blockchain has its natural limitations in computing power. So how do you balance the two? For example, when developing AI smart contracts, are there any requirements for the underlying infrastructure?

Luis: That’s a very important question—how do we integrate AI on the blockchain?

Currently, our implementation is based on existing AI models, which all run off-chain and not on-chain. Of course, we’ve tried different approaches, such as our ZKML (zero-knowledge machine learning) integration model, but for now, we think the most suitable and practical way is: AI doesn’t run directly on-chain but is integrated with the chain.

We know there are some blockchains specifically built for on-chain AI, even creating AI model marketplaces, but that’s not Vara’s main direction. We prefer to let developers train their models off-chain and use our integration tools to upload the results on-chain. In other words, AI runs off-chain, and the results are integrated on-chain via ZKML.

In addition, we have a solution called Gear EXE, which allows developers to build AI based on centralized computing networks. This approach is not only cheap and fast but also very flexible. But if you insist on running AI models fully on-chain on the Vara network, it’s still quite costly at the moment and not as cost-effective as other AI platforms.

So our main direction now is to help developers use AI to accelerate idea incubation, regardless of whether AI runs on-chain or off-chain.

Kristen: Yes, simply put: the AI’s computing logic is executed off-chain, and the results are written on-chain. Have you seen any specific application scenarios for AI smart contracts?

Luis: Yes, we’ve already provided some templates that support this on-chain/off-chain interaction model. For example, you can take your own trained AI model (any algorithm implemented in your chosen programming language) and, with our ZKML support, write its results to the Vara network.

So far, this is one of our most complete cases. Of course, it’s extensible—you can extend from the template to develop any functionality you want.

We provide these templates to help developers save time, so they don’t have to start from scratch every time. But if you have higher technical capabilities, we very much welcome you to extend these templates and develop your own applications—we’re also happy to help in the process.

Kristen: Thank you, Luis! I also hope that developers interested in trying AI smart contracts will follow you and Vara Network to learn more.

Kylix Mainnet Expected to Launch in September—Will You Also Apply for Treasury Incentives?

Next, let’s have PakMan introduce the mainnet launch plan for the Kylix project. Community members are very concerned—when will you go live?

PakMan: I’d love to say we’re launching tomorrow (laughs), but honestly, it’s not that fast.

Before becoming the co-founder of Kylix, I worked on many projects for years and was often frustrated by repeated TGE (token generation event) delays. At the time, I never understood—how hard could it be to launch a project? Why are there always delays?

It wasn’t until I started my own project that I truly understood the reason—it’s really complicated. That’s when I had my epiphany.

For example, you have to do auditing and UI/UX design. I always say, it’s better to launch later with a solid product than to rush out something full of problems.

We’re very eager to launch as soon as possible. The testnet is already live, UI/UX is being improved, and the frontend team is continuously developing. This process involves coordination among many different teams, and every step requires communication and alignment.

If I had to give a rough timeline, I don’t want to overpromise, but a realistic estimate is: between the end of August and September, we might officially launch. Of course, it could be earlier, but we’re still testing and auditing, and every detail must be in place.

You only get one chance to launch—if you mess it up, it could be the project’s biggest failure. So we have to proceed cautiously to ensure a successful launch. Therefore, I think September is an ideal launch time.

Kristen: I know that for DeFi projects, liquidity is very important. Are you considering applying for treasury liquidity incentives?

PakMan: That’s a very good question and one I get asked a lot. I think if you look at trends in the Polkadot ecosystem, such as Bifrost, Hydration, Acala, and Stellaswap, they’ve all applied for liquidity support from the Polkadot treasury.

This is something we might consider as well. I’m not saying we definitely won’t, but we’re currently more inclined to build a utility-driven model rather than rely entirely on incentives. After we launch and start exploring future paths, this may be a direction we’ll seriously consider.

After all, if you’re building a project in this ecosystem, you should be eligible for ecosystem support.

So for now, my answer is neither a 100% yes nor a 100% no—it’s a “maybe.” We’ll see how things develop, and at some stage, we might go down this path.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The "Black Tuesday" for US stock retail investors: Meme stocks and the crypto market plunge together under the double blow of earnings reports and short sellers

Overnight, the US stock market experienced its worst trading day since April, with the retail-heavy stock index plunging 3.6% and the Nasdaq dropping more than 2%. Poor earnings from Palantir and bearish bets by Michael Burry triggered a sell-off, while increased volatility in the cryptocurrency market added to retail investor pressure. Market sentiment remains tense, and further declines may follow. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

Crypto Market Macro Report: US Government Shutdown Leads to Liquidity Contraction, Crypto Market Faces Structural Turning Point

In November 2025, the crypto market experienced a structural turning point. The U.S. government shutdown led to a contraction in liquidity, pulling about 20 billions USD out of the market and intensifying capital shortages in the venture capital sector. The macro environment remains pessimistic.

Market volatility intensifies: Why does Bitcoin still have a chance to reach $200,000 in Q4?

Institutional funds continue to buy despite volatility, targeting a price level of $200,000.

Key Market Intelligence for November 6: How Much Did You Miss?

1. On-chain funds: $61.9M flowed into Hyperliquid today; $54.4M flowed out of Arbitrum. 2. Largest price changes: $SAPIEN, $MMT. 3. Top news: ZEC surpassed $500, marking a 575% increase since Naval’s call.