Date: Fri, Nov 07, 2025 | 08:50 AM GMT

The cryptocurrency market continues to highlight strong performance among long-standing altcoins. Internet Computer (ICP) has already surged by more than 200% in just one week, and now attention is shifting toward another established project — Polkadot (DOT).

DOT has gained 8% today, and more importantly, its chart is beginning to show signs of a potential “Power of 3” (PO3) reversal pattern — a structure that often appears near major market bottoms and signals a possible trend shift.

Source: Coinmarketcap

Source: Coinmarketcap

Power of 3 Pattern in Play

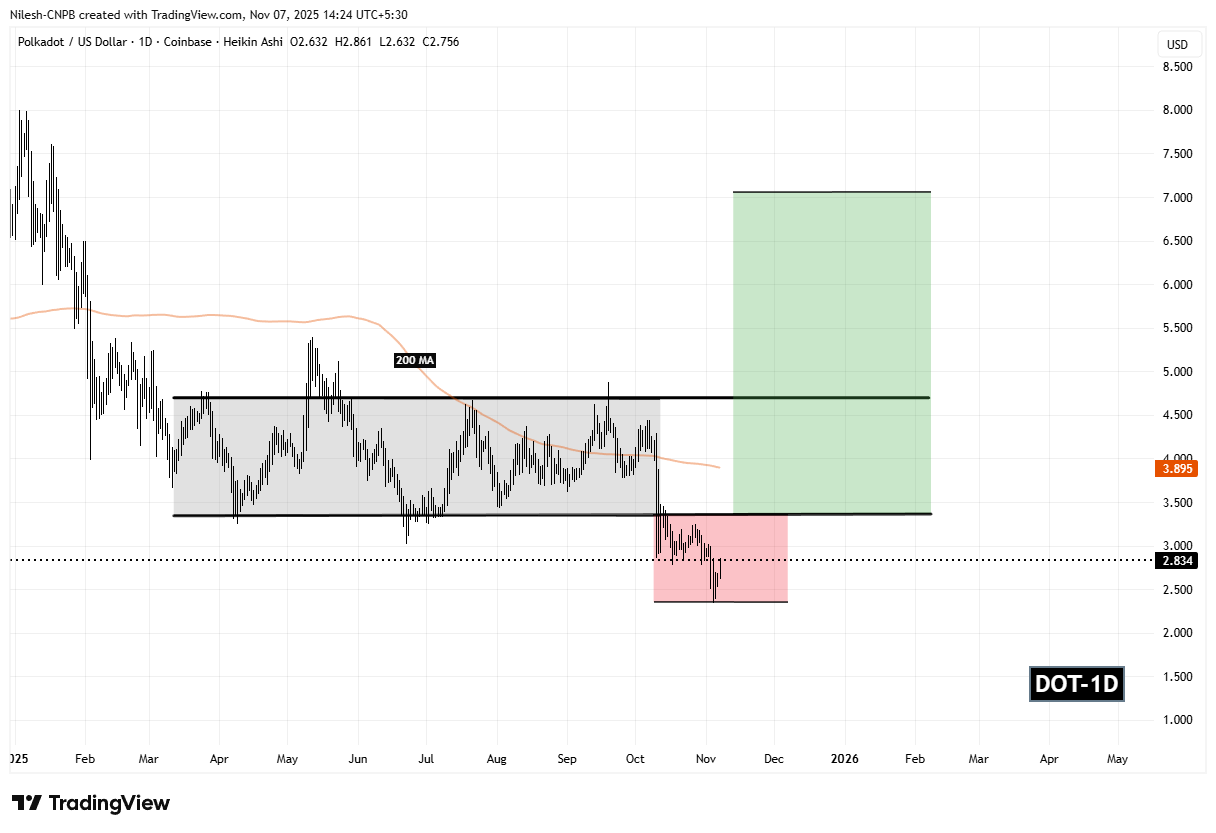

On the daily chart, DOT’s recent price movement aligns with the key stages of the PO3 model, which typically includes accumulation, manipulation, and expansion.

Accumulation Phase

From March to October, DOT consolidated within a wide range, with resistance near $4.70 and support around $3.36. This prolonged sideways action suggests that larger players may have been quietly accumulating positions while volatility remained low.

Manipulation Phase

On 10 October, DOT broke below the $3.36 support level and dropped sharply to $2.34 before recovering. This move below the established range forms the manipulation phase of the PO3 structure, where weaker hands are shaken out before a potential bullish leg begins.

Polkadot (DOT) Daily Chart/Coinsprobe (Source: Tradingview)

Polkadot (DOT) Daily Chart/Coinsprobe (Source: Tradingview)

DOT is now trading around $2.83, still within the manipulation zone highlighted on the chart.

What’s Next for DOT?

DOT remains in the manipulation phase, meaning short-term volatility is still likely. However, the next decisive levels will determine whether the expansion phase of the PO3 pattern takes shape.

Key levels to watch:

- Reclaiming $3.89 (200-day Moving Average) would indicate a shift in momentum.

- A breakout above $4.70 resistance would confirm the expansion phase.

If DOT successfully breaks above $4.70, it could trigger a strong move toward the $7.06 target zone, representing a potential 150 percent rise from the recent low.

DOT’s current structure is showing early signs of a possible reversal. While confirmation is still needed, the developing PO3 pattern suggests that Polkadot may be preparing for a significant upward trend if buyers continue to show strength and reclaim key resistance levels.