DeFi faces a potential $8 billion risk, but only $100 million has exploded so far

Chainfeeds Guide:

Do you really understand where DeFi yields come from? If you don't, then you are the yield.

Source:

Author:

BlockBeats

Opinion:

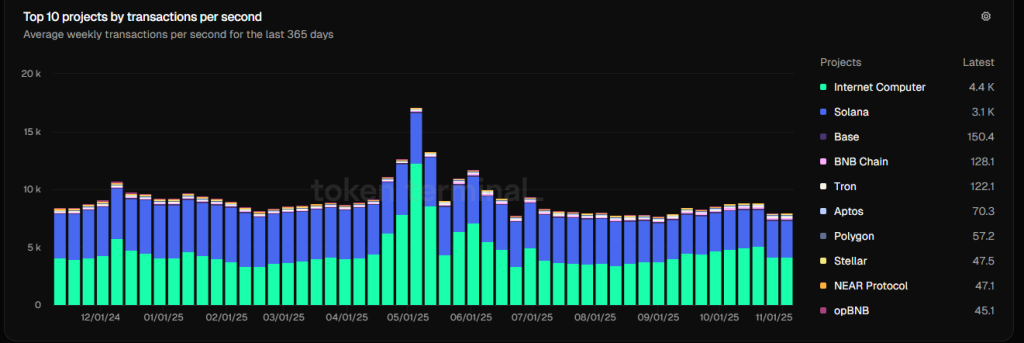

BlockBeats: Fund managers, a role once trusted and later disenchanted in the stock market, carried the wealth dreams of countless retail investors during the heyday of the A-share market. At first, everyone flocked to fund managers with prestigious academic backgrounds and impressive resumes, believing that funds were a safer and more professional alternative to direct stock trading. However, when the market declined, investors realized that so-called "professionalism" could not withstand systemic risk. Worse still, fund managers took management fees and performance bonuses—profits were their own skills, but losses were borne by investors. Now, as the role of "fund manager" reappears on-chain under the new name "Curator" (external manager), the situation has become even more dangerous. They do not need to pass any qualification exams, undergo any regulatory scrutiny, or even disclose their real identities. All it takes is to create a "vault" on a DeFi protocol, use an outrageously high annualized yield as bait, and billions of dollars will flood in. Where this money goes and what it is used for, investors have no idea. On November 3, 2025, when Stream Finance suddenly announced the suspension of all deposits and withdrawals, a storm sweeping through the DeFi world reached its climax. The next day, the official statement was released: an external fund manager was liquidated during the market turbulence on October 11, resulting in a loss of approximately $93 million in fund assets. The price of Stream's internal stablecoin xUSD plummeted, crashing from $1 to a low of $0.43 within just a few hours. This storm did not come without warning. As early as 172 days prior, Yearn's core developer Schlag had warned the Stream team. At the center of the storm, he bluntly stated: "Just one conversation with them and five minutes browsing their Debank would make it clear this would end badly." Stream Finance is essentially a yield-aggregating DeFi protocol that allows users to deposit funds into vaults managed by so-called Curators to earn yields. The protocol claims to diversify funds into various on-chain and off-chain strategies to generate returns. This blow-up was caused by two main reasons: first, external Curators used user funds for opaque off-chain trading, and their positions were liquidated on October 11. Second, on-chain analysts further discovered that Stream Finance also engaged in recursive lending with Elixir protocol's deUSD, using a small amount of real capital to leverage multiple times. This "left foot stepping on the right foot to reach the sky" model, while not the direct cause of the losses, greatly amplified the protocol's systemic risk and laid the groundwork for subsequent cascading collapses. These two issues combined to trigger a catastrophic chain reaction: $160 million in user funds were frozen, the entire ecosystem faced $285 million in systemic risk, Euler protocol incurred $137 million in bad debt, and 65% of Elixir's deUSD was backed by Stream assets, putting $68 million on the brink of collapse. To understand the root of this crisis, we must return to the origins of DeFi. Traditional DeFi protocols represented by Aave and Compound have their core appeal in "Code is law." Every deposit and loan must follow rules hardcoded into smart contracts—open, transparent, and immutable. Users deposit funds into a massive public pool, and borrowers must provide overcollateralization to borrow funds. However, in this cycle, a new generation of DeFi protocols represented by Morpho and Euler, in pursuit of higher yields, have implemented a new type of fund management. They believe Aave's public pool model is inefficient, with large amounts of idle capital failing to maximize returns. Thus, they introduced the Curator model. Users no longer deposit money into a unified pool but instead choose individual "vaults" managed by Curators. Users deposit money into the vault, and Curators have full discretion over how to invest and generate returns with these funds. The expansion speed of this model is astonishing. To date, the total value locked in just Morpho and Euler protocols has exceeded $8 billion, meaning over $8 billion in real money is being managed by numerous Curators with diverse backgrounds. This model essentially replicates the core risk of P2P lending: users cannot judge where their funds are going, nor can they assess the Curator's true capabilities, risk strategies, or repayment ability. The so-called decentralization only occurs at the moment of deposit and withdrawal, while the actual operation and risk management of the funds are entirely centralized in the hands of the Curator. The protocol itself only provides the infrastructure; the real banking business is decided by the Curator. Even worse, Curators' profits depend on management fees and performance bonuses. To chase higher APY, they tend to use high-risk leveraged strategies—if they make money, they take a cut; if they lose money, the users bear the loss.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Market Update: Traders Reduce Risk as Bitcoin Tests Key $100K Support

NEAR Protocol Price Prediction 2025: Usage Growth Signals a Potential $10 Reversal

Aptos Price Prediction 2025: Can APT Repeat ICP’s Explosive Rally from $3 zone?

Bitcoin Price Analysis: Key Levels to Watch and Altcoin Rotation Signals