Ray Dalio's latest post: This time is different, the Federal Reserve is fueling a bubble

Because the fiscal side of government policy is now highly stimulative, quantitative easing will effectively monetize government debt, rather than simply reinjecting liquidity into the private system.

Since the fiscal side of government policy is now highly stimulative, quantitative easing will effectively monetize government debt rather than simply re-injecting liquidity into the private system.

Written by: Ray Dalio

Translated by: Golden Ten Data

On November 5 local time, Bridgewater Associates founder Ray Dalio posted on social media. Here are his views:

Have you noticed that the Federal Reserve has announced it will stop quantitative tightening (QT) and begin quantitative easing (QE)?

Although this has been described as a "technical operation," it is, in any case, an easing move. This is one of the indicators I (Dalio) use to track the dynamic progress of the "Big Debt Cycle" described in my last book, and it needs to be closely watched. As Chairman Powell said: "...at some point, you will want reserves to begin to grow gradually to keep up with the size of the banking system and the size of the economy. So, at some point, we will increase reserves..." How much they will increase is something to keep an eye on.

Given that one of the Fed's jobs is to control the "size of the banking system" during bubbles, we will need to watch this closely, while also observing how quickly it implements easing through rate cuts in the emerging bubble. More specifically, if the balance sheet starts to expand significantly while interest rates are being cut and the fiscal deficit is large, then in our view, this is the classic monetary and fiscal interaction between the Fed and the Treasury, monetizing government debt.

If this occurs while private credit and capital market credit creation remain strong, stocks are hitting new highs, credit spreads are near lows, unemployment is near lows, inflation is above target, and artificial intelligence (AI) stocks are in a bubble (according to my bubble indicators, they indeed are), then in my view, it is as if the Fed is stimulating a bubble.

Given that the current administration and many others believe that restrictions should be greatly reduced so that monetary and fiscal policy can be formulated with an "all-out pursuit of growth" approach, and considering the upcoming huge deficit/debt/bond supply and demand issues, if I suspect that this is more than just the technical issue it claims to be, that should be understandable.

While I understand that the Fed will pay close attention to risks in the funding markets, which means it tends to prioritize market stability over actively fighting inflation, especially in the current political environment, it remains to be seen whether this will become a full and classic stimulative quantitative easing (accompanied by large-scale net purchases).

At this point, we should not ignore the fact that when the supply of US Treasuries exceeds demand, and the Fed is "printing money" and buying bonds, while the Treasury is shortening the maturity of the debt it sells to make up for the lack of demand for long-term bonds, these are all dynamics of the late stage of the classic "Big Debt Cycle." While I explain the mechanics of all this in detail in my book "How Countries Go Broke: The Big Cycle," I want to point out here that this classic milestone is approaching in this Big Debt Cycle and briefly review its mechanics.

I am eager to teach by sharing my thoughts on market mechanisms and showing what is happening, just as one teaches fishing by sharing ideas and pointing out what is happening, leaving the rest to you, because that is more valuable for you and avoids me becoming your investment advisor, which is better for me. Here is the mechanism as I see it:

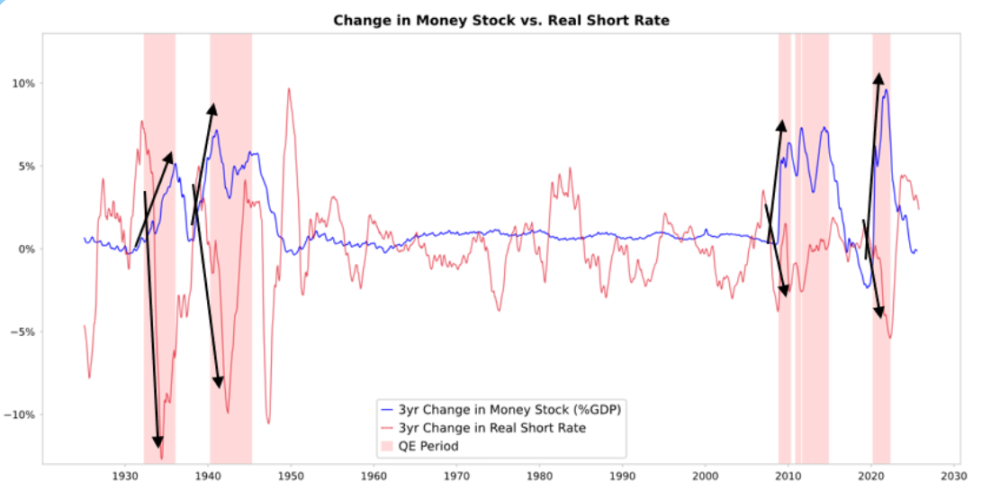

When the Fed and/or other central banks buy bonds, they create liquidity and push down real interest rates, as shown in the chart below. What happens next depends on where the liquidity goes.

Comparison of money supply changes and short-term real interest rates

If the liquidity stays in financial assets, it pushes up financial asset prices and lowers real yields, causing price-to-earnings ratios to expand, risk spreads to narrow, gold to rise, and "financial asset inflation" to form. This benefits holders of financial assets relative to non-holders, thereby exacerbating the wealth gap.

It usually seeps to some extent into the markets for goods, services, and labor, pushing up inflation. In this case, as automation replaces labor, the extent to which this happens seems to be less than usual. If the inflation it stimulates is high enough, it may cause nominal interest rates to rise to offset the decline in real rates, which will hurt bonds and stocks both nominally and in real terms.

Mechanism: Quantitative Easing Transmits Through Relative Prices

As I explained in my book "How Countries Go Broke: The Big Cycle," all financial flows and market movements are driven by relative attractiveness rather than absolute attractiveness, and the explanation there is more comprehensive than I can provide here.

In short, everyone has a certain amount of money and credit, and central banks influence these through their actions. Everyone decides how to use them based on the relative attractiveness of their choices. For example, they can borrow or lend depending on the relationship between the cost of funds and the return they can get; where they put their money depends mainly on the relative expected total returns of various alternatives, with expected total return equal to the yield of the asset plus its price change.

For example, gold has a yield of 0%, while the nominal yield on 10-year Treasuries is now about 4%. Therefore, if you expect gold's price to rise less than 4% per year, you will prefer to hold bonds; if you expect it to rise more than 4%, you will prefer to hold gold. When thinking about the performance of gold and bonds relative to this 4% threshold, one should naturally consider what the inflation rate will be, because these investments need to pay enough return to make up for the inflation that erodes our purchasing power.

All else being equal, the higher the inflation rate, the more gold rises, because most inflation is due to the value and purchasing power of other currencies falling as supply increases, while the supply of gold increases little. This is why I pay attention to money and credit supply, and why I pay attention to what the Fed and other central banks are doing.

More specifically, over a long period, the value of gold has been linked to inflation. The higher the inflation, the less attractive a 4% bond yield becomes (for example, a 5% inflation rate makes gold more attractive, supporting gold prices, and makes bonds unattractive, as it results in a real return of -1%), so the more money and credit the central bank creates, the higher my expected inflation rate, and the less I like bonds relative to gold.

All else being equal, an increase in quantitative easing by the Fed should lower real interest rates and increase liquidity, specifically by compressing risk premiums, lowering real yields, and pushing up price-to-earnings multiples, especially boosting the valuations of long-duration assets (such as technology, AI, growth stocks) and inflation-hedged assets (such as gold and inflation-protected bonds). Once inflation risk re-emerges, tangible asset companies (such as mining, infrastructure, physical assets) may outperform pure long-duration tech stocks.

The lagged effect is that quantitative easing should push inflation above what it would otherwise be. If quantitative easing causes real yields to fall but inflation expectations to rise, nominal price-to-earnings ratios can still expand, but real returns will be eroded.

It is reasonable to expect that, similar to late 1999 or 2010-2011, there will be a wave of strong liquidity-driven rallies, which will eventually become too risky and have to be curbed. During this rally, and before tightening actions sufficient to curb inflation and burst the bubble, is the classic ideal time to sell.

This Time Is Different: The Fed Is Easing Into a Bubble

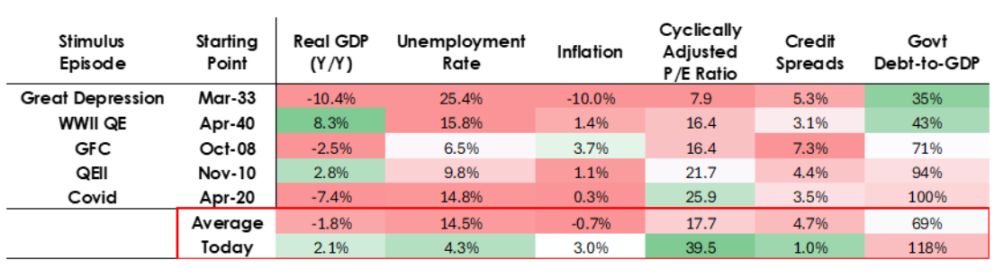

While I expect the mechanisms to work as I have described, the conditions under which this round of quantitative easing is occurring are very different from before, because this time the easing is a stimulus to a bubble rather than to a depression. More specifically, when quantitative easing was deployed in the past, the situation was:

- Asset valuations were falling and prices were cheap or not overvalued.

- The economy was contracting or very weak.

- Inflation was subdued or falling.

- Debt and liquidity problems were severe, and credit spreads were wide.

Therefore, past quantitative easing was "stimulus to a depression."

But now, the situation is exactly the opposite:

Asset valuations are high and rising. For example, the S&P 500's earnings yield is 4.4%, while the nominal yield on 10-year Treasuries is 4%, and the real yield is about 1.8%, so the equity risk premium is low, about 0.3%.

The economy is relatively strong (real growth has averaged 2% over the past year, and unemployment is only 4.3%).

Inflation is above target and at a relatively moderate level (slightly above 3%), while the inefficiencies brought by "deglobalization" and tariff costs are putting upward pressure on prices.

Credit and liquidity are abundant, and credit spreads are near historical lows.

Therefore, the current quantitative easing is "stimulus to a bubble."

US economic data at different stages

So, current quantitative easing is no longer "stimulus to a depression," but "stimulus to a bubble."

Let's look at how these mechanisms typically affect stocks, bonds, and gold.

Since the fiscal side of government policy is now highly stimulative (attributable to the huge existing outstanding debt and massive deficits, financed by large-scale Treasury issuance, especially at relatively short maturities), quantitative easing will effectively monetize government debt rather than simply re-injecting liquidity into the private system.

This is what makes what is happening now different, and the way it is being done seems to make it more dangerous and more inflationary. This looks like a bold and risky "big bet"—a bet on growth, especially growth brought by artificial intelligence, and this growth is being financed by very liberal easing of fiscal, monetary, and regulatory policy. We will have to monitor closely in order to respond appropriately.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Google Finance Integrates AI and Prediction Market Data for Smarter Insights

Kazakhstan launches a billion-dollar crypto fund with seized assets

Ripple Avoids Wall Street After SEC Victory

The Story of Brother Machi's "Going to Zero": Just Be Happy