Polymarket Rebounds With Growing User Activity as Wash Trading Concerns Rise

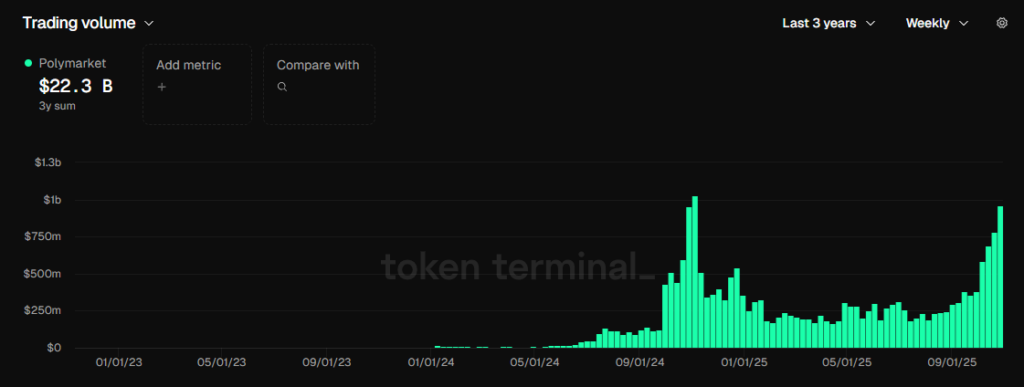

Polymarket is regaining momentum after a long cooldown period as trading activity climbs again. User participation is also on the rise, with renewed interest from both crypto-native and mainstream audiences. Recent data shows the platform nearing the trading volumes last seen during the peak activity surrounding the 2024 U.S. elections.

In brief

- Weekly volume hit $961M with 247K active users, showing strong growth as activity spreads across more diverse prediction markets.

- Social media virality, wallet improvements, and POLY token rewards boosted user engagement across political and global events.

- Study from Columbia found up to one quarter of activity may be wash trading, with some weeks showing nearly 60 percent fake volume.

- Large wallet clusters and repetitive loops suggest attempts to game rewards, yet platform visibility and usage continue to rise.

Platform Activity Climbs With 247K Weekly Users and Near-Record Volumes

Polymarket recorded roughly $961 million in weekly volume, approaching the slightly more than $1 billion reached during election week in November 2024. This follows a year spent rebuilding its user base after its most active prediction pair concluded on November 6, 2024.

Liquidity remains below peak levels, with about $248 million locked compared to $375 million during the election’s trading highs. Activity has returned at a steadier pace and is now distributed across more markets rather than concentrated in a single event.

More than 247,000 weekly active users joined the platform, equivalent to around 72,000 daily users—an increase of roughly 30% compared to the same period last year. October volumes reached a record $4.1 billion, placing Polymarket just behind Kalshi, which ended the month at $4.4 billion.

Rising visibility also boosted Polymarket’s presence in Google searches linked to polarizing topics, bringing in an additional wave of attention.

Social Media Heat Drives Polymarket’s Strongest User Growth Since 2024

Current events have become a key driver of Polymarket’s renewed growth. Sports once served as a temporary source of traffic, but the recent surge came from political and global news . A busy election year and broader uncertainty have fueled strong demand for real-time predictions.

Social media has amplified this growth, as certain markets went viral and attracted thousands of newcomers. Easier wallet integrations further supported the trend by simplifying access for first-time users. Non-election wallets grew from about 6,000 to over 27,000 in October, while total active wallets reached 84,000 by month’s end.

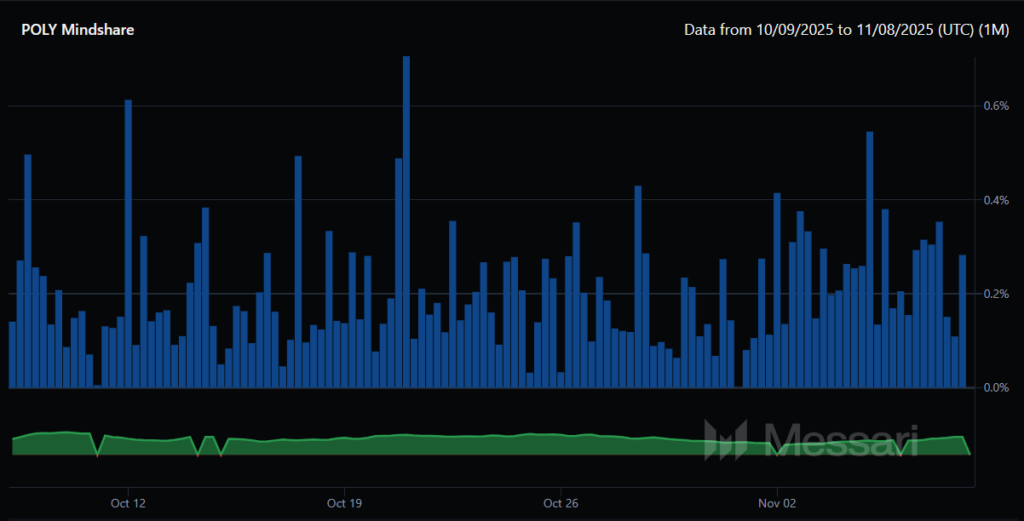

As traffic shifted, trading became more evenly distributed across smaller positions. Retail-sized bets increased, partly due to expectations surrounding Polymarket’s announced POLY token and its upcoming airdrop, which will reward users based on account activity.

New reward programs for selected markets helped sustain engagement during quieter periods. Interest in the POLY token rose sharply, with mindshare up 203% over the past month—positioning it as a major storyline heading into early 2026.

Columbia Study Flags Widespread Wash Trading on Polymarket

However, concerns have surfaced following a Columbia University study that analyzed more than two years of on-chain data. Researchers identified long-running wash trading patterns that appear to have inflated historical volumes.

According to the study, nearly one-quarter of Polymarket’s total activity may have resulted from users repeatedly buying and selling the same contracts. Sometimes, these transactions are conducted through interconnected wallets, creating an illusion of higher demand.

Suspicious activity reportedly intensified during periods of heavy attention. In December 2024, fake volume may have accounted for nearly 60% of weekly trades.

Sports and election markets showed the highest concentration of questionable transactions, with some weeks exceeding 90% flagged as inauthentic. Beyond quick back-and-forth trades, the research uncovered coordinated clusters of wallets forming extended trading loops.

A key part of the methodology involved identifying wallet behavior patterns, which revealed:

- Frequent, instant open-and-close trades that left positions unchanged.

- Wallets interacting exclusively within the same small groups across sessions.

- Large clusters of wallets creating repetitive trading loops.

- Contracts passed through dozens of accounts to mimic organic movement.

- USDC circulated across multiple wallets to recycle the same funds.

One cluster included more than 43,000 wallets, contributing nearly $1 million in volume, mostly in markets priced below one cent. Almost all of that activity was flagged as likely wash trading. Many wallets showed no meaningful profit, suggesting that motivations centered on gaming future rewards or airdrops rather than genuine market returns.

Despite these findings, Polymarket continues to see rising engagement and expanding reach . Increasing user activity, renewed interest in current events, and growing anticipation around the POLY token place the platform in a strong position as it approaches 2026.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

"Crypto President" Trump presses the bull market start button?

Trump's victory led BTC to reach new highs for two consecutive days, with a peak at $76,243.

Behind the x402 boom: How does ERC-8004 build the trust foundation for AI agents?

If the emergence of x402 has demonstrated the substantial demand for AI agent payments, then ERC-8004 represents another fundamental and underlying core element necessary for building this vast machine economy.

PFDEX Makes a Grand Debut at the PopChain Global Ecosystem Conference in Hong Kong

Cathie Wood Revises Bitcoin’s 2030 Forecast: Will Stablecoins Take Over?

In Brief Cathie Wood revises Bitcoin's 2030 target due to rapid stablecoin adoption. Stablecoins serve as digital dollars, impacting Bitcoin's expected role. Trump's crypto-friendly policies encourage Bitcoin's market prominence.