Visa Connects Conventional Finance and Blockchain with Real-Time Stablecoin Payments

- Visa launches stablecoin payout pilot, enabling instant cross-border transfers to crypto wallets via Visa Direct, targeting freelancers in emerging markets. - The program converts fiat to USD-backed stablecoins like USDC , addressing delays and volatility while leveraging blockchain for transparency and auditability. - Aligning with growing stablecoin adoption, Visa aims to bridge traditional finance and decentralized systems, competing with Mastercard's crypto initiatives and a $670B market potential. -

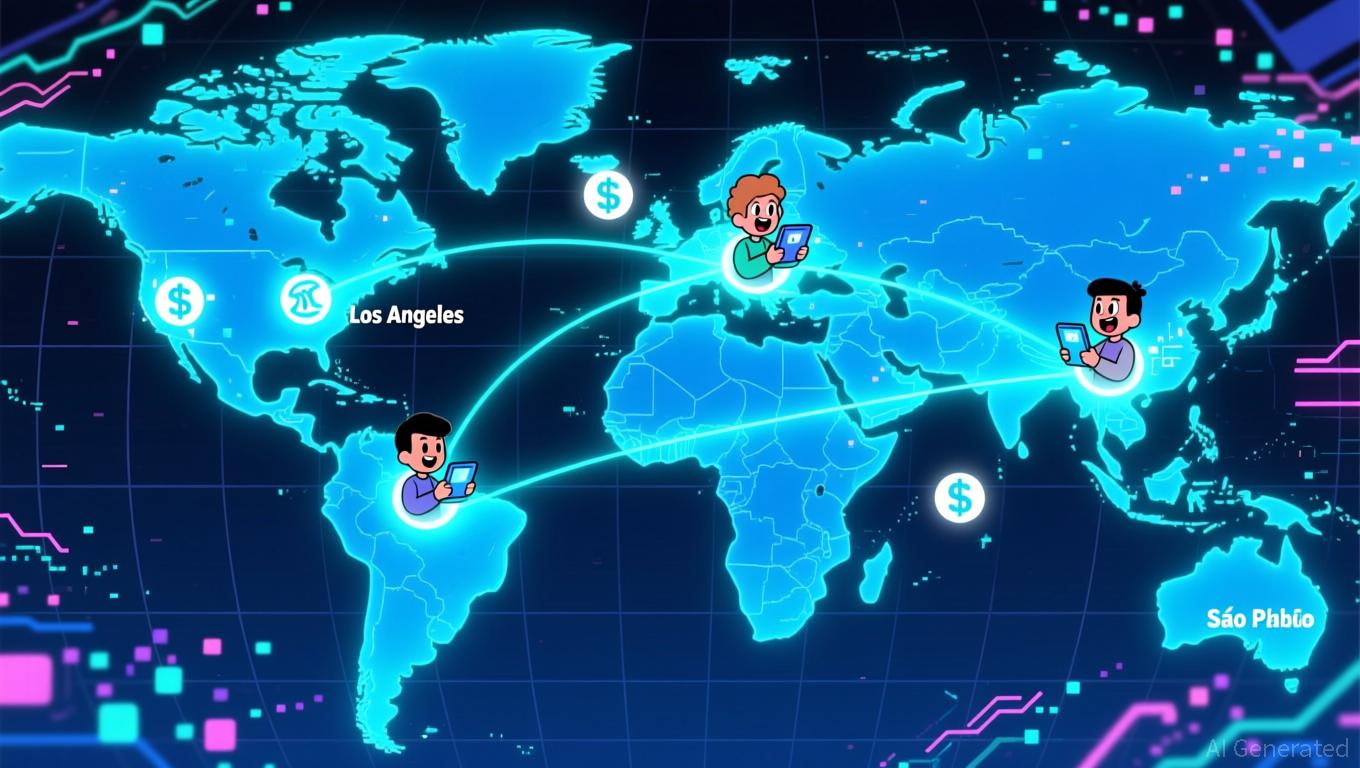

Visa Inc. (NYSE: V) has introduced an innovative pilot project enabling businesses to send stablecoin payments straight to recipients' crypto wallets, representing a major advancement in merging conventional finance with blockchain. Announced at the Web Summit in Lisbon, this program is designed for global freelancers, gig economy workers, and digital creators—especially in regions where unstable currencies and limited banking access create obstacles, as

This pilot seeks to resolve persistent issues in international payments. For example, content creators on platforms like TikTok and Uber often encounter delays in receiving their earnings due to banking schedules or currency exchange complications.

This effort aligns with the rising interest in stablecoins, which are increasingly viewed as a dependable alternative to more volatile digital currencies. In places like Bolivia, where inflation has fueled USDC adoption, the pilot could offer recipients a stable way to store value, as

Visa referenced a 2025 Creator Economy Report, which found that 57% of digital creators consider instant access to funds a top priority when choosing payment options, as

Visa’s stablecoin initiatives are part of a broader industry transformation. Earlier this year, the company rolled out a pre-funding pilot that lets businesses use stablecoins for international transactions, as

Regulation remains a central concern. While the pilot broadens access to stablecoin payments, issues around anti-money laundering, tax compliance, and consumer safeguards remain unresolved, as

This announcement comes as Visa and Mastercard are close to finalizing a landmark settlement in a two-decade dispute over merchant fees, which could lower interchange costs and give retailers more authority to decline rewards cards, as

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AllScale Invests $120K: Driving Innovation During Market Uncertainty

- AllScale launches $120K Global Creator Program to boost digital innovation and attract creators. - Astar Network’s EVM compatibility and decentralized governance plans reflect industry trends toward democratizing platforms. - Mixed Q3 results across education and tech sectors highlight balancing profitability with innovation. - Challenges like Riskified’s revenue drop and Snail Inc.’s losses underscore market volatility, making AllScale’s incentives critical for stability.

Ethereum Latest Update: Large Investors Acquire $1.37 Billion During Price Drop While Ethereum Challenges $3,300 Support Level

- Ethereum's price fell 3.46% to $3,417.77 on Nov. 11, its largest drop since Nov. 4, with a 11.44% monthly decline despite a 2.18% year-to-date gain. - Institutional investors accumulated $1.37B worth of ETH during the $3,247–$3,515 pullback, but failed to reclaim $3,350 resistance, intensifying bearish concerns. - Technical indicators show deteriorating momentum below key EMAs, with $3,300–$3,200 as critical support levels and 138% above-average selling volume confirming institutional participation. - De

Ethereum Updates: Shodai Network Secures $2.5M in Seed Funding to Address Crypto’s Capital Challenges

- Shodai Network raised $2.5M in seed funding led by ConsenSys to address crypto's "toxic capital" misalignment issues. - The platform aims to align incentives between developers and investors through open-source tools and community-driven structures. - Backed by Ethereum co-founder Joseph Lubin, Shodai faces regulatory risks but gains credibility through ConsenSys' technical expertise. - This initiative reflects growing institutional demand for sustainable crypto fundraising solutions amid intensified reg

Ark Invest Turns to Circle Amid Growing Regulatory Certainty in Stablecoin Industry

- Ark Invest boosts Circle stake by 353,300 shares, signaling confidence in stablecoin growth amid market volatility and regulatory clarity. - Circle reports $740M Q3 revenue (66% YoY) and $73.7B USDC circulation, but faces margin pressures and a $482M net loss despite strong cash flow. - Ark shifts focus from Tesla to Circle and Alibaba , selling $30. 3M in Tesla shares amid China sales concerns and AI-driven tech bets. - Regulatory progress like the U.S. GENIUS Act and Circle's strategic partnerships (e.