HYPE Token: Evaluating Immediate Price Fluctuations and Speculative Dangers in the Meme-Based Cryptocurrency Sector

- HYPE token, a meme-driven crypto, relies on social media hype and influencer endorsements rather than traditional financial metrics. - The $TRUMP meme coin example highlights extreme volatility, with large profits for top wallets and massive losses for retail investors. - Institutional products like CMC20 exclude meme coins, signaling limited recognition of their market utility despite growing crypto infrastructure. - Regulatory scrutiny intensifies as SEC targets influencer promotions, while foreign inv

The Meme Coin Ecosystem: Social Media as a Catalyst

Meme coins depend on their ability to go viral, with their worth largely shaped by active communities and stories promoted by influencers. The recent $TRUMP meme coin is a prime example of this phenomenon.

Institutional Infrastructure vs. Meme-Driven Volatility

Whereas meme coins like HYPE depend on grassroots

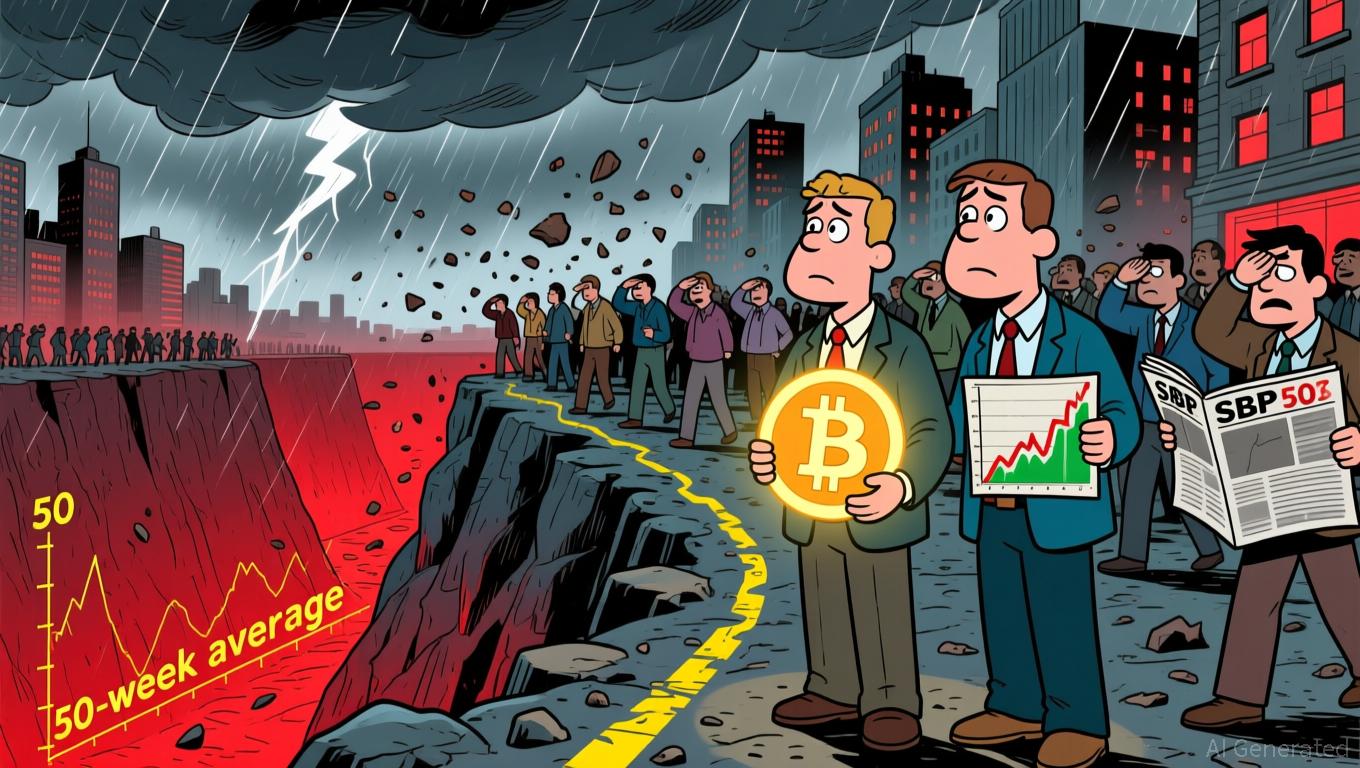

Speculative Risks: A Double-Edged Sword

The path of the $TRUMP coin illustrates the significant dangers tied to meme-based tokens.

Regulatory and Ethical Concerns

Strategic Entry Point or Bubble?

For those considering investment, the key question is whether HYPE is a smart entry or a speculative pitfall. Its dependence on social media buzz and influencer deals puts it in the high-risk, high-reward category. Yet, its lack of institutional support and the regulatory challenges faced by similar tokens warrant a cautious approach. While the CMC20’s debut signals a maturing crypto market, it also emphasizes how meme coins are sidelined in institutional portfolios.

Conclusion

HYPE, like other meme-based tokens, sits at the crossroads of online virality and speculative trading. Although its rapid price changes may present profit chances, the associated risks—regulatory, liquidity, and ethical—are substantial. Investors should view HYPE more as a speculative gamble on community sentiment than as a sound strategic asset. The $TRUMP case shows just how thin the line is between genuine innovation and unsustainable bubbles.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dogecoin News Today: Institutional Altcoin ETFs Resist Crypto Market Downturn

- Grayscale and VanEck launch Dogecoin/Solana ETFs as crypto markets decline, defying broader outflows. - U.S. spot Bitcoin ETFs see $870M outflows; Ethereum ETFs lose $259.7M amid third-week withdrawal streak. - Institutional altcoin ETFs gain traction with $550M+ assets, signaling growing crypto legitimacy in portfolios. - Ethereum's 3.6M token treasury and Fusaka upgrade optimism contrast with 4% ETF outflows of AUM. - Persistent retail caution contrasts with institutional adoption, as crypto's traditio

Bitcoin News Update: Blockchain.com’s Co-CEOs Steer Through Crypto Market Fluctuations as Company Relocates Headquarters to Texas

- Blockchain.com appoints Lane Kasselman as co-CEO alongside Peter Smith, adopting a dual leadership model to enhance operational efficiency during transition. - The firm relocates its U.S. headquarters to Dallas, Texas, leveraging the state's tax incentives, regulatory flexibility, and proximity to the Texas Stock Exchange. - This move aligns with broader corporate trends in Texas, as companies like Coinbase and McKesson shift operations to capitalize on business-friendly policies and innovation hubs. - T

Bitcoin Updates Today: Is Bitcoin’s Drop Indicating a Bear Market or Revealing Foundational Strength?

- Bitcoin's drop below $95,000 triggered a 2.8% S&P 500 decline, raising fears of synchronized market downturns. - American Bitcoin (ABTC) reported $3.47M profit but shares fell 13% as BTC price erosion offset mining gains. - 43-day U.S. government shutdown created information vacuum, while $869M Bitcoin ETF outflows highlighted investor panic. - Fed rate cut odds dropped to 45% amid inflation concerns, with analysts warning of cascading price drops below $90,000. - Institutional ETF adoption and $835M Mic

Hyperliquid News Today: Goldman: AI's $19 Trillion Buzz Surpasses Actual Progress, Bubble Concerns Rise

- Goldman Sachs warns U.S. stock markets have overvalued AI's economic potential, pricing $19T gains ahead of actual productivity impacts. - The bank identifies "aggregation" and "extrapolation" fallacies as key risks, mirroring historical tech bubbles from 1920s/1990s over-optimism. - AI expansion extends beyond tech sectors, with blockchain compliance tools and energy management markets projected to grow via AI integration. - Regulatory challenges persist as DeFi collapses expose gaps in AI token definit