Strategy Adds $836M in Bitcoin

Michael Saylor has done it again. Strategy , the company formerly known as MicroStrategy, has added another massive block of bitcoin to its treasury, buying 8,178 BTC for roughly 836 million dollars between November 10 and November 16. The average price came in at 102,171 dollars per coin. With this move, Strategy now holds an astonishing 649,870 BTC , worth more than 61 billion dollars at current market prices. That’s over three percent of the total bitcoin supply that will ever exist. It’s another reminder that Saylor isn’t simply bullish on bitcoin; he is architecting one of the largest and most aggressive acquisition strategies in modern corporate history.

A Capital Machine Designed for One Purpose

What makes this buy especially interesting is the machinery behind it. The latest accumulation didn’t come from operational cash flow or debt. It was funded almost entirely through proceeds from the company’s perpetual preferred stock programs, including STRK, STRF, STRC, and the newer euro-denominated STRE issuance.

Strategy has effectively built a multi-layered funnel that turns capital markets into a continuous bitcoin acquisition engine. Each preferred instrument offers different dividend structures, conversion terms, and risk profiles, letting the company tap into investor appetite across the spectrum. This isn’t improvisation; it’s a long-term financial structure engineered purely to acquire more bitcoin through every market cycle.

Strategy’s Bitcoin Position Is Now in a League of Its Own

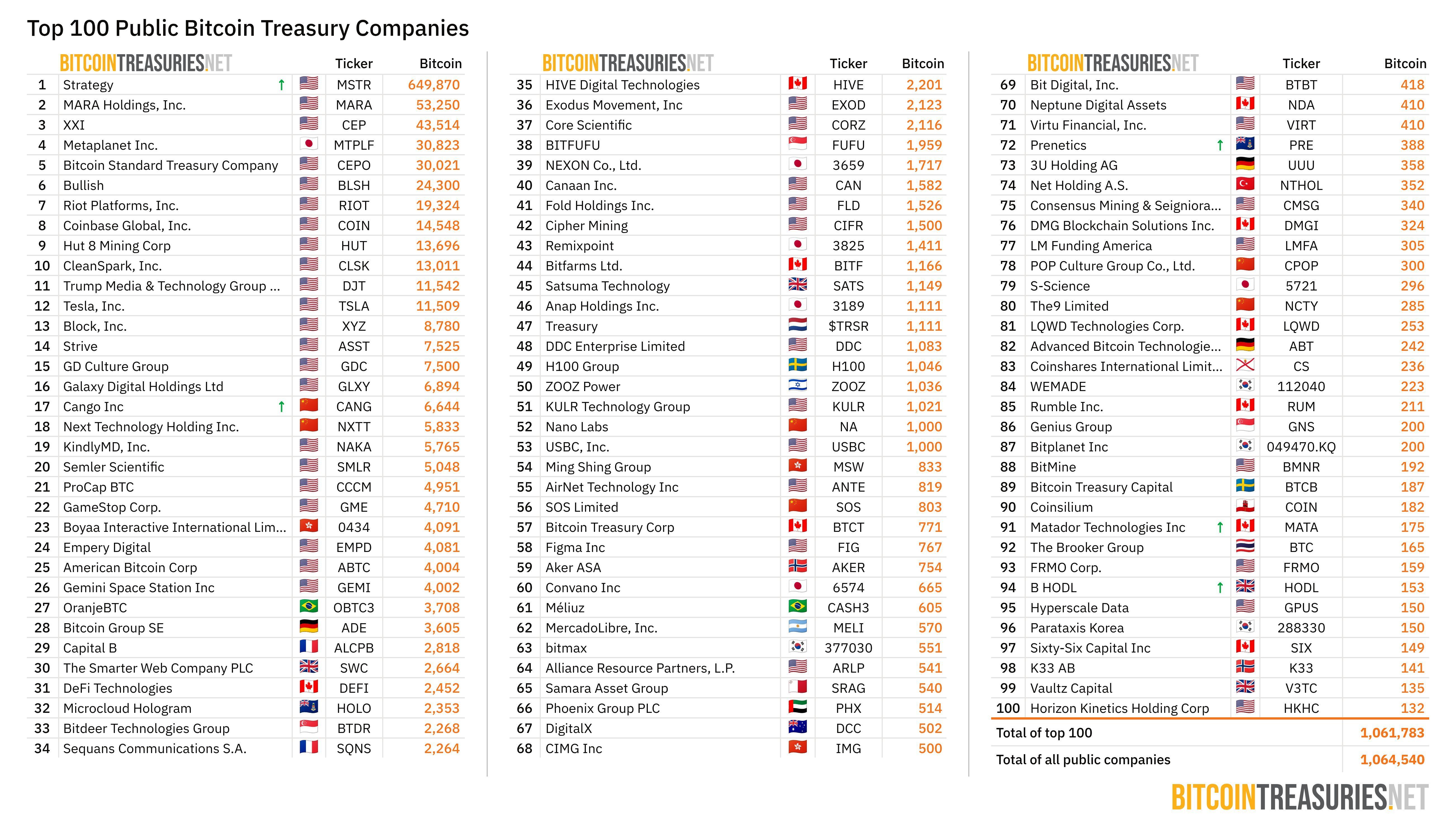

With nearly 650,000 BTC on the books, Strategy towers above every other public company with a bitcoin treasury strategy. It has outpaced not only bitcoin miners and crypto-native firms but also major financial institutions experimenting with digital assets.

For context, Marathon, Tether-backed Twenty One, Metaplanet, and Cantor Fitzgerald-backed Bitcoin Standard Treasury Company sit far behind Saylor’s mountain of holdings. Even if you combine the next several companies in line, they still don’t match Strategy’s total. The scale of this operation matters because the more bitcoin Strategy absorbs, the more long-term supply becomes effectively inaccessible to the open market.

Why the Stock Isn’t Matching the Momentum

Despite the enormous bitcoin haul, Strategy’s stock price has not reflected the same enthusiasm. The company’s market-cap-to-NAV ratio has contracted sharply, its shares remain well below summer peaks, and the stock is down more than 30 percent year-to-date. This disconnect has fueled speculation that Strategy may be forced to liquidate assets if bitcoin weakens further.

Analysts at Bernstein call those fears misplaced. They point out that Strategy’s leverage remains conservative. Its eight billion dollars of debt is small compared to its sixty-plus billion dollars in bitcoin, and its capital programs continue to draw strong institutional demand. According to them, the structure Saylor has built is too robust and too liquid to be pressured into selling bitcoin during a market pullback.

Michael Saylor Says the Rumors Are Nonsense

Last week, rumors circulated online claiming Strategy sold more than 47,000 BTC. Saylor was quick to swat down the speculation, saying the movements detected on-chain were standard custodial rotations rather than sales. He told CNBC that the company is buying aggressively and that more disclosures were coming. The filings this week backed him up. In public and in practice, Michael Saylor stance hasn’t wavered: the company hasn’t sold a single bitcoin, and it doesn’t intend to.

Why This Accumulation Matters for Bitcoin’s Future

With every purchase like this, Strategy is effectively locking away a chunk of the finite bitcoin supply for the long haul. That supply squeeze becomes more pronounced as more institutional players adopt similar strategies.

Even in a year when crypto markets have corrected and sentiment has cooled, Michael Saylor buying continues at full speed. His approach is built to withstand severe downturns. He has said repeatedly that the company’s capital structure can survive a ninety percent bitcoin correction lasting several years. That level of endurance matters because it signals that bitcoin is not simply an investment for Strategy—it’s the company’s operating thesis.

Final Take

What this really comes down to is conviction. Saylor isn’t reacting to headlines, fear, or short-term market noise. He is executing a long-term plan that continues to absorb enormous amounts of bitcoin regardless of price conditions. Each acquisition pushes Strategy further ahead of every other corporate holder and tightens bitcoin’s available supply that much more. The message he keeps sending is simple: they’re not selling, not slowing down, and not changing course.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

APAC Leads Global AI Growth with Emphasis on Human-Focused Approaches

- APAC leads global AI adoption with 26% of firms investing $400k-$500k in generative AI, driven by CEO-led strategies (33% APAC vs 18% North America). - 91% APAC employees receive AI training, supporting rapid deployment as energy management markets grow from $56B to $219B by 2034 via AI analytics and blockchain. - Pegasystems and Ambarella showcase AI integration in enterprise automation and computer vision, while SoundHound AI leverages $269M liquidity for strategic acquisitions. - Challenges persist fo

Republican Party Splits and Inflation Issues Created Internally Complicate Trump’s Plans for a Second Term

- Trump's second-term agenda faces GOP internal divisions and affordability crises as inflation and tariff policies strain public support. - Republican lawmakers like Rep. Massie challenge Trump's Epstein file stance, exposing party fractures despite official "America First" alignment. - Tariff rollbacks on staples address self-inflicted inflation but fail to resolve core affordability concerns undermining Trump's economic legacy. - Constitutional term limits and waning influence in Trump's "lame duck" per

Dogecoin News Today: Institutional Altcoin ETFs Resist Crypto Market Downturn

- Grayscale and VanEck launch Dogecoin/Solana ETFs as crypto markets decline, defying broader outflows. - U.S. spot Bitcoin ETFs see $870M outflows; Ethereum ETFs lose $259.7M amid third-week withdrawal streak. - Institutional altcoin ETFs gain traction with $550M+ assets, signaling growing crypto legitimacy in portfolios. - Ethereum's 3.6M token treasury and Fusaka upgrade optimism contrast with 4% ETF outflows of AUM. - Persistent retail caution contrasts with institutional adoption, as crypto's traditio

Bitcoin News Update: Blockchain.com’s Co-CEOs Steer Through Crypto Market Fluctuations as Company Relocates Headquarters to Texas

- Blockchain.com appoints Lane Kasselman as co-CEO alongside Peter Smith, adopting a dual leadership model to enhance operational efficiency during transition. - The firm relocates its U.S. headquarters to Dallas, Texas, leveraging the state's tax incentives, regulatory flexibility, and proximity to the Texas Stock Exchange. - This move aligns with broader corporate trends in Texas, as companies like Coinbase and McKesson shift operations to capitalize on business-friendly policies and innovation hubs. - T