LUNA Value Remains Steady as Wearable Health Integration Broadens

- LUNA maintains stable price at $0.0774 despite 81.5% annual decline, driven by health-tech partnerships rather than crypto market shifts. - Expanded integration with Clue enables LUNA wearables to sync sleep/temperature data with 100M+ users for menstrual cycle tracking insights. - Strategic partnerships with leading wearables (Fitbit, Huawei) and exclusive discounts aim to boost adoption of cycle-aware health tracking devices. - 60%+ user demand for health wearables highlights growing market opportunity

On November 18, 2025, LUNA’s price remained steady at $0.0774 over a 24-hour period. However, the token has seen a 5.77% decrease in the past week, a 17.88% drop over the last month, and a significant 81.5% fall over the previous year. These numbers highlight a persistent long-term downward

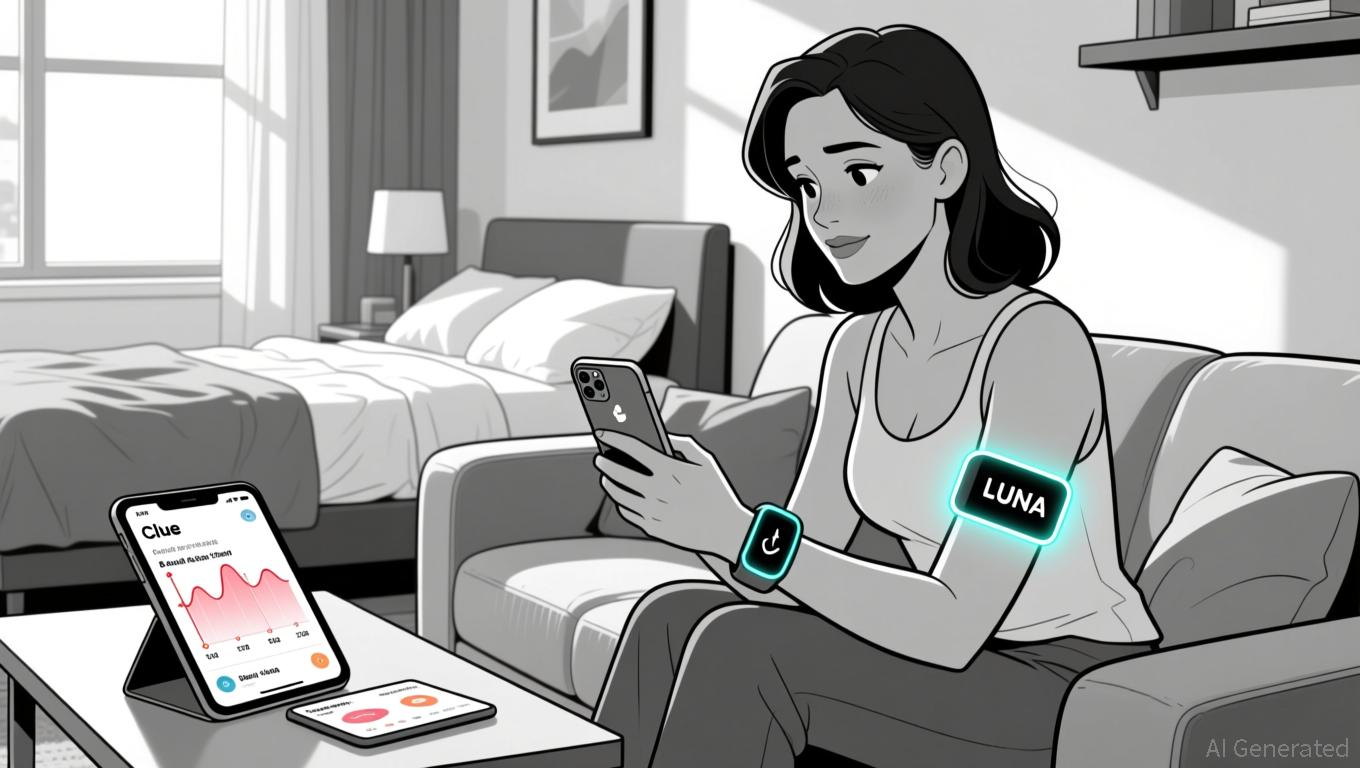

LUNA, known for its wearable health devices, has revealed new integrations with Clue, a top period and cycle tracking application used by more than 100 million people worldwide. This collaboration brings LUNA into a growing network of

This alliance is part of Clue’s larger initiative to broaden its ecosystem of wearable technology partners, which already features Withings, Ultrahuman, WHOOP, Huawei, Polar, Fitbit, and Noise. These partnerships enable ongoing passive collection of essential biometric information, followed by secure syncing and contextual analysis within Clue’s platform. Users are now able to track how their sleep, body temperature, and hormonal shifts interact, offering deeper insights into their overall health.

Clue Plus members benefit from exclusive perks through this integration, such as a 15% discount on all LUNA products and three complimentary months of Clue Plus for every LUNA user. These offers are designed to encourage the adoption of cycle-focused wearables, which are increasingly popular among those looking to gain deeper health insights.

This partnership marks a strategic effort by both Clue and LUNA to address the rising demand for wearable health tracking technology. According to a recent Clue survey of 1,382 participants, over 60% expressed interest in using wearables for health and fitness tracking, with nearly 40% specifically wanting to use them for monitoring menstrual cycles. These findings point to a significant market potential for companies like LUNA to integrate their health data with broader platforms such as Clue.

Rhiannon White, CEO of Clue, reiterated the company’s commitment to providing users with meaningful health insights, noting that expanding wearable partnerships is essential to this mission. By linking data from wearables with self-reported symptoms and cycle details, users gain a better understanding of their health in sync with their bodies’ natural patterns.

Although this announcement does not have an immediate impact on LUNA’s token price, it strengthens the company’s position in the wearable health tech industry. The integration with Clue also reflects a broader movement toward sharing health data across platforms, which could foster long-term user loyalty and engagement—factors that may influence investor confidence over time.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Investor’s $33M ETH Wager Withstands $1.1B Liquidation Surge While Crypto Markets Approach Bearish Levels

- A top crypto trader liquidated $7. 3M before re-entering with a $33M ETH long amid $1.1B market-wide liquidations on Nov 14, 2025. - Long positions suffered 973M losses vs 131M short liquidations, with a $44.29M BTC-USDT position marking extreme leverage use. - Bitcoin's RSI hit "massively oversold" levels and fell below its 3-year volatility band, echoing 2022 FTX-era market stress. - The crisis reignited debates over leveraged trading risks, with 246,000 traders forced to exit positions during the shar

Tokenizing Development: Trump’s Hotel Sets a New Standard for Luxury Real Estate Investment

- Trump Organization partners with Dar Global to launch world's first tokenized hotel in the Maldives, blending luxury real estate with blockchain technology. - The project tokenizes construction-phase investments, offering fractional ownership in 80 ultra-luxury villas before completion, unlike traditional post-construction models. - Eric Trump highlights the venture as a "benchmark" for redefining real estate investment, aligning with the Trump family's expanding crypto-friendly business strategy. - Mark

Fed Weighs Job Growth Against Inflation Concerns in 2026 Interest Rate Decisions

- The Fed plans two 2026 rate cuts amid weak labor markets and stubborn inflation, balancing job support with inflation risks. - Internal FOMC divisions persist, with Vice Chair Jefferson advocating caution and Governor Waller pushing for aggressive cuts, while Trump’s appointee Miran amplifies easing pressure. - Incomplete data from a government shutdown complicates decisions, and market expectations for a December cut dropped to 42.9% amid inflation concerns. - J.P. Morgan urges diversification to hedge

Bitcoin News Update: The Cryptocurrency Market's Ongoing Struggle: Careful Hopefulness Against Persistent Threats

- Crypto market shows stabilization as funding rates on major exchanges return to neutrality after overselling, per Coinglass data. - Bitcoin's 14-day RSI dipped below 30 (oversold level) on Nov 18, suggesting potential short-term rebound despite analysts' caution. - Institutional interest grows with Ark Invest adding $10.2M in Bullish shares, while Hyperliquid (HYPE) shows on-chain resilience. - Macroeconomic risks persist, including U.S. government shutdown impacts and stalled ETF inflows, keeping $95,00