Bitcoin News Update: Short-Term Investors Face Losses as Bitcoin Falls Under $95K

- Bitcoin fell below $95,000 on Nov 15, erasing 23% from its October peak amid extreme fear signaled by a 10-point Fear & Greed Index. - 2.8 million BTC held under 155 days are underwater, with STHs driving 90% of recent sell volume as SOPR dipped below 1 repeatedly. - Institutional outflows ($870M from US ETFs) and Fed policy uncertainty (53.6% Dec rate cut chance) intensified liquidations exceeding $600M in hours. - Analysts split between bearish corrections to $85,000 if $92,000 support breaks or mid-cy

The cryptocurrency market is currently experiencing significant volatility, with Bitcoin dropping below important psychological levels. This has led to discussions about whether the recent decline marks the start of a bearish trend or is simply a routine market correction. The Fear & Greed Index—a popular gauge of investor sentiment—has plunged to 10, its lowest reading since late February 2025, indicating "extreme fear" among market participants after a week of widespread losses in major digital assets

Short-term investors have been hit hardest by the downturn. Glassnode reports that 2.8 million BTC held by short-term holders—defined as coins held for less than 155 days—are now at a loss, the highest since the FTX crisis in 2022

Institutional withdrawals have added to the downward pressure. U.S.-listed Bitcoin ETFs recorded net outflows of $870 million on November 14, reflecting declining confidence as expectations for Federal Reserve policy shift

Despite the current challenges, some analysts maintain that this correction is a normal part of the ongoing bull market, not a sign of a trend reversal.

Ethereum has shown relative resilience, trading at $3,205 as of November 15—a 0.2% increase—despite the broader market downturn

The next major turning point for the crypto market may depend on renewed institutional interest and clearer signals from the Federal Reserve. Although ETF inflows have slowed, BlackRock’s spot Bitcoin ETF stands out, attracting $28.1 billion in net inflows this year even as other funds see withdrawals

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

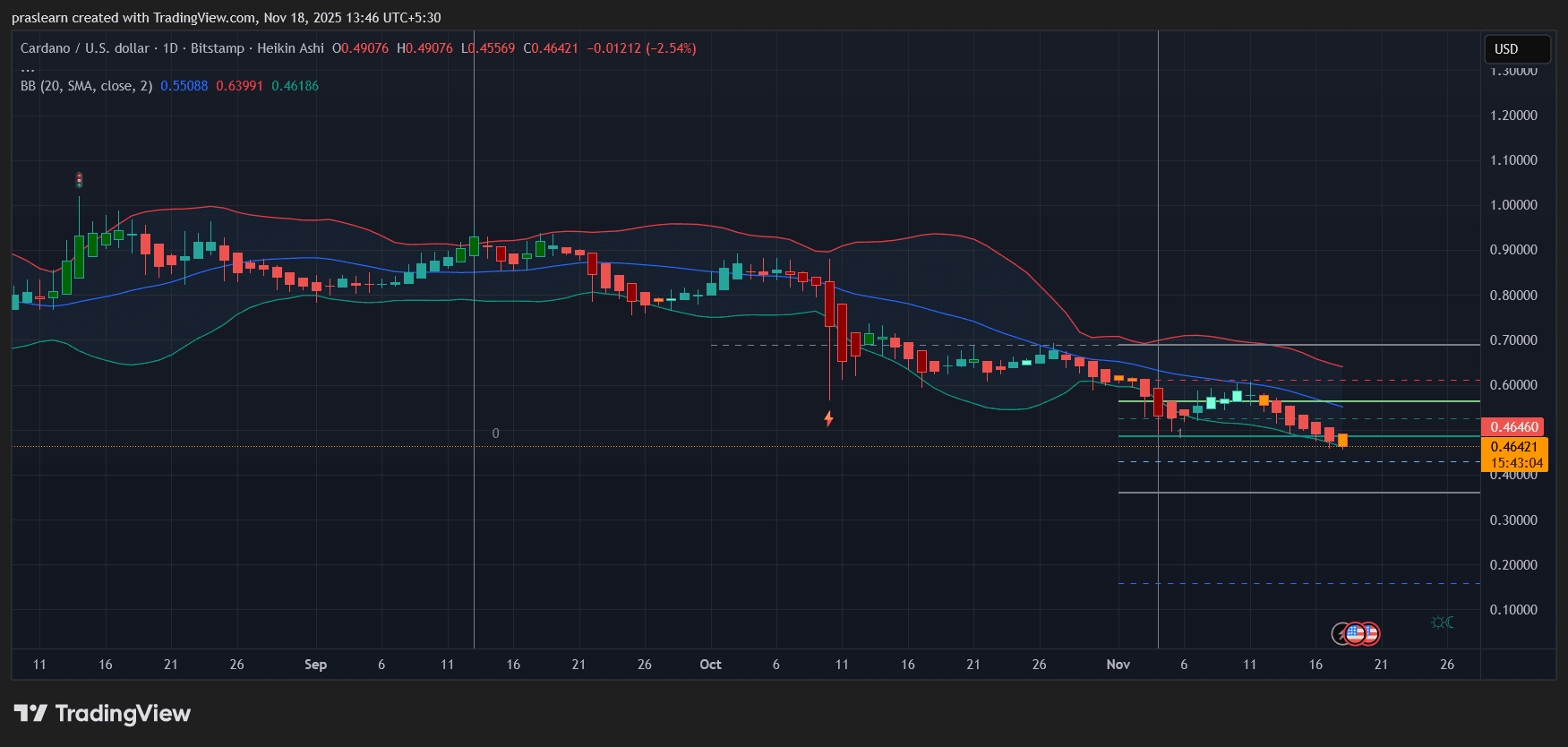

Cardano Price Crashes: Is $0.40 Next?

Bitcoin Updates: Investor’s $33M ETH Wager Withstands $1.1B Liquidation Surge While Crypto Markets Approach Bearish Levels

- A top crypto trader liquidated $7. 3M before re-entering with a $33M ETH long amid $1.1B market-wide liquidations on Nov 14, 2025. - Long positions suffered 973M losses vs 131M short liquidations, with a $44.29M BTC-USDT position marking extreme leverage use. - Bitcoin's RSI hit "massively oversold" levels and fell below its 3-year volatility band, echoing 2022 FTX-era market stress. - The crisis reignited debates over leveraged trading risks, with 246,000 traders forced to exit positions during the shar

Tokenizing Development: Trump’s Hotel Sets a New Standard for Luxury Real Estate Investment

- Trump Organization partners with Dar Global to launch world's first tokenized hotel in the Maldives, blending luxury real estate with blockchain technology. - The project tokenizes construction-phase investments, offering fractional ownership in 80 ultra-luxury villas before completion, unlike traditional post-construction models. - Eric Trump highlights the venture as a "benchmark" for redefining real estate investment, aligning with the Trump family's expanding crypto-friendly business strategy. - Mark

Fed Weighs Job Growth Against Inflation Concerns in 2026 Interest Rate Decisions

- The Fed plans two 2026 rate cuts amid weak labor markets and stubborn inflation, balancing job support with inflation risks. - Internal FOMC divisions persist, with Vice Chair Jefferson advocating caution and Governor Waller pushing for aggressive cuts, while Trump’s appointee Miran amplifies easing pressure. - Incomplete data from a government shutdown complicates decisions, and market expectations for a December cut dropped to 42.9% amid inflation concerns. - J.P. Morgan urges diversification to hedge