Klarna Achieves Highest Revenue Yet, but Strategic Lending Leads to Losses

- Klarna reported $903M Q3 revenue (up 31.6%) but $95M net loss due to higher loan loss provisions as it expands "Fair Financing" loans. - Klarna Card drove 4M sign-ups (15% of October transactions) and 23% GMV growth to $32.7B, central to its AI-driven banking strategy. - Q4 revenue guidance of $1.065B-$1.08B reflects $37.5B-$38.5B GMV, supported by $1B facility to sell U.S. loan receivables. - CEO cites stable loan portfolio and AI-driven efficiency (40% workforce reduction) but warns of macro risks incl

Klarna Group Plc (KLAR)

The firm’s revenue

Although Klarna exceeded revenue expectations, it

Klarna’s outlook for the fourth quarter

The company’s emphasis on artificial intelligence

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Aster News Today: Transparent Token Unlocks Fuel 9% Surge for Aster, $1.38 Target in Focus

- ASTER surged 9% to $3.27B market cap after team clarified tokenomics and Binance's CZ disclosed $2.5M holdings. - Misstated unlock schedules and a $10M trading competition fueled demand, with price stabilizing above $1.14. - Analysts highlight $1.38 target if $1.26 resistance holds, but warn of risks from stagnant fees and declining user growth.

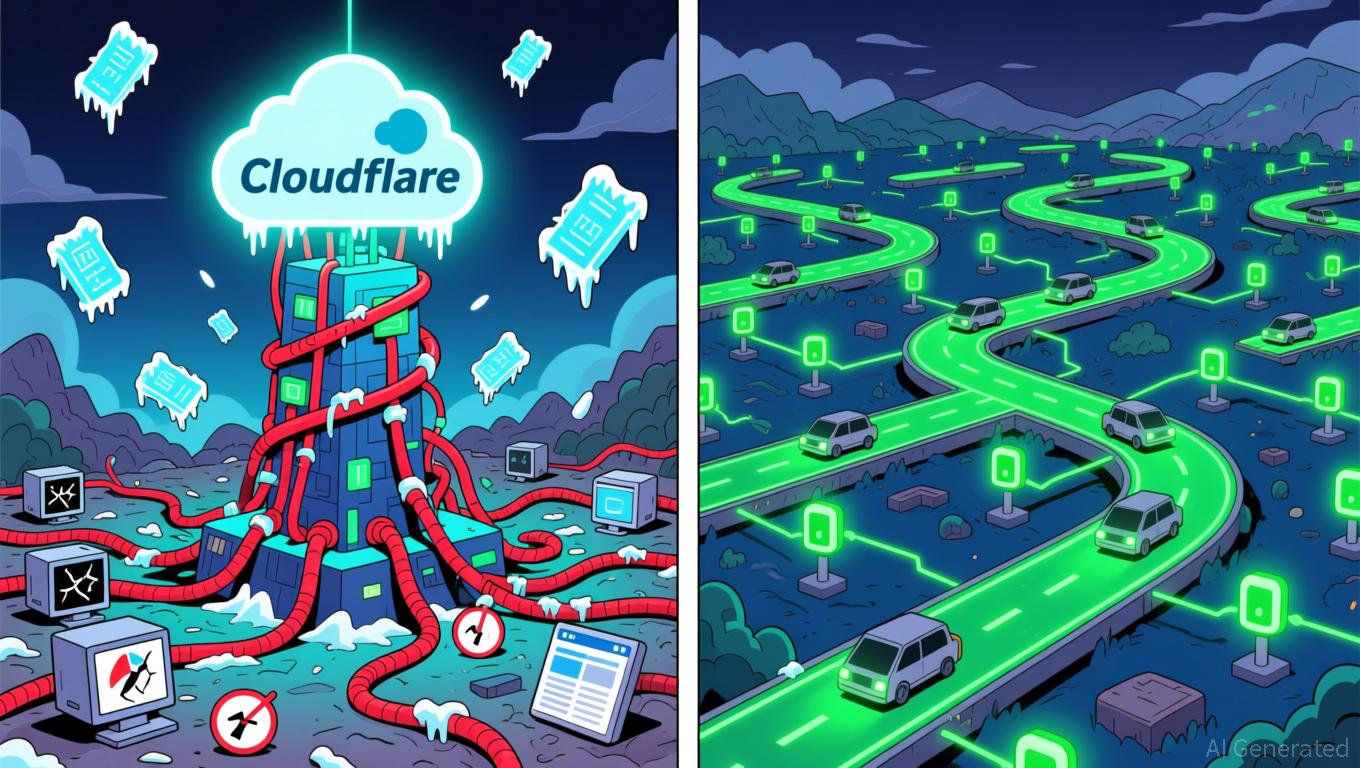

Bitcoin News Update: Recent Cloud Outages Highlight Systemic Risks, Fueling DePIN Adoption

- Cloudflare's 2025 global outage disrupted major websites and crypto platforms, exposing centralized infrastructure vulnerabilities and boosting DePIN interest. - The incident caused 500 errors and API failures, impacting services like ChatGPT, X, and crypto exchanges, while pushing Cloudflare's stock down 3.5%. - DePIN advocates argue decentralized infrastructure reduces single-point failures, with projects like Gaimin promoting distributed cloud models using global resources. - Blockchain's operational

Bitcoin Updates Today: Is Bitcoin's Decline a Temporary Correction or the Start of a Crash? Experts Disagree

- Bitcoin's recent sharp price swings, dipping below $90,000 before rebounding to $96,500, have intensified debates over bear market risks versus bull cycle consolidation. - MicroStrategy's CEO Michael Saylor denied Bitcoin sales, reaffirming accumulation strategies as institutional ETF redemptions hit $870M, signaling bear market concerns. - Technical analysts highlight critical $92,000–$95,000 support zones, with breakdown risks pushing prices toward $85,000–$90,000 amid deteriorating market sentiment. -

ICP Caffeine AI and Its Transformative Impact on the AI-Powered Investment Sector

- ICP Caffeine AI, a blockchain-AI platform by DFINITY, launched in 2025, boosted ICP token price by 56% and partnered with Microsoft and Google Cloud. - Its cost-efficient AI tools and chain-of-chains architecture enable real-time portfolio optimization and risk management for institutions. - Despite a 22.4% Q3 dApp activity drop, it achieved $237B TVL, but faces scalability and regulatory challenges from competitors and SEC scrutiny. - Analysts project growth if ICP sustains above $6.50, but institutions