El Salvador Buys Bitcoin Dip, Expands Reserves Amid IMF Pressure

Quick Breakdown:

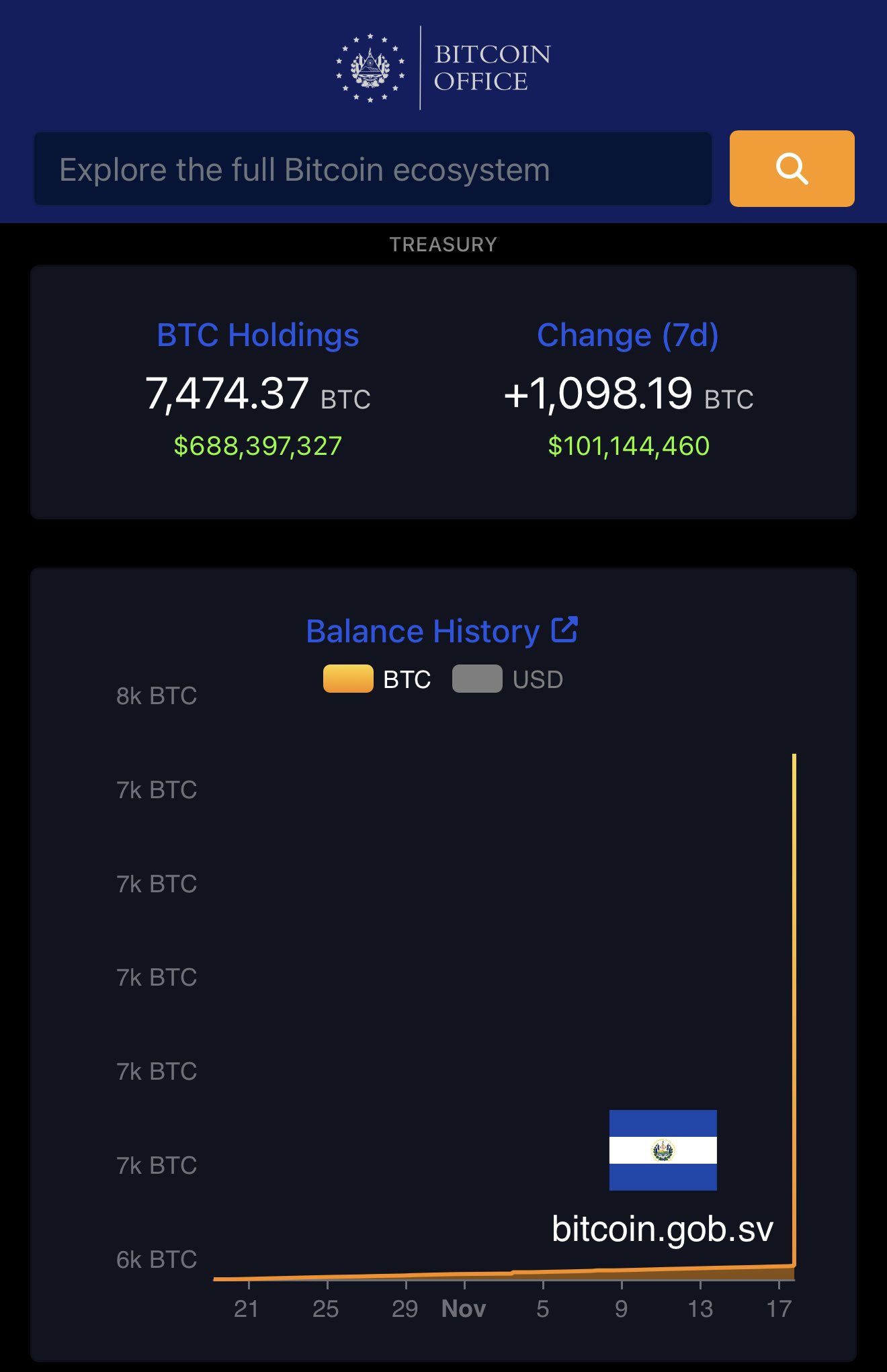

- El Salvador marked the fourth anniversary of adopting Bitcoin as legal tender with a significant purchase of 420 BTC worth $25.6 million.

- This move increased its Bitcoin reserves to over 7,474.37 BTC, valued at approximately $700 million, despite the International Monetary Fund’s (IMF) advice to halt acquisitions.

- The government’s proactive buying strategy highlights its commitment to Bitcoin despite market volatility and IMF constraints.

Nation makes record Bitcoin purchase

El Salvador’s Bitcoin Office announced the acquisition of 1,090 BTC, valued at approximately $100 million, marking the country’s largest single-day purchase since adopting Bitcoin as legal tender in 2021. The transaction, occurring during a sharp market dip, signals the administration’s ongoing faith in Bitcoin as a strategic national asset. President Bukele shared the purchase details on social media, reiterating his government’s intention to continue buying the cryptocurrency regardless of prevailing market conditions.

Source:

President Nayib Bukele

Source:

President Nayib Bukele

With this investment, El Salvador’s holdings have increased to 7,474 BTC, valued at nearly $676 million at current market rates. This purchase comes even as the IMF reportedly maintains restrictions on new public-sector Bitcoin purchases due to existing loan agreements, leading to questions about the source and structure of the latest buy. The gap between public statements and blockchain data has prompted debate about transparency in the nation’s reporting and reserves management.

Implications and global reactions

The purchase highlights the Bukele administration’s commitment to positioning El Salvador as a leader in state-level digital asset adoption. While proponents argue this move could boost financial inclusion and reduce remittance costs, critics, including the IMF, point to risks such as market volatility and potential fiscal instability. The IMF had cautioned against further accumulation, and recent discrepancies between official wallet activities and public announcements have intensified calls for greater transparency around El Salvador’s strategy.

El Salvador’s continued accumulation of Bitcoin has attracted both attention and scrutiny. International observers question the long-term impacts on national finances, given the volatile nature of the crypto market, even as the country posts significant unrealized gains amid Bitcoin’s upward price cycles.

Notably, Bolivia’s central bank now views cryptocurrency as a “viable and reliable alternative,” following the formalization of a collaboration with El Salvador, which has made Bitcoin legal tender. Through a memorandum of understanding, the nations will continue to work together on crypto policy and regulation. This partnership aims to modernize Bolivia’s financial system, utilizing El Salvador’s expertise to enhance financial inclusion and establish a regulated digital asset ecosystem, thereby integrating blockchain technology into its long-term economic strategy.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: Bitcoin Drops $90K—Is This a Bear Market Pullback or a Prime Buying Chance?

- Bitcoin fell below $90,000 on Nov. 18, its lowest in seven months, driven by a death cross pattern and shifting macroeconomic expectations, erasing 2025 gains and triggering $1B in liquidations. - The selloff intensified as Fed rate-cut odds dropped to 42%, with ETF outflows reaching $2.8B, while altcoins like ICP and HYPE bucked the trend amid extreme market anxiety (fear/greed index at 11). - Analysts highlighted "stickier" inflation concerns and mixed institutional activity, noting BlackRock's IBIT ET

JPMorgan Faces Allegations of Politically Motivated Account Closures; Refutes Claims, Points to Regulatory Requirements

- Florida AG James Uthmeier probes JPMorgan for alleged politically motivated "shadow de-banking" targeting conservative entities like Trump Media . - Investigation claims JPMorgan shared TMTG banking data with DOJ and closed accounts after a 2024 merger, citing a 2023 subpoena demanding pre-incorporation records. - JPMorgan denies political bias, emphasizing compliance with legal requests while critics highlight lack of evidence and CFPB data showing minimal political bias in account closures. - Probe ove

Brazil Implements Crypto Tax to Close Loopholes, Align with International Norms, and Increase Revenue

- Brazil proposes tax on cross-border crypto transactions to align with OECD standards and boost public revenue. - The IOF tax expansion targets stablecoin transfers, reclassified as forex operations under 2025 central bank rules. - Unregulated crypto flows cost Brazil $30B annually; new rules aim to combat tax evasion and money laundering via stablecoins. - Political tensions emerge as lawmakers push for crypto tax exemptions amid regulatory tightening and global compliance efforts.

Bitcoin Updates Today: Is the Crypto 'Extreme Fear' Index Signaling a Prime Buying Moment or Hinting at a Larger Downturn?

- Bitcoin falls below $90,000 for first time in seven months as crypto market loses $600B, driven by profit-taking and institutional outflows. - U.S. Senate classifies Bitcoin/Ethereum as "digital commodities," shifting regulatory authority to CFTC amid ETF outflows and hybrid fund approvals. - sFOX-Nomura joint liquidity offering aims to stabilize markets, but leveraged positions and automated liquidations worsen downward spiral. - Analysts debate long-term resilience: while institutional buying persists,