Malaysia’s Power Network in Jeopardy: Cryptocurrency Theft Highlights Weaknesses in Infrastructure and Law

- Malaysia's TNB reports $1.1B losses from crypto mining-linked electricity theft at 13,827 sites over five years. - Power theft cases surged 300% (2018-2024), with raids seizing $482K in mining rigs and disrupting networks. - TNB deploys AI analytics and smart meters to detect theft, while authorities push for crypto-specific regulations. - Current laws impose minimal penalties ($2,400 fines/jail), failing to deter sophisticated theft operations. - Experts warn theft destabilizes grid and pricing, urging

Malaysia’s main electricity provider, Tenaga Nasional Berhad (TNB), has reported losses

These illegal activities, which often involve direct wiring to transformers or altered smart meters, have grown more advanced. Criminal groups frequently move their operations—

In response, TNB has rolled out sophisticated monitoring tools, such as smart meters and AI-powered analytics, to

The financial impact goes beyond TNB’s direct losses.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

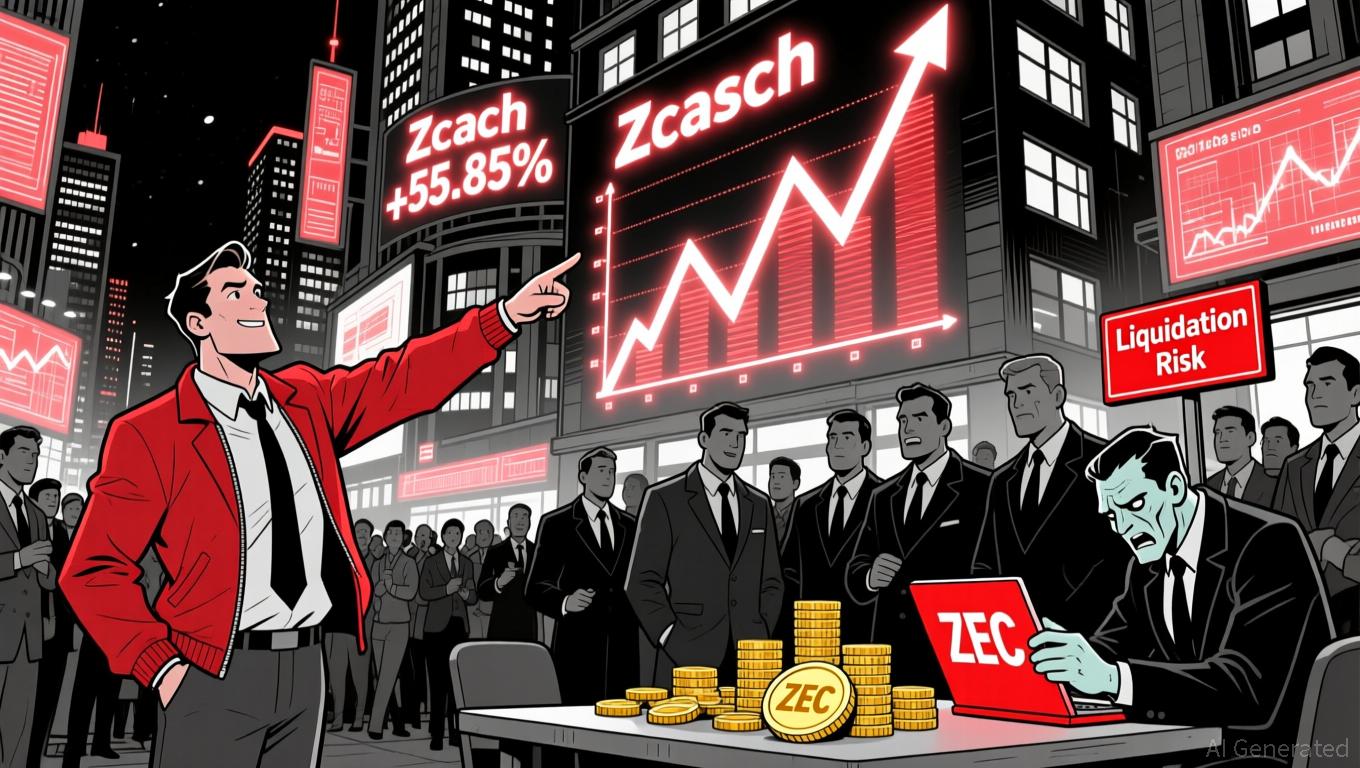

ZEC has surged by 55.85% over the past month as large investors engage in short selling while institutions are making purchases

- ZEC surged 55.85% in one month amid whale shorting and institutional buying, hitting $621.6 on Nov 19, 2025. - Whale address 0x7b7 opened a $19M ZEC short with 134% unrealized gains, while three $20M+ short positions face $653–$655 liquidation risks. - Cypherpunk Technologies added 29,869 ZEC ($18M) to its holdings, now owning 1.43% of ZEC supply, aiming for 5% long-term ownership. - Market dynamics highlight conflicting bearish whale activity and institutional bullish accumulation, with ZEC up 1020.67%

Panic Rising, Miners Buying: Is Bitcoin Near Its Breaking Point?

Crypto Airdrops' Growing Centralization Threatens the Principles of Decentralized Fairness

- aPriori's crypto airdrop sparked controversy after one entity claimed 60% of tokens, raising transparency and centralization concerns. - Airdrop farming tactics, like Arbitrum's $3. 3M consolidation across 1,496 wallets, undermine decentralized fairness for retail investors. - HTX DAO's 90% growth in token subscriptions ($9B total) highlights deflationary strategies boosting scarcity and market value. - IPO market volatility and regulatory risks have pushed projects toward airdrops for liquidity, despite

Bitcoin News Today: Bitcoin ETFs Offload $2.96 Billion in November, Exceeding Mt. Gox Repayment Amounts

- Bitcoin ETFs sold $2.96B in November, exceeding Mt. Gox's $953M debt repayment transfers, signaling extreme bearish sentiment. - BlackRock's IBIT led outflows with $2.1B, including a $523M single-day withdrawal, as BTC prices fell 28% below $90,000. - Market analysts warn ETF redemptions could accelerate Bitcoin's decline, citing technical indicators like the "death cross" and weak institutional sentiment. - The sell-off contrasts Bitcoin's historical November rallies, driven by macroeconomic fears and A