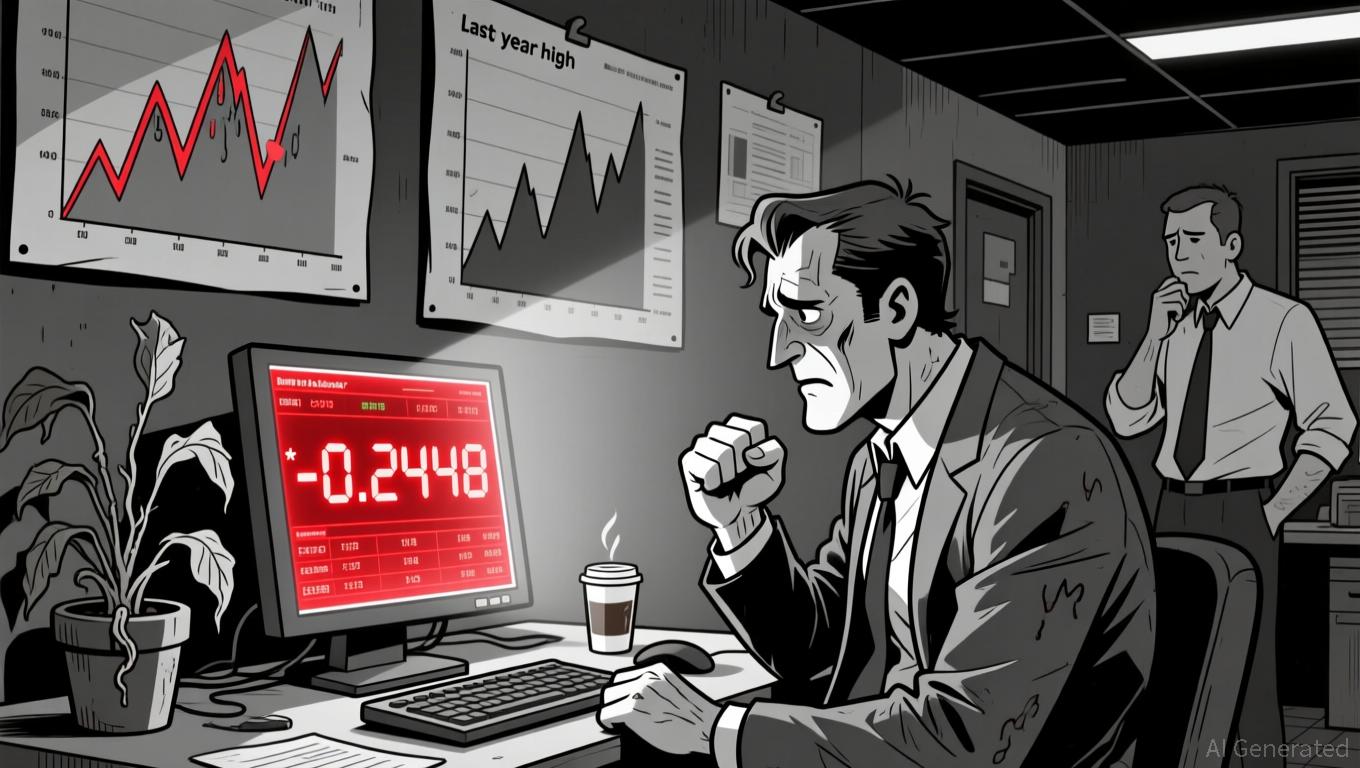

Stellar (XLM) Drops 4.18% Over 24 Hours as Market Fluctuates

- Stellar (XLM) fell 4.18% in 24 hours to $0.2448, with 19.57% monthly and 26.27% annual declines. - The drop reflects broader crypto market volatility, not direct XLM-specific news or catalysts. - While Bitcoin and Ethereum rose, XLM's decline persists independently, lacking short-term momentum. - Analysts cite macroeconomic uncertainty and regulatory shifts as potential future risks for XLM's trajectory.

On November 19, 2025,

The news summary provided covers a range of business and market updates, but none are connected to Stellar (XLM) or its ecosystem. Announcements from organizations like XPLR Infrastructure, Maryland-based firms, Quanex Building Products, and Xometry pertain to unrelated matters such as tender offers, school enrollment statistics, securities lawsuits, and business growth awards. While significant in their own sectors, these developments have no bearing on XLM’s price or direction.

Likewise, updates about Husky Inu (HINU) mention a slight price uptick during its pre-launch period, but this has no direct impact on XLM’s market. The article also points to a general rebound in the crypto sector, with

With no direct news affecting XLM and only broad market commentary available, the ongoing decline seems to stem from general market forces rather than any specific event related to the Stellar network. Experts suggest that ongoing macroeconomic challenges and shifting regulatory landscapes may influence XLM’s future performance, but there are currently no immediate triggers affecting its price.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stellar News Today: Established Market Prefers Altcoins with Practical Use Cases Rather Than Pure Speculation

- MoonBull (MOONBULL) raised $600,000 in funding, highlighting growing institutional interest in utility-driven altcoins with DeFi infrastructure and staking rewards. - Crypto.com's CRO token maintains stability through expanded merchant partnerships and AI-driven tools, positioning it as a "safe haven" amid market volatility. - Stellar's XLM sees renewed adoption via cross-border payment partnerships, with 20% higher transaction volumes reflecting demand for low-cost solutions in emerging markets. - Marke

Hong Kong Steps Up Global Stablecoin Oversight, Focuses on Competition with Tokyo

- Hong Kong regulators impose strict rules on stablecoin issuers, requiring fiat-collateralized tokens and a 25M HKD capital requirement. - Aligning with global trends, the rules aim to curb risks from algorithmic stablecoins but raise concerns about Hong Kong's competitiveness against rivals like Japan. - Japan's pro-crypto policies and incentives attract firms, while global players like Deutsche Börse integrate fiat-backed stablecoins into financial systems. - Hong Kong's framework mandates reserves and

Bitcoin News Update: Japan's Bond Turmoil Triggers Worldwide Crypto Sell-Off Amid Yen Carry Trade Reversal

- Japan's $135.4B stimulus package triggered a 3.41% surge in 30-year bond yields, destabilizing the $20T yen carry trade and sparking global crypto/stock selloffs. - Rising yields threaten Japan's 230% GDP debt load with higher servicing costs, creating a "debt death spiral" risk as BOJ hesitates to tighten policy. - Forced deleveraging by financial institutions intensified Bitcoin's 26% drop, with Ethereum/XRP/Solana also falling 3-5.6% amid margin calls and capital repatriation. - Upcoming 40-year bond

Bitcoin News Today: Bitcoin ETFs See $523M Outflow as Investors Weigh Fear Against Long-Term Strategies

- BlackRock's IBIT ETF recorded a $1.26B net outflow in Nov 2025, its largest redemption since 2024 launch. - Bitcoin price fell 16% to $52, triggering $2.59B outflows across 11 spot ETFs as bearish options demand surged. - Put-call skew hit 3.1% (7-month high), reflecting heightened pessimism and capitulation pressures in Bitcoin's price action. - Gold ETFs gained $289M as investors sought safe havens, contrasting with $1B inflows to tech/healthcare sector funds. - Year-to-date Bitcoin ETF inflows ($27.4B