Bitcoin Updates Today: Bitcoin's Recent Decline Faces Calculated Buying as Miners Indicate a Shift in Market Trends

- Bitcoin miners and institutional investors are strategically accumulating Bitcoin as market sell pressure eases, signaling a potential inflection point after months of decline. - The selloff, driven by macroeconomic risks and ETF outflows, saw Bitcoin dip below $90,000 in November, with BlackRock’s IBIT recording $523M in redemptions. - Miners like KULR prioritize treasury growth through mining, while Bitfury pivots $1B to AI and crypto innovation, reflecting shifting risk management strategies. - Altern

Recent industry trends and data indicate that Bitcoin miners and large-scale investors are starting to deliberately build up their Bitcoin holdings as downward pressure in the crypto market appears to be lessening.

The decline intensified at the end of November, with Bitcoin dipping under $90,000 for the first time in seven months. This drop was fueled by global economic uncertainty, profit-taking among long-term investors, and ongoing regulatory issues

Despite these challenges, some market players are preparing for a potential recovery. Bitcoin mining companies such as

Market experts

As the market navigates economic headwinds and regulatory changes, the interaction between institutional strategies, alternative yield products, and technological progress is expected to play a key role in shaping Bitcoin’s path in the months ahead.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CFTC’s Expanded Crypto Responsibilities Challenge Regulatory Preparedness and Cross-Party Cooperation

- Senate Agriculture Committee confirmed Trump's CFTC nominee Michael Selig along party lines, advancing his nomination for final Senate approval. - Selig, an SEC crypto advisor, would expand CFTC's oversight of crypto spot markets under the CLARITY Act, positioning it as a key digital asset regulator. - Democrats raised concerns about CFTC's limited resources (543 staff vs. SEC's 4,200) and potential single-party control after current chair's expected resignation. - Selig emphasized "clear rules" for cryp

Bitcoin Updates: Bitcoin Approaches Crucial Support Level Amid Heightened Fear, Indicating Possible Recovery

- Bitcoin fell to a seven-month low near $87,300, testing key support levels amid heavy selling pressure and extreme bearish sentiment. - Analysts highlight a "max pain" zone between $84,000-$73,000, with historical patterns suggesting rebounds after fear indices hit annual lows. - The Crypto Fear & Greed Index at 15—a level preceding past rebounds—aligns with historical 10-33% post-dip recovery trends. - A 26.7% correction triggered $914M in liquidations, but a 2% rebound to $92,621 shows resilience amid

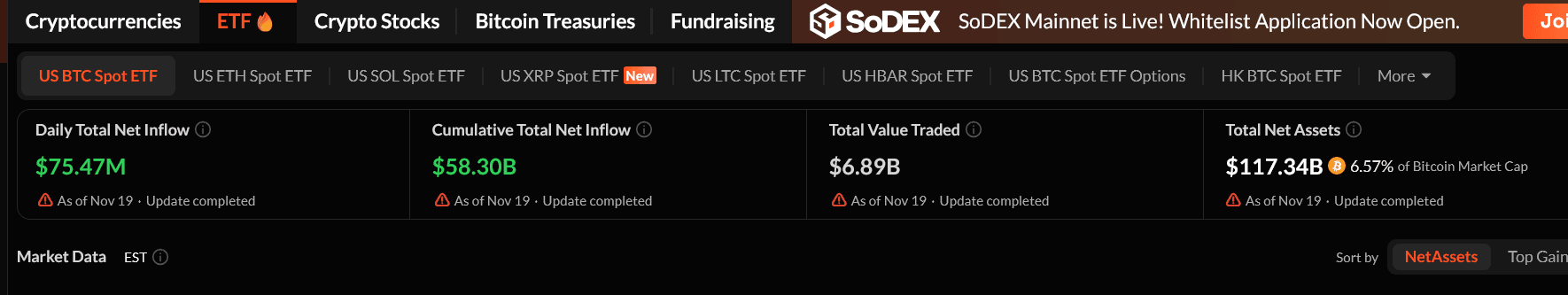

Bitcoin ETFs Are Back: Did the Crash Just End?

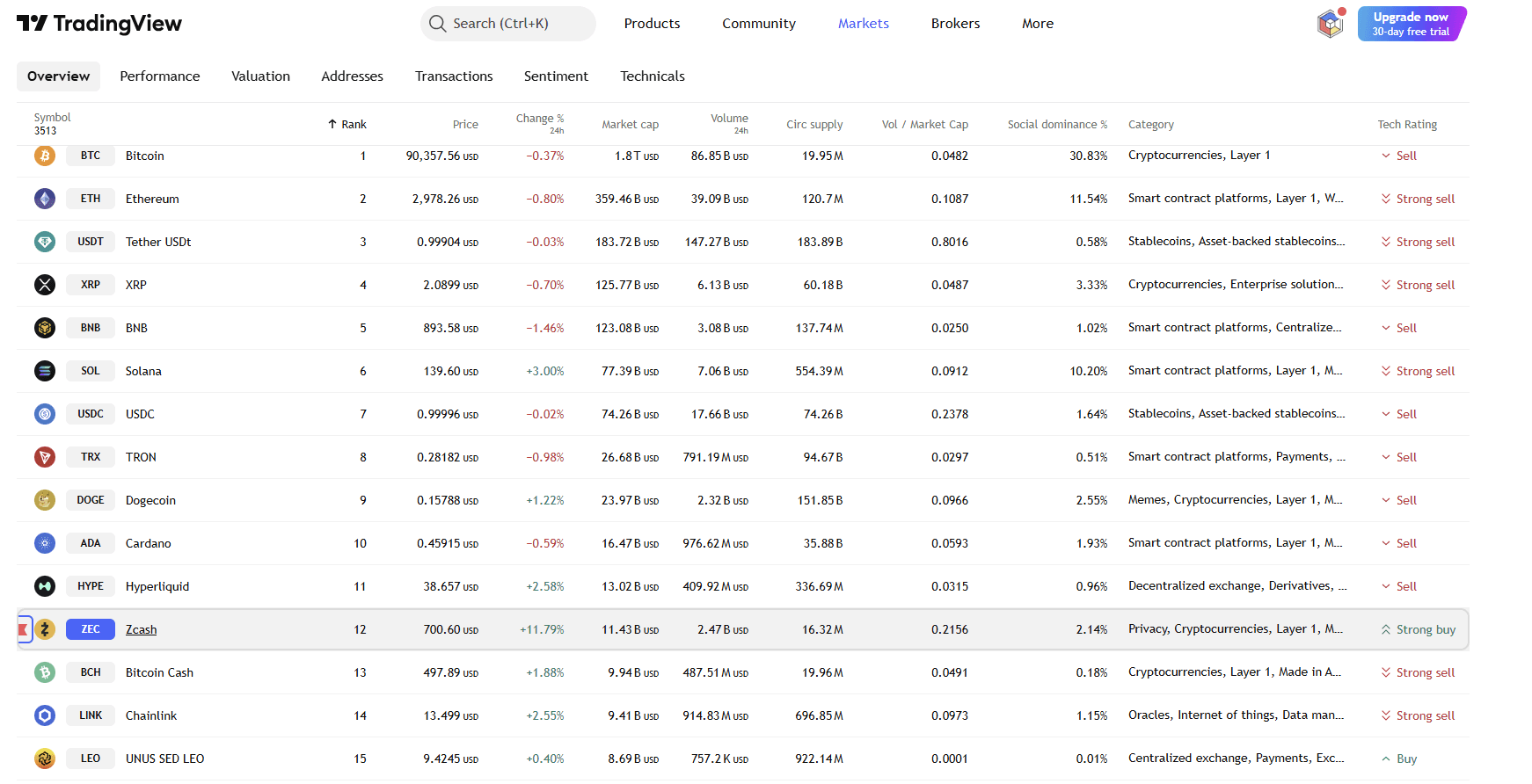

Should You Buy ZEC During the Market Crash? Here’s What’s Really Happening