Musk's Vision of a Future Without Mandatory Work Ignites Discussions on the Practicality of AI and Social Disparities

- Elon Musk predicts work will become optional in 10-20 years as AI/robotics render traditional labor obsolete, comparing future employment to leisure activities. - Tesla aims for 80% of its value to derive from Optimus robots, while economists question scalability challenges and decreasing returns in robotics adoption. - AI-driven sectors like Energy Management Systems are projected to grow rapidly, but face high costs and integration barriers for small businesses. - Critics warn Musk's vision risks exace

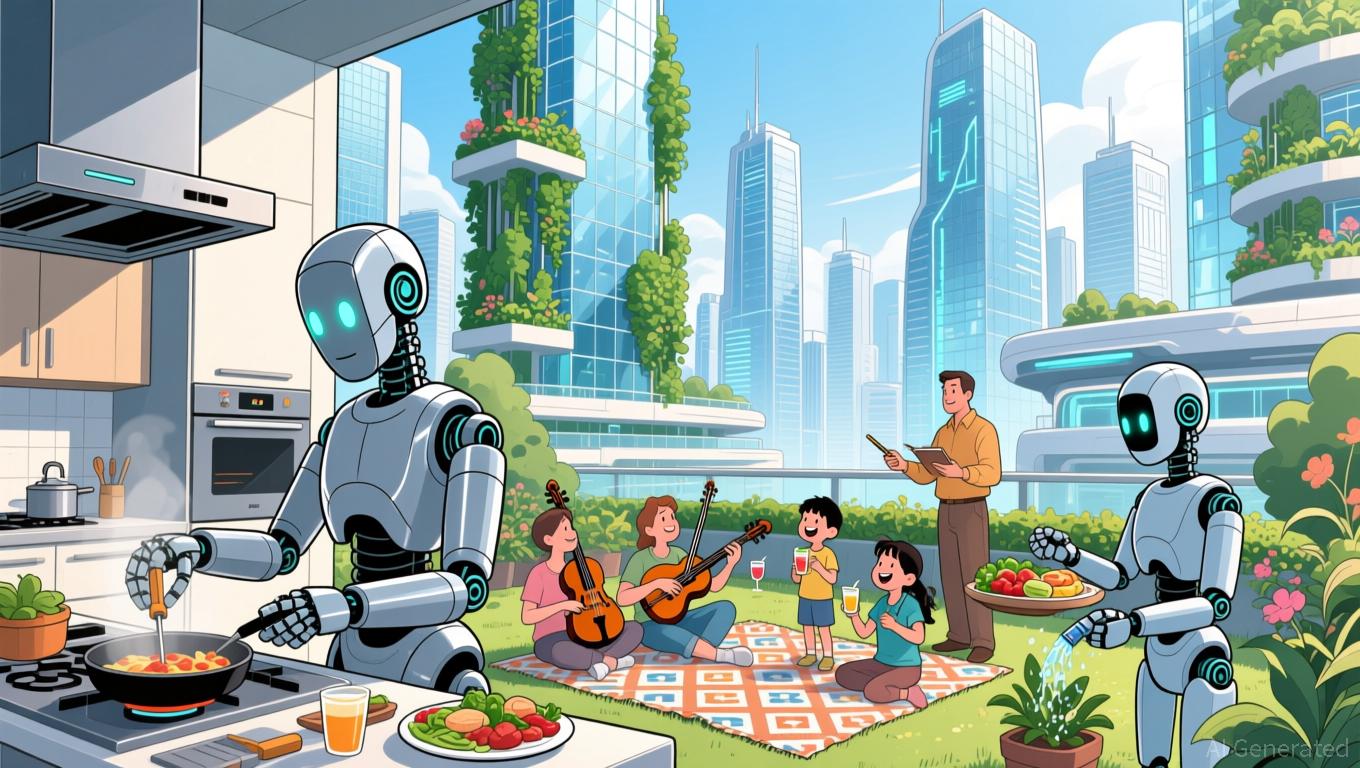

Elon Musk has forecasted that within the next decade or two, employment will become a matter of personal preference and financial concerns will diminish, all due to rapid progress in artificial intelligence (AI) and robotics. During his appearance at the U.S.-Saudi Investment Forum in Washington, D.C., the

Musk’s outlook is based on a world where countless robots take over physically demanding jobs, driving productivity so high that people can work for pleasure rather than for survival. His $470 billion company, Tesla,

The idea of a future where scarcity is eliminated and money becomes obsolete is inspired by science fiction writer Iain M. Banks’ Culture series, which

Major corporations are also evolving. C3.ai, a top provider of AI solutions for businesses,

Critics say Musk’s optimistic outlook ignores significant social and political barriers. Anton Korinek, an economist at the University of Virginia, cautions that a society where work is optional could disrupt social bonds,

As discussions about AI’s broader effects continue, Musk’s forecasts remain at the center of attention. Whether his vision of a society beyond work becomes reality will hinge not only on technological breakthroughs but also on tackling inequality and redefining human roles in an automated world

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates Today: Saylor’s Bitcoin Bet—Genius Move or Risky Venture?

- MicroStrategy's $835M Bitcoin purchase (8,178 BTC) raises questions about its strategy amid a 56% stock price drop and $61B BTC holdings. - Critics like Peter Schiff call the model unsustainable, while Arca's Jeff Dorman disputes forced sale risks as Bitcoin ETFs see outflows. - Bitcoin's $94K price and MicroStrategy's $8.1B debt amplify risks, with shares trading at a 19% premium to NAV amid bearish altcoin trends. - Regulatory support for Bitcoin tax payments contrasts with market volatility, as Saylor

Polkadot News Update: Dalio: Federal Reserve's Support Sustains AI Market Surge, Withdrawal Remains Too Soon

- Ray Dalio warns AI-driven stock market nears bubble territory but advises against premature exits, citing Fed's accommodative policy as a key deflationary delay. - His proprietary bubble indicator at 80% capacity highlights AI speculation risks, yet rate cuts until 2025 could prolong the rally before any correction. - Nvidia's $57B Q3 revenue and S&P 500 record highs underscore AI's market dominance, while energy/software sectors show AI's expanding systemic impact. - Dalio urges investors to monitor Fed

Solana News Update: Abu Dhabi Commits $54 Billion—Blockchain Innovation and Strategic Alliances Drive Global Hub Aspirations

- Abu Dhabi secures Solmate-Solana blockchain partnership during Finance Week, aligning with $54B infrastructure and global innovation goals. - Five-year infrastructure plan combines government funding and public-private partnerships to boost connectivity across key regions. - Indian firms show 38.4% CAGR growth in Abu Dhabi (2019-2024), driven by business-friendly policies and strategic market access advantages. - Bitcoin Munari integrates Solana blockchain for token operations, highlighting UAE's role in

Bitcoin News Update: MSCI Index Removal Threatens to Topple MSTR's Fragile Structure

- MSCI's potential removal of MicroStrategy (MSTR) from major indices risks triggering $8.8B in passive outflows, worsening its fragile financial position. - JPMorgan warns index exclusion would damage MSTR's valuation credibility and hinder capital raising amid Bitcoin's 30% drop and collapsing stock premium. - MSTR's reliance on high-yield preferred shares has backfired as yields rise to 11.5%, while MSCI's recalibration of float metrics sparks sector-wide uncertainty. - The January 15 decision could res