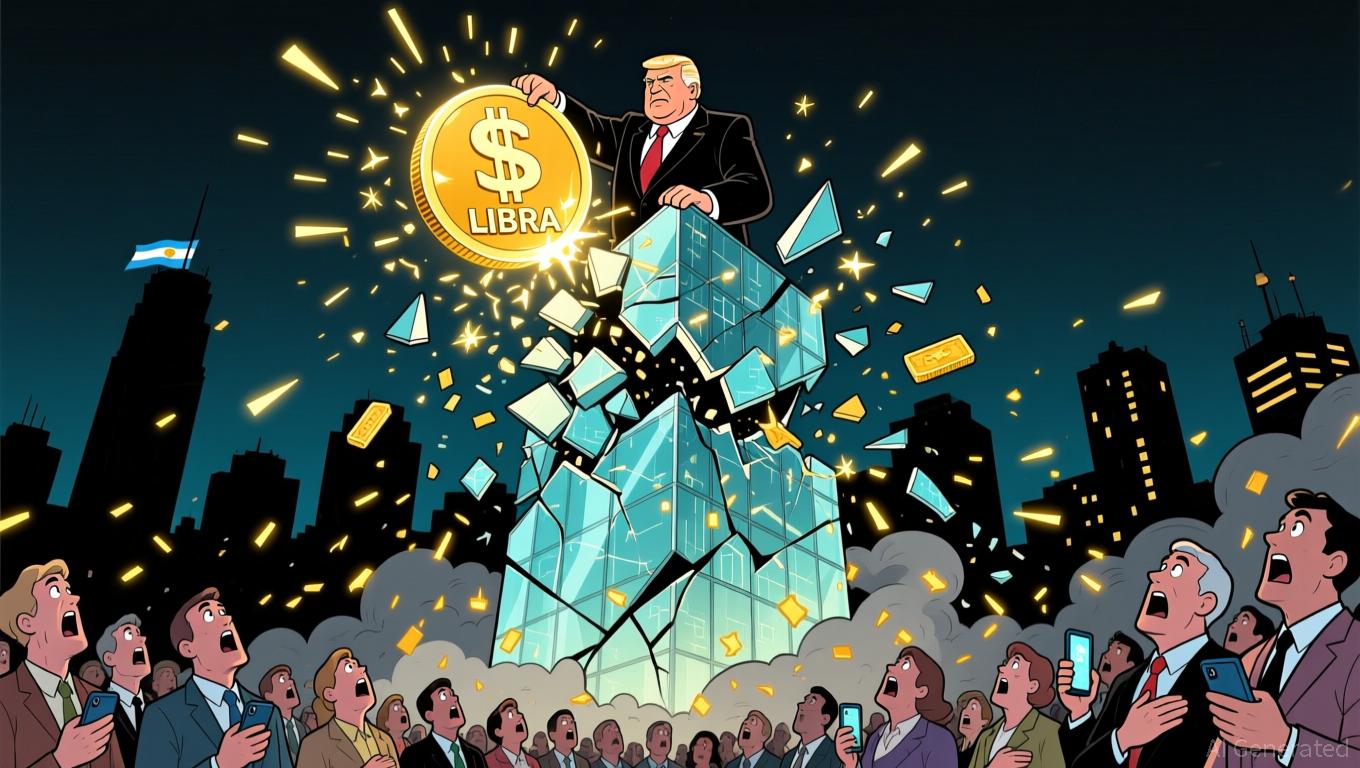

Milei's $LIBRA Endorsement Reportedly Led to $100M Cryptocurrency Crash, Investigation Suggested

- Argentine President Javier Milei faces investigation for promoting $LIBRA, a collapsed crypto linked to $100M+ investor losses. - Congressional report claims his endorsement boosted the token's visibility, enabling a "rug pull" and draining liquidity pools. - The probe also ties Milei to prior crypto projects and corruption allegations involving his sister at the National Disability Agency. - Legal actions freeze assets of $LIBRA organizers, while political challenges persist amid a new Congress dominate

Argentine President Javier Milei is under increasing examination after a congressional committee determined that his endorsement of the failed $LIBRA cryptocurrency amounted to official misconduct, urging a formal probe into his activities. The Chamber of Deputies' investigative panel issued a 200-page document

The report highlights that Milei’s public backing of $LIBRA in February 2025—through a social media post that has since been deleted—sparked a spike in trading activity before the token’s sudden downfall, which experts described as a "rug pull." Investigators claim the president’s involvement was "crucial" to the scheme,

Legal and political fallout is escalating.

The controversy adds to Milei’s mounting difficulties, as his administration is already under fire for alleged corruption involving the National Disability Agency (ANDIS), where his sister is accused of accepting bribes from pharmaceutical deals

As the $LIBRA scandal continues to unfold, the report’s focus on systematic avoidance of regulatory oversight raises larger concerns about cryptocurrency governance in Argentina. The conclusions may shape future legislative discussions on digital assets,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Kiyosaki Trades BTC for Steady Earnings During Crypto Slump, Promises Future Repurchase

- Robert Kiyosaki sold $2.25M in Bitcoin at ~$90,000/coin to fund surgery centers and billboards, aiming for $27,500/month tax-free income by 2026. - The sale occurred amid Bitcoin's 33% drop from $126K peak, with the Crypto Fear & Greed Index hitting a multi-year low of 11. - Kiyosaki insists this is tactical cash flow generation to reaccumulate BTC, maintaining $250K/2026 and $27K/ounce gold price targets. - Market analysts remain divided on Bitcoin's trajectory, with some citing ETF outflows as short-te

Ethereum Updates: Automated Bear Market: $2 Billion in Crypto Liquidations Reveal the Dangers of Leverage

- Cryptocurrency markets faced $2B in 24-hour liquidations, with Ethereum and Bitcoin suffering largest losses as leveraged longs dominated exits. - Macroeconomic pressures including surging Japanese yields and algorithmic trading triggered cascading sell-offs, pushing ETH below $2,900 for first time in months. - High-profile traders like "Anti-CZ Whale" and Machi lost millions as leveraged positions collapsed, exposing systemic risks in crypto's interconnected markets. - Market turmoil highlighted crypto-

Bitcoin Updates: Major Institutions Increase Bitcoin Holdings While Retail Investors Withdraw $3 Billion

- Bitcoin faces divergent flows: $2B institutional inflows vs. $3B ETF outflows in November, highlighting market fragmentation. - Mubadala, El Salvador, and Czech Republic boost Bitcoin holdings, signaling institutional confidence despite 21% price drop. - Leverage Shares launches 3x crypto ETFs in Europe while BlackRock's IBIT records $2.1B redemptions, reflecting risk appetite shifts. - BTC.ℏ expands cross-chain capabilities as ETF outflows and weak derivatives markets underscore waning retail demand for

Hyperliquid (HYPE) Price Rally: DeFi Liquidity Breakthroughs and Investor Outlook in Late 2025

- Hyperliquid (HYPE) introduces HIP-3 Growth Mode and BLP to attract institutional liquidity via fee cuts and shared pools. - Despite 30% usage growth and $2.15B TVL, HYPE's $37.54 price lags key resistance amid volatile sentiment and a $4.9M bid manipulation loss. - Breaking $42.75 resistance could trigger self-reinforcing liquidity growth, but failure risks $35 support breaches and eroded trust in DeFi's institutional readiness.