Ethereum Price Stalls as Derivatives Traders Load up for the Week Ahead

Ethereum is hovering at $2,818 this Sunday, but the quieter spot price action is wildly out of sync with what’s happening under the hood. Derivatives traders are loading up, shifting size across venues, and positioning ahead of a dense cluster of expiries that could force ethereum out of its holding pattern sooner rather than later.

Ethereum Derivatives Markets Say Something Big Is Brewing

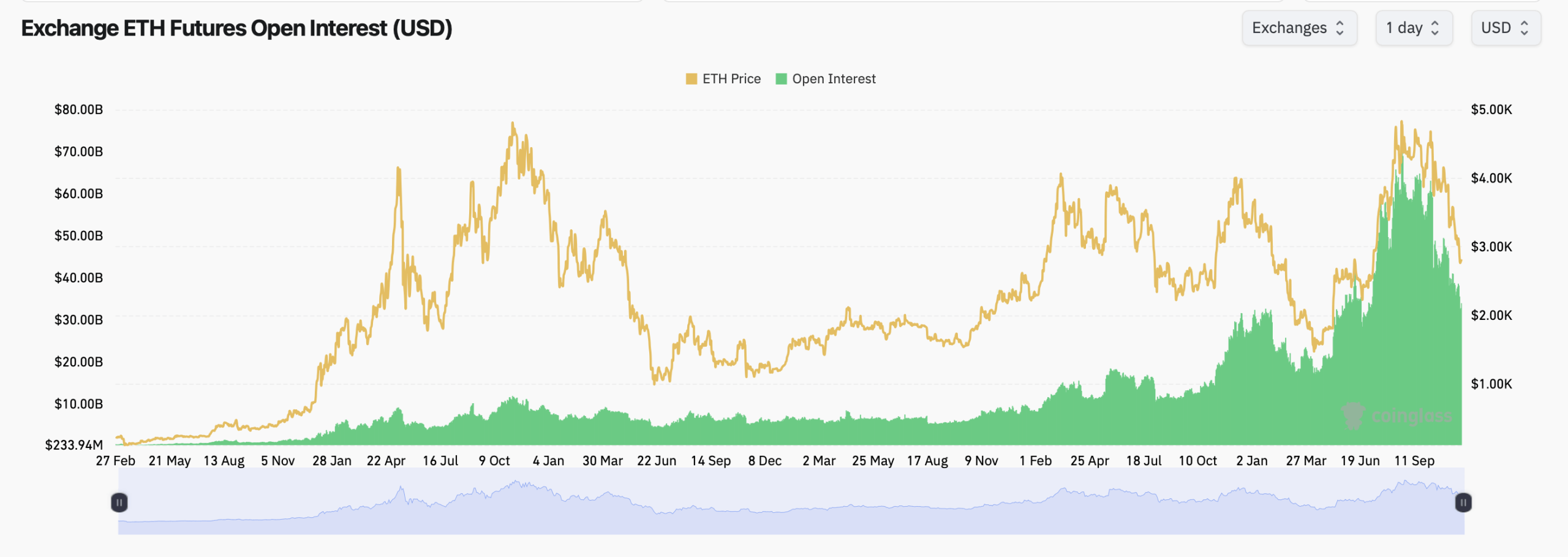

Coinglass.com stats show futures open interest remains elevated, showing a market that refuses to step back even as spot momentum has cooled. Total ethereum futures OI stands at $34 billion, with more than 12 million ETH parked in contracts across CME, Binance, OKX, Bybit, Kucoin, Gate, and others.

Binance currently leads with about 2.48 million ETH in open interest, while CME’s 2.10 million ETH still shows steady institutional exposure. Hour-over-hour action was uneven — Binance slipped, OKX dipped, and Gate saw heavier outflows — but Bybit nudged higher, signaling selective bullish positioning. Over the past 24 hours, the tone was noticeably brighter, with Bybit jumping more than 5%, Kucoin gaining nearly 4%, and Gate climbing above 5%, lifting total futures OI by 3.13% in a single day.

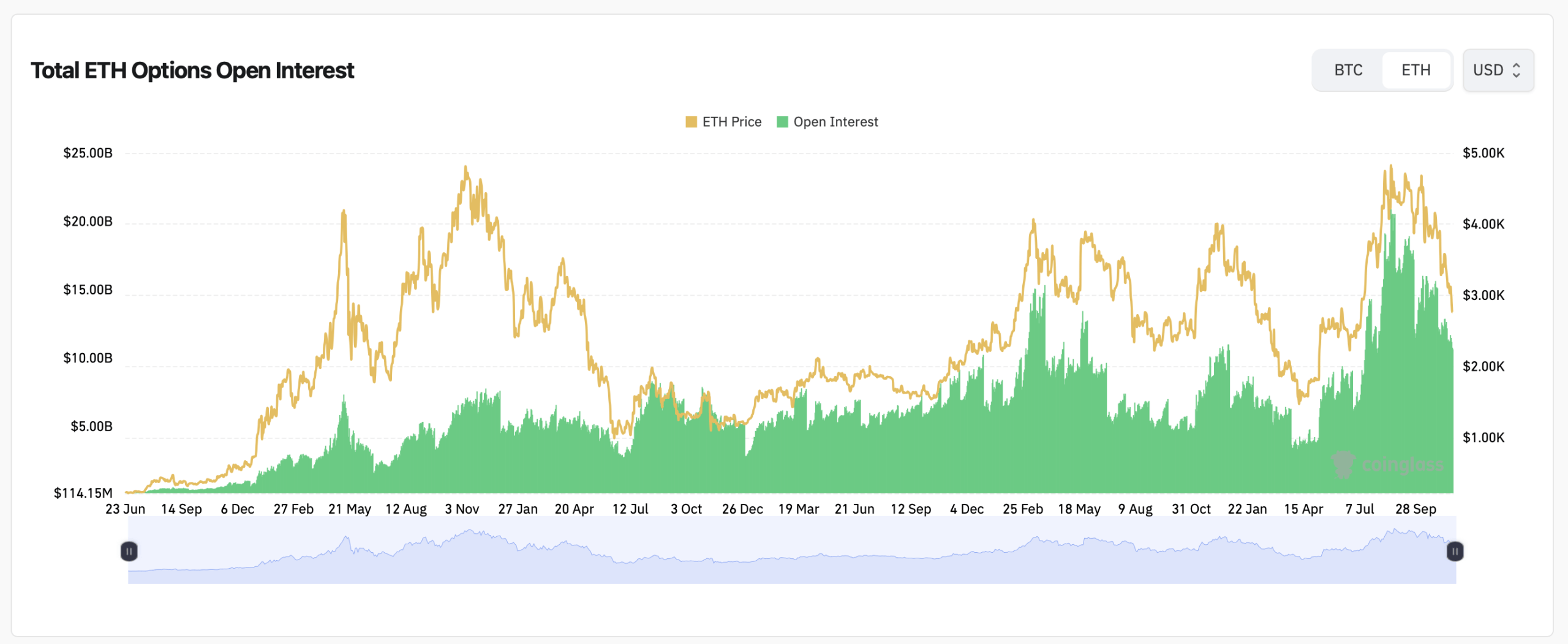

Options traders were even more dialed in. Ethereum options open interest has crossed 3.46 million ETH, with calls making up an assertive 65.80% of the stack. Puts remain active, but they’re clearly the minority at just over 34%. In the last 24 hours, calls captured 60% of trading volume — more than 105,000 ETH — while puts accounted for roughly 70,000 ETH. Traders aren’t signaling fear here; they’re expressing conviction, even if it’s wrapped in cautious near-term pricing.

Deribit continues to command the lion’s share of ethereum’s options market, handling bigger flows and deeper books than any other exchange. Most of the activity centers on major expirations in Dec. 2025 and Mar. 2026, where traders are betting aggressively on higher price levels. Some of the largest call positions — each holding more than 60,000 ETH — target substantial price milestones for late next year.

In everyday terms, the biggest players are placing large, confident bets that ethereum won’t be anywhere near current levels by the end of 2025. Max pain metrics tell their own story. On Deribit, short-dated expiries cluster in the high-$2,000s to low-$3,000s, while larger December expiries stretch toward the upper-$4,000 region.

Read more: Saylor Says Bitcoin Has Found Its Floor, Says ‘Most of the Liquidation Selling Is out of the System’

Binance’s curve sits in a similar lane, with near-term expiries around $3,000–$3,600 and late 2025 clustering closer to $4,000. OKX maintains the steepest outlook, beginning around $2,700–$3,200 for early expirations but rising toward and beyond the $5,000 zone for mid-2026 contracts. Zoomed out, short-term expectations look cautious, but long-term positioning tilts notably optimistic.

Futures depth in USD terms further reinforces that theme. Even with ethereum’s decline from the $4,000 range earlier this fall, traders continue scaling into positions rather than retreating from them. The steady upward climb in futures OI through the summer and fall points to a market preparing for volatility, not avoiding it.

Ethereum may look frozen at $2,818 today, but the derivatives market is buzzing with intent. Calls dominate the options ledger, futures OI remains strong across institutional and retail hubs, and max pain curves reveal a market that’s conservative in the near term but strikingly confident about the road ahead. As large expiries approach, traders are clearly positioning for movement — and ethereum rarely stays quiet for long when derivatives traders start leaning this hard in one direction.

FAQ 💡

- What is ethereum’s price today?Ethereum trades at $2,818 as the market drifts through weekend consolidation.

- How active is ETH futures open interest right now?Futures open interest sits near $34 billion with strong participation across Binance, CME, OKX, and others.

- Are traders favoring calls or puts in the ethereum options market?Calls dominate with more than 65% of all open interest and 60% of recent volume.

- What do max pain levels suggest for ETH?Short-term expiries center around $2,700–$3,300 while long-dated expiries point to $4,000–$5,000.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Is Bitcoin Experiencing a 2019-Like Recovery? Discussions Sparked by Market Mood and Liquidity

- Bitcoin's price swings between bearish and bullish signals, with analysts divided on its recovery from a seven-month low. - Technical indicators and historical patterns suggest a potential reversal, as Bitcoin tests key support levels and retail pessimism precedes past rebounds. - Historical parallels to 2019 and anticipated quantitative easing fuel optimism, though macroeconomic uncertainties and recent liquidations pose risks. - Experts caution against volatility, noting mixed market reactions and the

Anti-CZ Whale Loses $61M Profit in 10 Days on Hyperliquid

Quick Take Summary is AI generated, newsroom reviewed. The "Anti-CZ Whale" lost $61 million in profit in 10 days, suffering losses on aggressive long positions in ETH and XRP. The whale's overall realized and unrealized profit dropped from $100 million to $38.4 million. One of the whale's accounts is running 12.22x leverage on a $255 million long exposure, with alarmingly thin 95.40% margin usage. The reversal highlights the high risk and volatility in perpetual futures trading, even for successful contrar

Watch Out: Numerous Economic Developments and Altcoin Events in the New Week – Here is the Day-by-Day, Hour-by-Hour List

‘I Won’t Back Down,’ Michael Saylor Reinforces Strategy’s Bitcoin Mission