XRP Rich List Update: Here’s How Much You Need to Join Top 0.1% Holders

While XRP often grabs headlines for its price swings and regulatory developments, another story unfolds quietly on the XRP Ledger (XRPL): the distribution of wealth among its holders.

How XRP is spread across wallets can reveal not just scarcity but also the potential influence a few key holders exert over market liquidity and movements. Understanding this distribution is crucial for investors aiming to navigate the ecosystem strategically.

Levi Rietveld’s Insights on Top-Tier Holdings

Levi Rietveld of Crypto Crusaders recently shed light on XRP’s wealth stratification in a video shared on X. Drawing from rich-list.info, he detailed what it takes to secure a position in the highest percentiles of XRP holders.

According to Rietveld, reaching the top 0.1% of holders requires a minimum balance of 300,000 XRP. Currently, only 7,421 wallets qualify for this tier.

How Much $XRP To Be In The Top 0.1%?

Comment “knowledge” and I’ll DM you access to my community!

Like & repost to spread awareness!!

— Levi | Crypto Crusaders (@LeviRietveld) December 19, 2025

For those aiming even higher, the top 0.01% — the ultra-elite holders — requires at least 3,653,014 XRP, a level reached by just 743 wallets. These numbers highlight the rarity of deep-reserve positions and the exclusivity of upper-tier ownership in the XRP ecosystem.

How the XRP Rich List Determines Rankings

The XRP rich list ranks wallets by the amount of XRP held and assigns percentile positions based on these balances. While the XRPL hosts millions of addresses, the majority contain relatively small amounts of XRP, often due to dust wallets, duplicate addresses, or exchange-managed accounts.

This results in a steep distribution curve: a small number of wallets hold a disproportionately large portion of the total supply.

Historical and on-chain data confirm this pattern. The jump from the top 1% to the top 0.1% is dramatic, and moving into the ultra-elite 0.01% bracket requires millions of XRP. These rankings not only quantify scarcity but also signal the potential market impact of these large holders.

Implications for Investors

Understanding the thresholds for top-tier XRP holdings has practical implications. Accumulating 300,000 XRP or more is a significant financial commitment, particularly for retail investors. Achieving such positions can also affect market behavior, as concentrated holdings in a few wallets may influence liquidity and price dynamics during periods of high volatility.

Additionally, these rich list rankings provide a framework for strategic accumulation. Investors can gauge their position relative to the broader community and make informed decisions about long-term holdings or potential market influence.

A Dynamic Snapshot

It is important to note that XRP wallet balances are not static. Transfers, exchange flows, and newly created addresses can shift rankings over time. Despite these fluctuations, the XRP rich list provides a clear, data-backed snapshot of wealth distribution within the ledger.

In conclusion, the latest rich list analysis underscores just how concentrated XRP ownership remains. For investors and enthusiasts, these insights offer a deeper understanding of scarcity and market structure.

Beyond price charts and regulatory news, knowing what it takes to enter the top 0.1% or even 0.01% of holders adds perspective, strategy, and context to the XRP market landscape.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

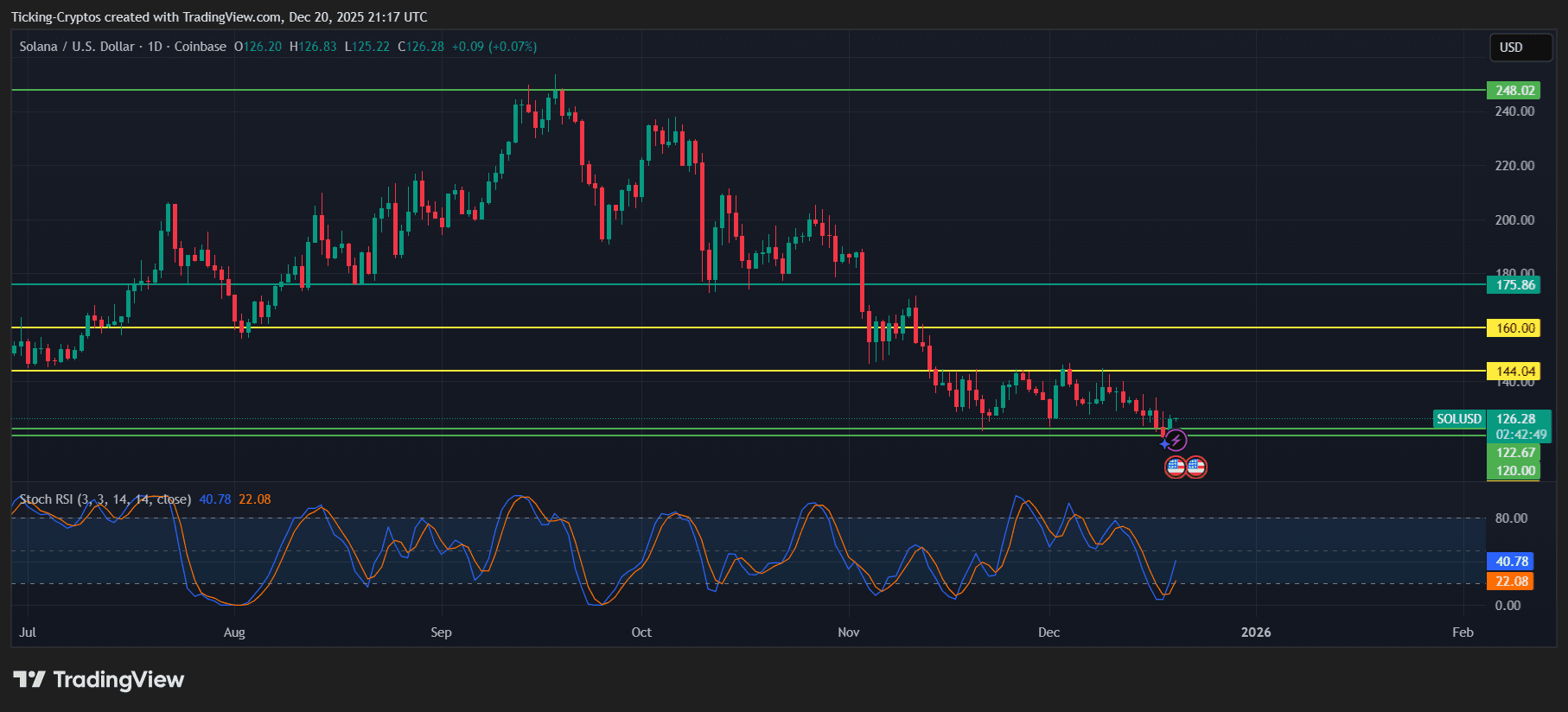

Solana Price Depends On Existing SOL Holders, Here’s Why

Crypto Price Today: Bitcoin, Ethereum, Dogecoin, and Solana at Key Levels

Banks Need XRP To Be Pricier—Here’s Why A Finance Expert Says So

Midnight Blockchain Draws Attention with Record Trading Volume and Strategic Partnerships