The market is at a point where investor patience is being tested.

Simply put, HODLers are deciding whether to stay positioned for upside or de-risk ahead of a deeper correction that could compress P/L. Meanwhile, uncertainty around Japanese bond yields is reinforcing a risk-off mood.

In this setup, it’s not surprising that Bitcoin’s [BTC] on-chain metrics aren’t seeing a Q2-style rebound. Back then, BTC’s STH NUPL snapped back after two months of FUD, but this time it remains firmly in the red.

Notably, the current FUD appears to be pushing further into the network.

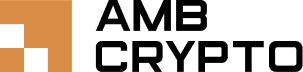

As per the chart above, Miner Reserves were down 900 BTC over the past two days, amounting to $76 million in sell-offs. When compared to their Average Mining Cost, it’s clear that these miners are operating at a loss.

In short, Bitcoin’s on-chain signals continue to point toward capitulation.

And yet, despite this apparent stress, BTC is still holding above the $85k level. This resilience raises an important question: Has the textbook “buy the fear” setup finally begun to take hold, reinforcing BTC’s bottom?

New whale activity drives half of Bitcoin’s realized cap

In the current macro setup, whale support is starting to play a major role.

For context, stress is building in Japan after the BOJ raised interest rates by 25 bps, the highest level in 30 years.

The effect?

Spot Bitcoin demand is muted, with U.S. investors in particular staying largely on the sidelines.

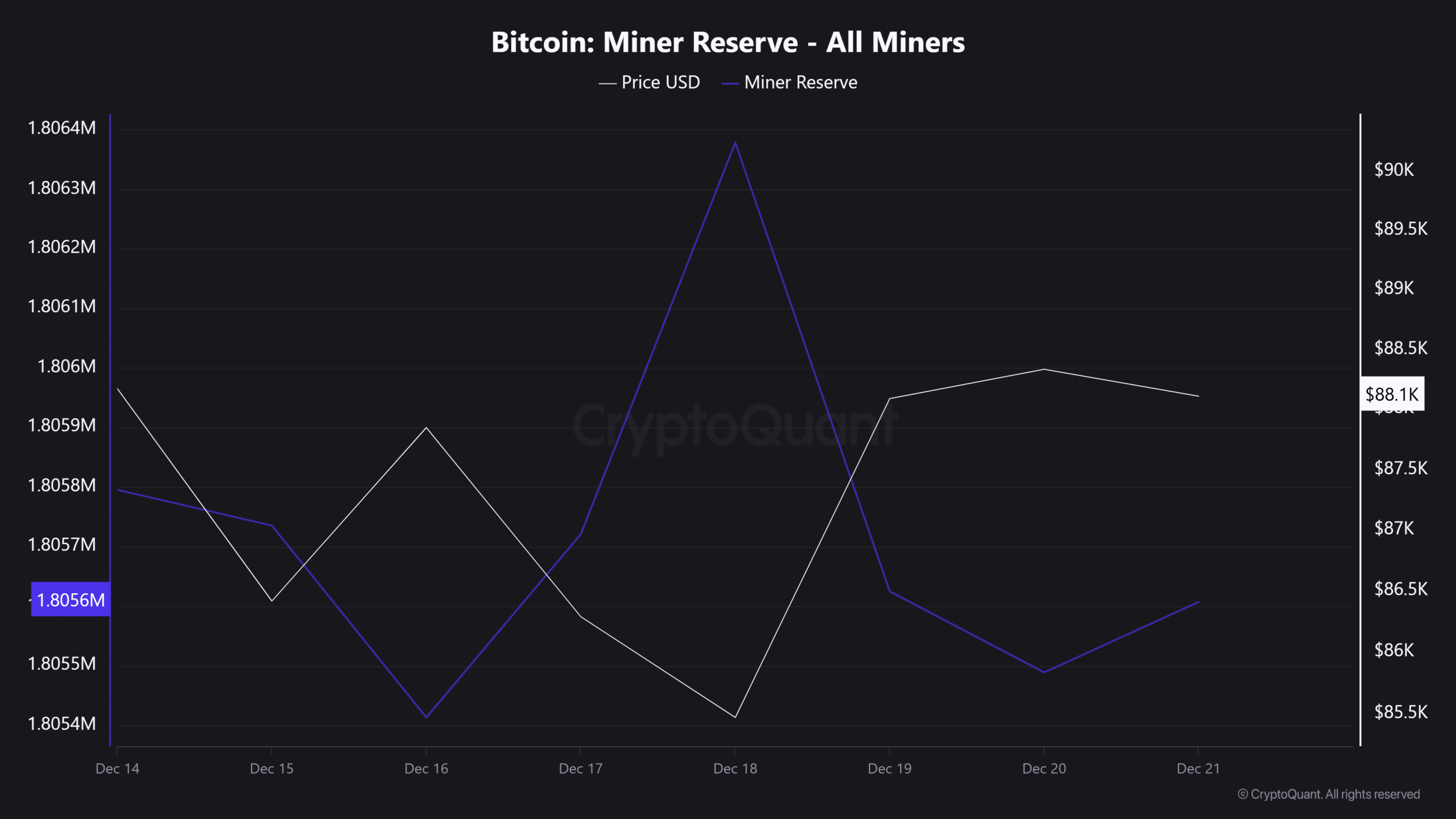

That said, this volatility is creating a prime setup for a shift in BTC’s supply dynamics. Weak hands are being shaken out, leaving stronger hands to pick up the available supply. Notably, the chart below reinforces this point.

Nearly 50% of Bitcoin’s realized cap now comes from new whale buyers.

For context, the realized cap reflects the “price” at which coins last moved on-chain. With nearly half of it now tied to recent whale purchases, a large portion of Bitcoin’s supply has rotated into stronger hands.

From a technical perspective, this dynamic helps explain BTC’s resilience.

Despite growing market FUD and capitulation pressure, BTC has now spent four weekly closes chopping in a defined range above $85k. If this behavior continues, calling a Bitcoin bottom doesn’t seem too far-fetched.

Final Thoughts

- On-chain metrics still signal stress, yet BTC continues to hold above $85k, suggesting underlying strength.

- Nearly 50% of Bitcoin’s realized cap is now driven by new whale buyers, indicating a rotation of supply from weak hands to stronger holders, reinforcing BTC’s potential bottom.