Bitcoin 2025–2026: From Retail Selloff to Institutional Accumulation as Market Structure Transforms

Industry commentary on the crypto markets signals a fundamental shift toward greater institutionalization and evolving market structure. Analysts note rising institutional allocation and a waning role for traditional retail speculation, with professional entities driving more durable capital commitments amid ongoing infrastructure improvements.

According to sector data, 2025 ETF inflows totaled about $25 billion, highlighting persistent demand from institutions and the resilience of institutional investors despite price volatility. The year also saw clearer policy signals and stronger infrastructure buildout, underpinning a credible investment thesis for the asset class.

Looking to 2026, policy dynamics around the midterm elections could shape market sentiment. The first half may feature a policy-driven tilt tied to institutional flow, while late 2026 could bring heightened volatility as politics and regulation intersect. Investors should monitor market infrastructure reforms and regulatory clarity.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CLARITY Act explicitly leaves DeFi rules blank, risking a total retail protection collapse if negotiations fail

Watch Out: Numerous Economic Developments and Altcoin Events This Week! Here’s the Day-by-Day, Hour-by-Hour List

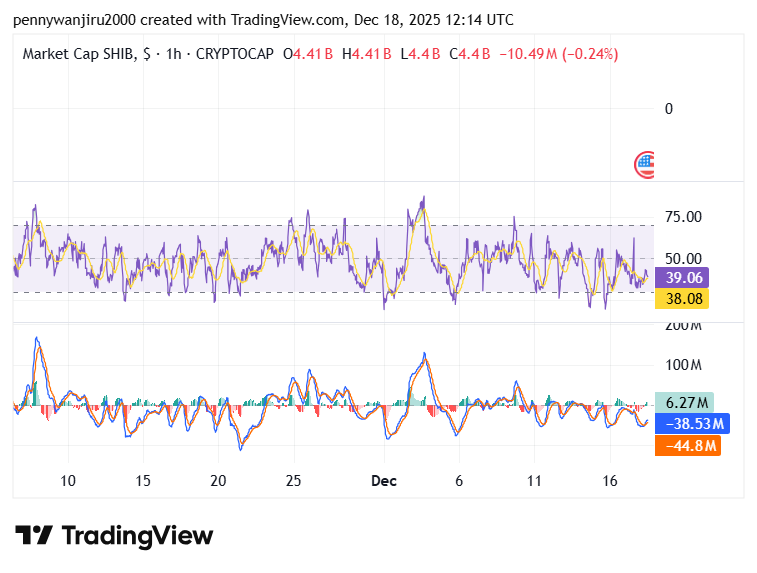

Shiba Inu Price Slips 2.9% as SHIB Defends $0.0574 Support Amid Tight Trading Range

The 15 Most Searched Altcoins in Recent Hours Have Been Revealed – Here’s the List