Author: Four Pillars

Translation: Plain Blockchain

Key Points

HIP-3 has removed the technical barriers to launching new perpetual contract markets and enabled a demand-driven market creation model. This shifts decentralized exchanges (DEXs) from a PvP dynamic of competing with centralized exchanges (CEXs) for existing market share, to a PvE-style expansion path that extends into non-crypto assets and real-world data.

The market is shifting from narrative-driven growth to a cash flow-driven, sustainability-oriented valuation system. Only a few projects with real revenue flowing to tokens (such as Hyperliquid and Pump.fun) may dominate the next cycle.

Prediction markets transform what were once private or illegal gambling activities into public on-chain data and serialized data of collective expectations. This creates real-time probability signals and alternative data that financial institutions, data providers, and AI models can use as an economic mechanism for information aggregation and probability estimation.

Regulation has created a bifurcated system: prediction markets are becoming institutionalized in the West, while being suppressed in Asia. This constitutes a major short-term constraint but also paves the way for prediction markets to evolve into infrastructure that "transforms collective beliefs into information and markets."

1. How HIP-3 Opens Up a New PvE-Style Growth Pattern

The business model of trading platforms is undergoing a transformation.

Centralized exchanges (CEXs) maintain their position thanks to structural advantages based on institutional trust (fiat on/off ramps, custody, and regulatory access). This makes them the natural entry point for institutional capital and provides stability in terms of liquidity and operational reliability. However, the same regulatory obligations, internal controls, and custody infrastructure also result in high fixed costs. As a result, CEXs experiment and make decisions more slowly, limiting their pace of innovation.

In contrast, decentralized exchanges (DEXs) grow through incentive structures. They natively coordinate rewards among LPs, traders, and builders on-chain. But previously, launching a new trading platform or market required teams to build matching engines, margin and liquidation systems, and oracles from scratch. This created a very high technical entry barrier.

HIP-3 has removed this barrier.

Hyperliquid now allows anyone who stakes 500,000 HYPE to deploy their own perpetual contract market using the same CLOB engine, margin logic, and liquidation system as the main platform. The technical burden of building a trading platform has disappeared. Market creation has become a standardized on-chain deployment process, requiring capital and reliable oracles rather than an entire engineering team. The threshold has shifted from technical capability to capital and oracle design.

This change is not just about increased efficiency; it also changes where innovation happens.

Builders can now experiment with different liquidity structures, fee designs, oracle definitions, and leverage limits without rebuilding the backend. The challenge becomes identifying the "demand surface" (i.e., how many people want to speculate on something) and anchoring it to a reliable oracle. In practice, markets can now be composed of three components: market + oracle + demand.

This expands the range of assets that can be listed.

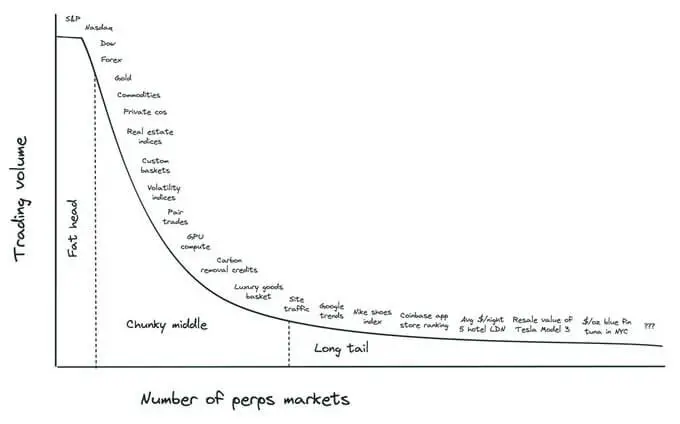

As described by Ventuals founder Alvin Hsia, the "Fat Head" consists of asset classes already covered by traditional finance (index products, forex, commodities); the "Chunky Middle" includes crowdfunded equity, real-world data sets, and commodity indices; while the "Long Tail" extends to niche signals such as local real estate prices, product premiums, or cultural trend indices. Traditional finance cannot easily commoditize these data points, but on-chain settlement systems can. HIP-3 effectively opens up a demand-driven market creation model.

This transforms DEXs from competitors of CEXs into structurally different entities.

HIP-3 is no longer about fighting for a fixed pool of crypto-native liquidity (PvP dynamic), but allows DEXs to expand into non-crypto assets and real-world data. This brings new traffic, new users, and new forms of demand—a PvE dynamic where market size grows rather than being redistributed. It also deepens protocol-level revenue.

A clear example is Hyperliquid's XYZ100 market, which surpassed $1.3 billion in cumulative trading volume within three weeks of launch, demonstrating how quickly new asset classes can scale once infrastructure is standardized.

In short, CEXs continue to provide stability and regulatory access, but perpetual DEXs based on HIP-3 gain advantages in speed, experimentation, and asset expansion. They are not substitutes, but entirely different growth paths. The competitive edge of trading platforms will shift from backend engineering to market design and user experience, and leadership will depend on which protocol can turn this into sustainable value.

2. From Narrative-Driven Valuation to Cash Flow-Driven Valuation

The market in 2025 is fundamentally different from previous cycles.

The liquidity glut that once boosted all assets has disappeared. Capital now flows selectively. Prices reflect actual performance more than narratives, and projects unable to generate revenue are being naturally squeezed out. Most altcoins have yet to recover to their 2021 highs, while protocols with clear revenue have shown relative strength even during market pullbacks.

The arrival of institutional capital has solidified this shift.

Traditional finance (TradFi) frameworks are being directly applied to crypto. Revenue, net profit, fee generation, user activity, and profit distribution are becoming the primary metrics for project evaluation. The market is moving away from valuing projects based on "storytelling" or expected growth. Only those with real revenue flowing back to tokens can achieve higher market valuations.

In this context, Uniswap's recent proposal to activate the fee switch is symbolic. A flagship DeFi protocol explicitly chooses to link cash flow to token value, signaling that fundamentals (rather than narrative) are now at the core of market pricing.

A group of clear leaders has already emerged.

Hyperliquid (HYPE) and Pump.fun (PUMP) are typical cases:

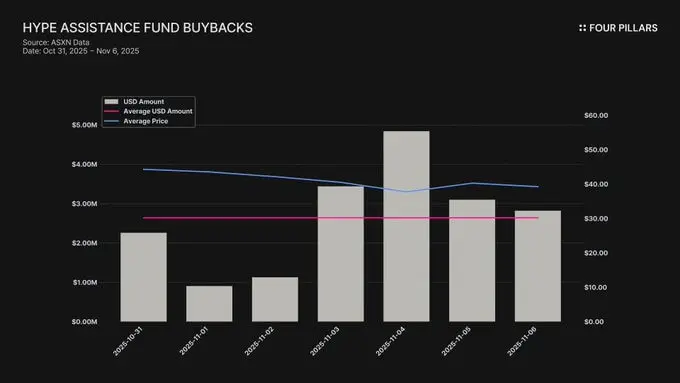

Hyperliquid is the largest perpetual DEX by trading volume, open interest (OI), and number of traders. As of November 2025, cumulative trading volume reached $3.1 trillion, with open interest at $9 billion. Notably, Hyperliquid uses 99% of perpetual contract fees to buy back HYPE, directly linking protocol cash flow to token value. Total buybacks have reached 34.4 million HYPE (about $1.3 billion), accounting for about 10% of circulating supply.

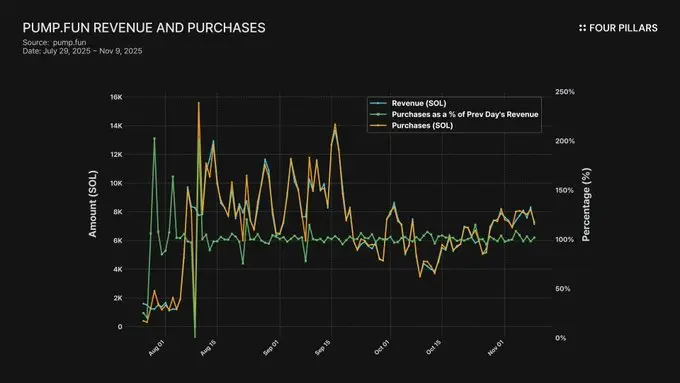

Pump.fun is a leading meme coin trading platform, generating about $1.1 billion in cumulative fees. Its buyback program has purchased about 830,000 SOL (about $165 million), equivalent to 10.3% of its (estimated) circulating value.

Other projects also show strong revenue momentum:

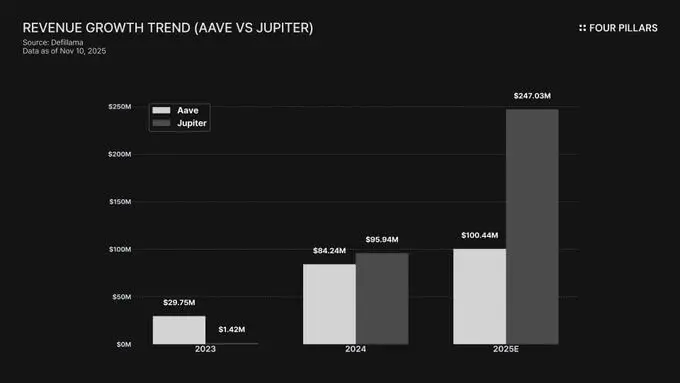

Aave (AAVE) and Jupiter (JUP) continue to post stable and growing cash flows. Aave's annual revenue grew from $29.75 million in 2023 to $99.39 million in 2025. Jupiter's revenue growth is even more impressive, soaring from $1.42 million in 2023 to $246 million in 2025.

Coinbase (COIN), though a listed stock, also benefits from the increasingly clear Base chain token issuance path. Coinbase has broadened its revenue structure: in Q3 2025, subscription and services revenue reached $746.7 million (up 13.9% quarter-on-quarter).

This shift is spreading from individual dApps to L1 and L2 ecosystems. Technical prowess or investor endorsements alone are no longer enough. Chains with real users, real transactions, and protocol-level revenue are gaining stronger market recognition. The core evaluation metric is becoming the sustainability of economic activity.

In summary, the market is undergoing a structural transformation. By 2026, the market may be reorganized around these performance-backed participants.

3. Quantifying Market Expectations Through Prediction Markets

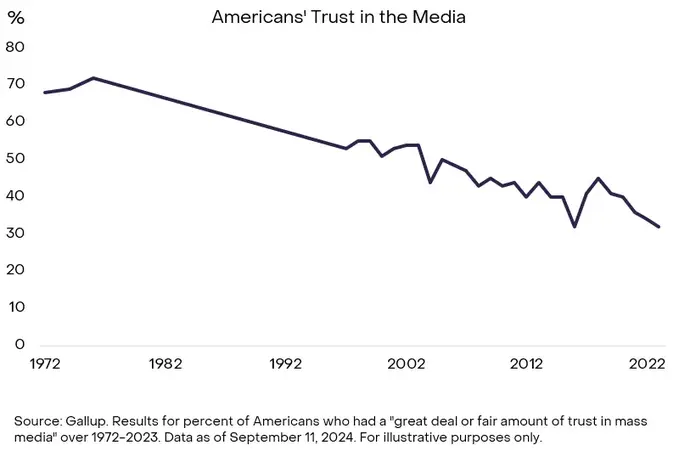

Prediction markets are an experiment in transforming what were once private or illegal gambling activities into public on-chain data. The core is that they quantify the probabilities people assign to future events by having participants put real money behind their beliefs. This makes them not just venues for speculation, but economic mechanisms for information aggregation and probability estimation.

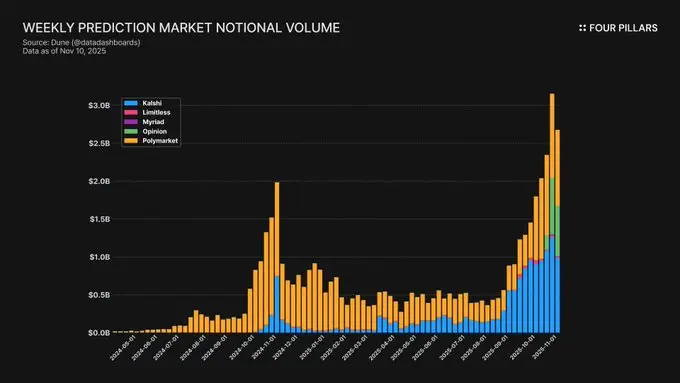

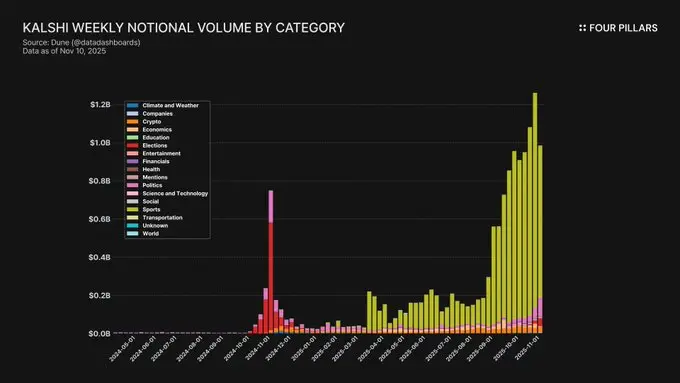

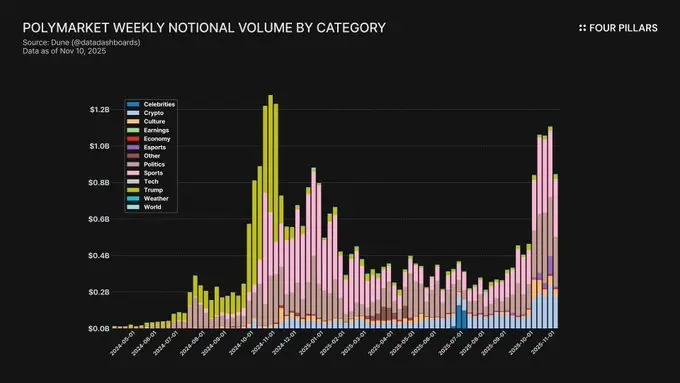

Prediction markets have grown rapidly since 2024: As of October 2025, weekly nominal trading volume is about $2.5 billion, with over 8 million trades per week. Polymarket accounts for 70–75% of activity, while Kalshi, after obtaining CFTC approval and expanding into sports and political markets, has climbed to around 20% market share.

The uniqueness of prediction market data lies in: Polls, social media sentiment, and institutional research are often slow to respond and expensive. Prediction markets, on the other hand, price expectations in real time. For example, Polymarket reflected the rise in Donald Trump's probability of winning the 2024 election significantly earlier than traditional polls.

In practice, prediction markets create serialized data of collective expectations. These curves can serve as real-time probability signals for political, economic, sports, and technological events. Financial institutions and AI models are increasingly viewing these markets as alternative data sources (Alt-data) for quantifying expectations.

From an institutional perspective, prediction markets do not represent "the datafication of gambling," but rather "the financialization of uncertainty." Because prices reflect consensus probabilities, macro traders can use them to manage risk. Kalshi already offers markets linked to inflation, employment data, and interest rate decisions, attracting significant hedging interest.

As prediction markets mature, they create a new value chain: market (signal generation) → oracle (outcome resolution) → data (standardized datasets) → applications (financial, media, AI consumption).

The main current obstacle is regulation:

Asia: Regions such as South Korea, Singapore, and Thailand mostly take a prohibitive stance, classifying them as illegal gambling and penalizing users.

The West: In the US, prediction markets are regulated as "event contracts" by the CFTC. Kalshi has DCM licensing for legal operation, while Polymarket plans to re-enter the US market in 2025 through the acquisition of QCX.

This regulatory difference has created a split: the West is moving toward institutionalization, while Asia is suppressing. While this is a short-term limitation, in the long run, prediction markets will evolve into infrastructure that transforms collective beliefs into information. They will shift from "markets that interpret information" to "markets that produce information," reinforcing a world where "price becomes the primary expression of collective expectations."