- Hashrate dropped within a month as rising mining costs pressured operations and slowed activity.

- Electricity breakeven costs fell sharply, putting older and less efficient miners under stress.

- Corporate treasuries accumulated Bitcoin as short-term holders cut exposure and reduced risk.

Bitcoin entered a renewed stress phase in recent weeks as network hashrate declined, price volatility surged, and short-term holders reduced exposure, while long-term investors largely held steady, according to new research from VanEck. The firm reported that Bitcoin’s network hashrate fell roughly 4% over the past 30 days. This marks its sharpest contraction since April 2024, following a difficult trading period that pushed prices down nearly 9%.

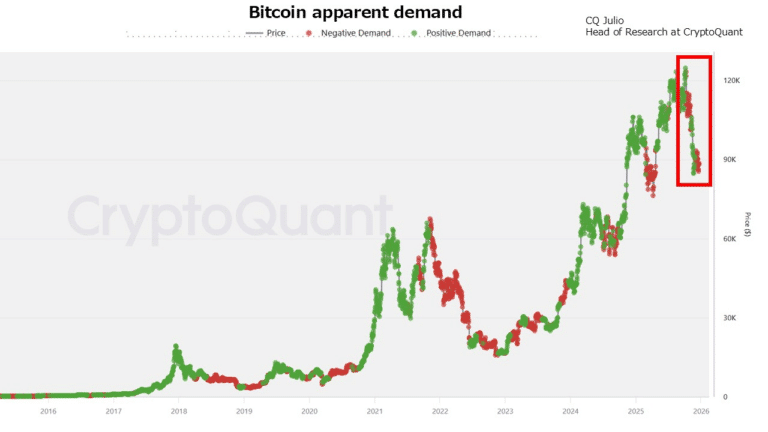

At the same time, market volatility climbed above 45% on a 30-day basis, reaching its highest level since April this year and signaling growing instability across spot and derivatives markets. This pullback occurred as trading conditions weakened across several metrics. Bitcoin briefly fell to about $80,700 on November 22, which dragged the 30-day relative strength index down to roughly 32, reflecting reduced momentum and subdued speculative demand.

As volatility increased, perpetual futures markets also cooled, with annualized basis rates sliding to around 5% and briefly dipping as low as 3.7%, compared with a yearly average of 7.4%.

Mining Economics Tighten as Margins Shrink

Mining conditions deteriorated rapidly during the same period as revenue and profitability metrics weakened. VanEck reported that daily transaction fee revenue declined 14% month over month in dollar terms, while new address growth slipped by 1%, pointing to slower on-chain activity.

These pressures compounded the strain on miners already facing shrinking margins from lower prices and higher operational costs. Electricity economics also shifted sharply. The breakeven power cost for a 2022-era Bitmain S19 XP miner fell from $0.12 per kilowatt-hour in December 2024 to about $0.077 per kilowatt-hour by mid-December.

VanEck analysts Matt Sigel and Patrick Bush said the nearly 36% drop reflected how quickly conditions worsened for miners operating older-generation equipment. Historically, VanEck noted that hashrate declines often occur when miners shut down machines or scale back production. Rather than signaling prolonged downturns, these periods have frequently aligned with market exhaustion.

“When hash rate compression persists over longer periods, positive forward returns tend to occur more often and with greater magnitude,” Sigel and Bush wrote in the report. Since 2014, VanEck data showed that when 90-day hashrate growth turned negative, Bitcoin delivered positive 180-day forward returns 77% of the time, with an average gain of 72%. Outside such periods, average returns were closer to 48%.

China Shutdowns and Holder Behavior Drive the Split

External disruptions also contributed to the recent slowdown. VanEck linked much of the hashrate decline to reported shutdowns in China’s Xinjiang region, where about 1.3 gigawatts of mining capacity reportedly went offline amid policy scrutiny. The closures may have removed as much as 10% of global Bitcoin hashpower, with roughly 400,000 machines potentially shut down.

The analysts added that much of this energy capacity could shift toward meeting rising demand from artificial intelligence workloads. They estimated that this trend alone could erase up to 10% of Bitcoin’s total hashrate if sustained.

Related: VanEck CEO Flags Rising Bitcoin Risks in Encryption and Privacy

On-chain data showed a clear divide among Bitcoin holders. Balances held for one to five years declined sharply, including a 12.5% drop in the two-to-three-year cohort. In contrast, coins held for more than five years remained largely unchanged, with balances flat or slightly higher.

Investment flows mirrored this split. Spot Bitcoin exchange-traded product holdings fell by 120 basis points month over month to 1.308 million BTC. Meanwhile, corporate treasuries added about 42,000 BTC between mid-November and mid-December, marking the most significant accumulation since July.

Most of that buying came from Strategy, which added approximately 29,400 BTC as its market net asset value remained above 1. Other firms began shifting away from common stock issuance toward preferred shares to fund future Bitcoin purchases, reinforcing the divergence between short-term selling pressure and long-term accumulation.