The broader crypto market is facing yet another selling pressure, with daily liquidations soaring past $250 million ahead of the US GDP data release on Dec. 23.

After the rejection at $90,000, Bitcoin BTC $87 780 24h volatility: 2.4% Market cap: $1.75 T Vol. 24h: $38.96 B price is down 2.4% as of press time and is currently trading at $87,546.

Ethereum ETH $2 970 24h volatility: 2.6% Market cap: $358.44 B Vol. 24h: $20.84 B and other altcoins have also corrected by a similar magnitude as market volatility picks up.

Crypto Market Faces Heightened Volatility Ahead of U.S. GDP Data

The overall crypto market cap has dropped 2.46% to $2.96 trillion as volatility catches up ahead of today’s US GDP data release.

Volatility has picked up across digital assets, with Bitcoin, Ethereum, and XRP XRP $1.90 24h volatility: 1.6% Market cap: $115.26 B Vol. 24h: $2.49 B extending recent losses.

According to Coinglass data, the overall market liquidations have soared past $250 million in the last 24 hours, with $192 million in long liquidations.

The Crypto Fear & Greed Index dropped to 24, signaling extreme fear among investors.

However, despite the price weakness, total crypto derivatives open interest edged higher by 1.1% to $129 billion. This suggests that traders are maintaining elevated positioning amid rising uncertainty.

This week will have some key macroeconomic events that are relevant to the crypto market. On Dec. 22, the U.S. Federal Reserve injected $6.8 billion of liquidity into the financial system.

Key U.S. GDP data is scheduled for release on Dec 23, followed by weekly jobless claims on Dec. 24. U.S. markets will be closed on Dec. 25 due to the Christmas holiday, while China’s M2 money supply data is set to be released on Dec. 26, adding another macro variable for markets to assess.

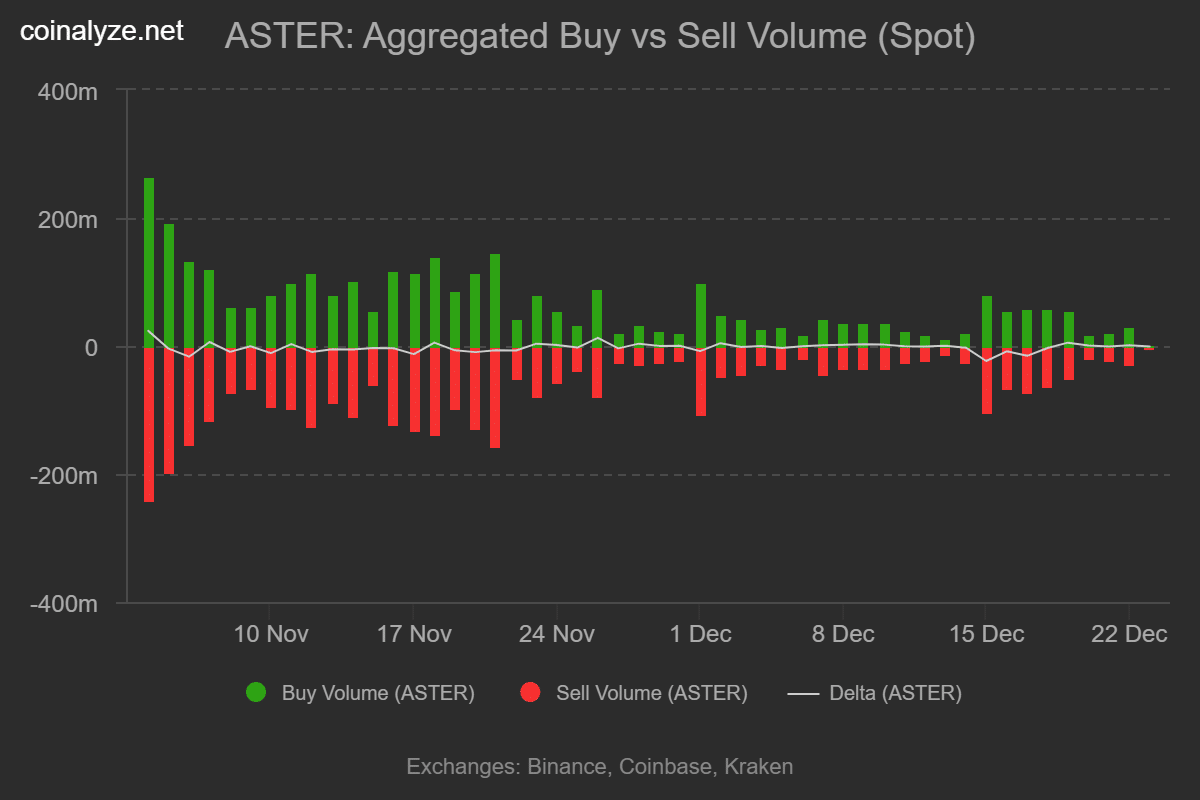

Buying Strength in the Market Weakens

Sharing the on-chain analysis, CryptoQuant analyst Mignolet warned that buying pressure across the crypto market continues to weaken. Both trading activity and network participation are showing signs of slowdown.

Active addresses decline signals weakening network activity. | Source: CryptoQuant

CryptoQuant noted that one of the early signals pointing to downside risk after August was the steady decline in buy-volume divergence on Binance futures.

While prices continued to rise during that period, trading volume consistently fell.

The divergence has yet to reverse from there for any meaningful recovery. The firm added that active address counts are now falling sharply, indicating reduced network engagement.

Based on these signals, the firm cautioned that the crypto market may need additional time to stabilize and recover.

Bhushan is a FinTech enthusiast and holds a good flair in understanding financial markets. His interest in economics and finance draw his attention towards the new emerging Blockchain Technology and Cryptocurrency markets. He is continuously in a learning process and keeps himself motivated by sharing his acquired knowledge. In free time he reads thriller fictions novels and sometimes explore his culinary skills.