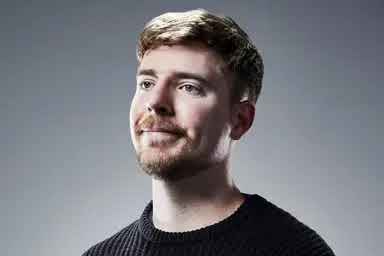

MrBeastSuckinMeatinu KursSOL

EUR

Der Kurs für MrBeastSuckinMeatinu (SOL) in Euro beträgt -- EUR.

Der Kurs dieser Coin wurde nicht aktualisiert oder die Aktualisierung wurde eingestellt. Die Informationen auf dieser Seite dienen ausschließlich zu Referenzzwecken. Die gelisteten Coins können Sie auf der Bitget-Spotmärkte einsehen.

RegistrierenLive MrBeastSuckinMeatinu Kurs heute in EUR

Der Live-Kurs von MrBeastSuckinMeatinu beträgt heute-- EUR, bei einer aktuellen Marktkapitalisierung von --. Der Kurs von MrBeastSuckinMeatinu ist in den letzten 24 Stunden um 0.00% gefallen, und das 24-Stunden-Trading-Volumen beträgt €0.00. Der Umrechnungskurs von SOL/EUR zu (MrBeastSuckinMeatinu EUR) wird in Echtzeit aktualisiert.

Wie viel ist 1 MrBeastSuckinMeatinu in Euro wert?

Derzeit liegt der Kurs für MrBeastSuckinMeatinu (SOL) bei Euro bei -- EUR. Sie können 1SOL jetzt für -- kaufen, 0 SOL können Sie jetzt für €10 kaufen. In den letzten 24 Stunden lag der höchste Kurs für SOL bei EUR bei -- EUR und der niedrigste Kurs für SOL bei EUR bei -- EUR.

MrBeastSuckinMeatinu Marktinformationen

Kursentwicklung (24S)

24S

24S Tief --24S Hoch --

Allzeithoch (ATH):

--

Kursänderung (24S):

--

Kursänderung (7T):

--

Kursänderung (1J):

--

Markt-Rangliste:

--

Marktkapitalisierung:

--

Vollständig verwässerte Marktkapitalisierung:

--

24S-Volumen:

--

Tokens im Umlauf:

-- SOL

Max. Angebot:

--

MrBeastSuckinMeatinu Kursprognose

Wie hoch wird der Kurs von SOL in 2026 sein?

In 2026 wird auf der Grundlage einer prognostizierten jährlichen Wachstumsrate von +5 % erwartet, dass der Kurs von MrBeastSuckinMeatinu(SOL) €0.00 erreichen wird; auf der Grundlage des für dieses Jahr prognostizierten Kurses wird die kumulative Kapitalrendite einer Investition in MrBeastSuckinMeatinu bis zum Ende von 2026 +5% erreichen. Weitere Informationen finden Sie unter MrBeastSuckinMeatinu Kursprognosen für 2025, 2026, 2030–2050.Wie hoch wird der Kurs von SOL im Jahr 2030 sein?

Im Jahr 2030 wird der Kurs von MrBeastSuckinMeatinu(SOL) auf der Grundlage einer prognostizierten jährlichen Wachstumsrate von +5 % voraussichtlich €0.00 erreichen; auf der Grundlage des für dieses Jahr prognostizierten Kurses wird die kumulierte Kapitalrendite einer Investition in MrBeastSuckinMeatinu bis Ende 2030 27.63% erreichen. Weitere Informationen finden Sie unter MrBeastSuckinMeatinu Kursprognosen für 2025, 2026, 2030–2050.

Trendige Aktionen

Wie man MrBeastSuckinMeatinu(SOL) kauft

Erstellen Sie Ihr kostenloses Bitget-Konto

Melden Sie sich bei Bitget mit Ihrer E-Mail-Adresse/Handynummer an und erstellen Sie ein sicheres Passwort, um Ihr Konto zu schützen.

Verifizieren Sie Ihr Konto

Verifizieren Sie Ihre Identität, indem Sie Ihre persönlichen Daten eingeben und einen gültigen Lichtbildausweis hochladen.

SOL in EUR konvertieren

Wählen Sie eine der Kryptowährungen für das Trading auf Bitget.

FAQ

Was ist der aktuelle Kurs von MrBeastSuckinMeatinu?

Der Live-Kurs von MrBeastSuckinMeatinu ist -- pro (SOL/EUR) mit einer aktuellen Marktkapitalisierung von -- EUR. Der Wert von MrBeastSuckinMeatinu unterliegt aufgrund der kontinuierlichen 24/7-Aktivität auf dem Kryptomarkt häufigen Schwankungen. Der aktuelle Kurs von MrBeastSuckinMeatinu in Echtzeit und seine historischen Daten sind auf Bitget verfügbar.

Wie hoch ist das 24-Stunden-Trading-Volumen von MrBeastSuckinMeatinu?

In den letzten 24 Stunden beträgt das Trading-Volumen von MrBeastSuckinMeatinu --.

Was ist das Allzeithoch von MrBeastSuckinMeatinu?

Das Allzeithoch von MrBeastSuckinMeatinu ist --. Dieses Allzeithoch ist der höchste Kurs für MrBeastSuckinMeatinu seit seiner Einführung.

Kann ich MrBeastSuckinMeatinu auf Bitget kaufen?

Ja, MrBeastSuckinMeatinu ist derzeit in der zentralen Börse von Bitget verfügbar. Ausführlichere Anweisungen finden Sie in unserem hilfreichen Wie man mrbeastsuckinmeatinu kauft Leitfaden.

Kann ich mit Investitionen in MrBeastSuckinMeatinu ein regelmäßiges Einkommen erzielen?

Natürlich bietet Bitget einen strategische Trading-Plattform, mit intelligenten Trading-Bots, um Ihre Trades zu automatisieren und Gewinne zu erzielen.

Wo kann ich MrBeastSuckinMeatinu mit der niedrigsten Gebühr kaufen?

Wir freuen uns, ankündigen zu können, dass strategische Trading-Plattform jetzt auf der Bitget-Börse verfügbar ist. Bitget bietet branchenführende Handelsgebühren und -tiefe, um profitable Investitionen für Trader zu gewährleisten.

Kurse ähnlicher Kryptowährungen

Ethereum Kurs (EUR)Worldcoin Kurs (EUR)dogwifhat Kurs (EUR)Kaspa Kurs (EUR)Smooth Love Potion Kurs (EUR)Terra Kurs (EUR)Shiba Inu Kurs (EUR)Dogecoin Kurs (EUR)Pepe Kurs (EUR)Cardano Kurs (EUR)Bonk Kurs (EUR)Toncoin Kurs (EUR)Pi Kurs (EUR)Fartcoin Kurs (EUR)Bitcoin Kurs (EUR)Litecoin Kurs (EUR)WINkLink Kurs (EUR)Solana Kurs (EUR)Stellar Kurs (EUR)XRP Kurs (EUR)

Wo kann ich MrBeastSuckinMeatinu (SOL) kaufen?

Videobereich - schnelle Verifizierung, schnelles Trading

Wie Sie die Identitätsverifizierung auf Bitget durchführen und sich vor Betrug schützen

1. Loggen Sie sich bei Ihrem Bitget-Konto ein.

2. Wenn Sie neu bei Bitget sind, schauen Sie sich unser Tutorial an, wie Sie ein Konto erstellen.

3. Bewegen Sie den Mauszeiger über Ihr Profilsymbol, klicken Sie auf "Unverifiziert" und dann auf "Verifizieren".

4. Wählen Sie Ihr Ausstellungsland oder Ihre Region und den Ausweistyp und folgen Sie den Anweisungen.

5. Wählen Sie je nach Präferenz "Mobile Verifizierung" oder "PC".

6. Geben Sie Ihre Daten ein, legen Sie eine Kopie Ihres Ausweises vor und machen Sie ein Selfie.

7. Reichen Sie Ihren Antrag ein, und voilà, Sie haben die Identitätsverifizierung abgeschlossen!

Kaufen Sie MrBeastSuckinMeatinu für 1 EUR

Ein Willkommenspaket im Wert von 6.200 USDT für neue Bitget-Nutzer!

Jetzt MrBeastSuckinMeatinu kaufen

Investitionen in Kryptowährungen – einschließlich des Online-Kaufs von MrBeastSuckinMeatinu über Bitget – unterliegen Marktrisiken.

Bitget bietet Ihnen einfache und bequeme Möglichkeiten zum Kauf von MrBeastSuckinMeatinu und bemüht sich, unsere Nutzer umfassend über jede auf der Plattform angebotene Kryptowährung zu informieren. Wir übernehmen jedoch keine Verantwortung für etwaige Ergebnisse, die sich aus dem Kauf von MrBeastSuckinMeatinu ergeben können. Diese Seite und die darin enthaltenen Informationen stellen keine Empfehlung oder Befürwortung einer bestimmten Kryptowährung dar. Alle Kursangaben und sonstigen Informationen auf dieser Seite stammen aus öffentlich zugänglichen Quellen im Internet und stellen kein Angebot seitens Bitget dar.

SOL Ressourcen

Bitget Insights

BuyDipsSellRips

5S

$SOL short. Tp 117

SOL-0.03%

BuyDipsSellRips

5S

$SOL short. Tp 117

SOL-0.03%

BitcoinSistemi

5S

The Altcoins Most Held in Cryptocurrency Users’ Wallets Revealed

The cryptocurrency networks and altcoins with the highest number of non-empty wallets have been revealed. Based on unique on-chain wallet address data, the list clearly shows the adoption level of the ecosystems and their changes over the past 30 days.

Here are the altcoins with the highest number of token holders currently, according to the latest onchain data, and how this number has changed over the past month:

BNB Chain (BNB) – 278.2 million users (+4.0%)

Ethereum (ETH) – 276.3 million users (+1.7%)

Tron (TRX) – 169.7 million users (0%)

Solana (SOL) – 154.5 million users (+1.3%)

TON (TON) – 142.6 million users (+1.3%)

NEAR Protocol (NEAR) – 131.2 million users (+0.2%)

Polygon (POL) – 121.9 million users (+4.2%)

Bitcoin (BTC) – 75.2 million users (+0.7%)

Aptos (APT) – 47.9 million users (0.0%)

Flow (FLOW) – 41.9 million users (+0.5%)

Mythos (MYTH) – 10.5 million users (+3.9%)

Stellar (XLM) – 6.1 million users (+0.2%)

Celo (CELO) – 5.9 million users (+0.8%)

Hedera (HBAR) – 4.6 million users (+0.7%)

peaq (PEAQ) – 3.2 million users (+0.6%)

Related News

Bitcoin Bull Arthur Hayes Did What He Said He Would: He Started Selling an Altcoin Today

In total, according to onchain data, there are 1.4 billion wallets with balances in them.

*This is not investment advice.

Follow our

Telegram and

Twitter account now for exclusive news, analytics and on-chain data!

BTC+0.05%

APT-0.73%

TimesTabloid

5S

2026 Astrological Wealth Outlook: Your Zodiac Sign and its Compatibility with XRPstaking platform

As we enter 2026, the cryptocurrency market is entering a more mature phase. Volatility hasn’t disappeared, but investor behavior is changing. Many are no longer chasing short-term price fluctuations, but are focusing more on stability, structure, and long-term wealth planning.

Astrology’s reflection of these changes is surprisingly accurate. Each zodiac sign approaches money differently—risk tolerance, patience, discipline, and emotional responses all vary. XRP staking, with its structured, time-based reward model, naturally aligns with many of these personality-driven investment strategies.

Below is a link between each zodiac sign’s financial outlook for 2026 andXRPstaking platform.

♈ Aries (March 21 – April 19)

2026 Money Theme: Maintain Discipline, Ride the Wave

Aries enjoy excitement, but are prone to overtrading when the market is volatile. In 2026, the key to success lies in slowing down while maintaining momentum.

Why XRP staking works for Aries: Fixed staking cycles reduce impulsive behavior. Automated reward mechanisms maintain capital productivity.

Less screen time, more action.

Best approach: Channel energy into structured growth through staking.

Recommended contract: Litecoin Stable Staking Program

Initial investment: $500 | Contract duration: 5 days | Settlement at maturity: $535

♉ Taurus (April 20 – May 20)

2026 Financial Theme: Stability and Accumulation

Taurus values security and predictable outcomes. If you can maintain a stable routine, this year will be one of your best financial years.

Why XRP staking works for Taurus:

Clear rules and predictable cycles

Reduces susceptibility to daily price fluctuations

Perfect for long-term compound interest investing

Best approach: Think of staking as a digital savings engine.

Recommended Contract: Dogecoin Enhanced Yield Plan:

Initial Investment: $3,500 | Contract Term: 20 Days | Settlement at Expiry: $4,571

♊ Gemini (May 21 – June 20)

2026 Money Theme: Flexibility and Focus

Geminis love choices, but too many choices can be distracting. In 2026, those who build a stable financial foundation will be rewarded.

Why XRP Staking Works for Gemini:

Multiple staking cycles suit your flexible nature

Earn passive income while exploring other opportunities

Minimum time required

Best approach: Use staking as your financial pillar.

Recommended Contract: SOL Medium- to Long-Term Income Plan: Initial Investment: $10,000 | Contract Term: 30 Days | Settlement at Maturity: $15,100

♋ Cancer (June 21 – July 22)

2026 Currency Theme: Stability Over Speculation

Cancer patients are emotionally and financially secure, especially when they need to help others. Market volatility can be stressful for them.

Why XRP Staking Works for Cancer Patients:

Reduces the emotional impact of daily fluctuations

Regular reward mechanisms bring inner peace.

Non-interventional Participation

Best Approach: Prioritize stable, gradual income sources.

Recommended Contract: Litecoin Stable Staking Plan

Initial Investment: $500 | Contract Term: 5 Days | Settlement at Maturity: $535

♌ Leo (July 23 – August 22)

2026 Money Theme: Control and Performance

Leos seek visibility and results. You’re confident—but only if you can track progress.

Why XRP staking works for Leo:

Transparent staking terms

Clear reward schedule

Strong sense of responsibility for strategy.

Best approach: Use staking where structure and performance match.

Recommended contract: BNB Staking Program Medium to long term return plan:

Initial investment $8,000 | Contract term 28 days | Settlement at maturity $11,673.6

♍ Virgo (August 23 – September 22)

2026 Financial Theme: Precision and Logic

Virgos abhor chaotic and poorly defined systems. 2026 will be highly favorable for your analytical thinking.

Why XRP staking works for Virgo:

Rule-based participation

Predictable computation

Reduce uncertainty

Best approach: Treat investing as a system, not gambling.

Recommended Contract: BTC Staking Plan Medium- to Long-Term Return Plan:

Initial Investment: $45,000 | Contract Term: 28 Days | Final Settlement: $79,200

♎ Libra (September 23 – October 22)

2026 Money Theme: Balance and Diversification

Libras seek harmony—both economically and emotionally. You dislike taking risks.

Why XRP Staking Works for Libra:

Hedge trading or long-term holding

Balance risk and reward

Smooth portfolio volatility

Best approach: Use piling for stabilization.

Recommended Contract: USDT Staking Plan Medium- to Long-Term Return Plan:

Initial Investment: $150,000 | Contract Term: 45 Days | Final Settlement: $302,550

♏ Scorpio (October 23 – November 21)

2026 Financial Theme: Patience and Depth

Scorpios focus on long-term planning. You are not disturbed by external noise—you simply wait for the results.

Why XRP staking works for Scorpio:

Rewards patience and persistence

Supports reinvestment strategies

Minimally disruptive to emotions

Best approach: Let time and compound interest work.

Recommended contract: Litecoin Stable Staking Program

Initial investment: $500 | Contract duration: 5 days | Settlement at maturity: $535

♐ Sagittarius (November 22 – December 21)

2026 Money Theme: Freedom and Efficiency

Sagittarians value independence. You don’t want to manage investments every day.

Why XRP staking works for Sagittarians:

Fully automated reward cycle

No continuous monitoring

Income doesn’t affect lifestyle

Best approach: Let your assets generate returns for you while you’re alive.

Recommended Contract: Dogecoin Enhanced Yield Plan:

Initial Investment: $3,500 | Contract Term: 20 Days | Settlement at Maturity: $4,571

♑ Capricorn (December 22 – January 19)

2026 Currency Theme: Long-Term Execution

Capricorns treat wealth as a business. Self-discipline determines your success.

Why XRP Staking Works for Capricorn:

Complies with structured financial plans

Easy to integrate into long-term goals

Encourages consistency

Best Approach: Incorporate staking into your multi-year strategy.

Recommended Contract: USDT Staking Plan Medium- to Long-Term Yield Plan:

Initial Investment: $150,000 | Contract Term: 45 Days | Settlement at Maturity: $302,550

♒ Aquarius (January 20 – February 18)

2026 Currency Theme: Systems and Innovation

Aquarians invest in ideas, not hype. You believe in frameworks rather than emotions.

Why XRP staking works for Aquarius:

Smart contract-driven logic

Systematic reward distribution

Reduces human bias

Best approach: Focus on infrastructure building, not speculation.

Recommended contract: ETH Staking Program

Medium- to long-term return plan:

Initial investment $25,000 | Contract duration 452 days | Settlement at maturity $44,110

♓ Pisces (February 19 – March 20)

2026 Financial Theme: Emotional Clarity

Pisces are easily troubled by market noise. Stability brings clear thinking.

Why XRP staking works for Pisces:

Reduces continuous decision-making.

Predictable reward cycles

Maintain emotional distance from volatility

Best approach: Choose calm over chaos.

Recommended Contract: TRX Staking Program Short-Term Profit Plan: Initial Investment: $1000 | Contract Term: 10 days | Settlement at Expiry: $1145

Final Summary: Different Signs, Same Direction

In 2026, the winning strategy is not guessing price movements, but managing time, structure, and consistency.

Regardless of your zodiac sign, XRP staking allows you to: reduce emotional trading, build predictable income, and let time work for you.

✨Astrology may guide your thinking, but a rigorous system determines your results.

What is XRPstaking platform?

XRPstaking is a future-oriented cryptocurrency yield platform designed for global users. We believe that digital assets should not merely be “stored,” but should achieve intelligent value appreciation on a secure and transparent basis. Therefore, the XRPstaking platform integrates cross-chain secure custody, AI-driven intelligent yield management, and a behavioral finance incentive model, aiming to provide users with a simpler, more reliable, and more sustainable asset appreciation experience.

For more details, please visit the official website: https://xrpstaking.com/

Disclaimer:This is a sponsored press release for informational purposes only. It does not reflect the views of Times Tabloid, nor is it intended to be used as legal, tax, investment, or financial advice. Times Tabloid is not responsible for any financial losses.

BTC+0.05%

ETH-0.02%

Coinpedia

5S

Grayscale Sees Chainlink as Key Infrastructure for RWA Tokenization

Story Highlights

Grayscale sees Chainlink as a bridge for tokenized assets, with crypto ETFs and adoption poised to grow as regulations clear.

Tokenized assets could surge 1,000x; Grayscale views market pullbacks as normal and ETFs as a way for investors to access crypto.

According to Grayscale Investments, the global push to tokenize real-world assets is only beginning, and Chainlink could become one of the key technologies driving that expansion.

Advertisement

-->

In an interview on the Thinking Crypto podcast, Grayscale Head of Research Zach Pandl said that just a small portion of global assets are currently on blockchain networks, but adoption could accelerate significantly over the next five to ten years as traditional finance moves on-chain.

Chainlink’s Role in Bridging Crypto and Traditional Finance

Grayscale recently launched a Chainlink ETF, converting its existing Chainlink investment vehicle into an exchange-traded fund. Pandl said the ETF structure makes it easier for investors to gain exposure to what he described as one of the most important projects in the crypto ecosystem.

According to Pandl, Chainlink acts as a bridge between blockchains and traditional finance by providing reliable data, compliance tools, and integrations needed for tokenized assets, stablecoins, and decentralized finance to function at scale.

“Chainlink is really the connective tissue between the crypto ecosystem and traditional finance,” he said. “It’s not a bet on one blockchain, but exposure to where the entire industry is going

ETFs Expand Beyond Bitcoin and Ethereum

Pandl also highlighted Grayscale’s expanding lineup of crypto ETFs, including products tied to XRP, Solana, Dogecoin, and Chainlink. He said regulatory clarity has accelerated the pace at which new crypto ETFs are coming to market, following the long approval process for Bitcoin and Ethereum ETFs.

XRP, originally built for payments, is now expanding into broader use cases, while Solana continues to attract activity due to its speed and low costs. Dogecoin, Pandl noted, represents a different segment of the market but reflects the growing diversity of investor interest.

Grayscale has also shown interest in privacy-focused assets such as Zcash, which Pandl said addresses a major gap in public blockchain systems.

“If public blockchains are going to transform finance, they must support privacy,” Pandl said. “Institutions will not operate on systems where payrolls, balances, and transactions are fully visible.”

Market Pullback Seen as Typical, Not a Cycle Top

Addressing recent market weakness, Pandl said Bitcoin’s roughly 30% decline from its recent highs may feel severe but is consistent with past bull markets.

He emphasized that Bitcoin frequently experiences multiple pullbacks of 10% to 30% during strong cycles and that Grayscale does not see signs of a major, long-term downturn.

“A 30% pullback is actually about an average drawdown for Bitcoin,” Pandl said. “We do not believe we are on the cusp of a larger multi-year decline.”

Pandl said two forces continue to support crypto markets: rising demand for alternative stores of value amid growing debt and inflation risks, and increased institutional access driven by clearer regulations.

He added that capital continues to flow into crypto through ETFs, platforms, and institutional products as regulatory barriers ease.

Tokenization Could Grow 1,000x

Pandl said tokenized assets currently total around $30–35 billion, which represents just a tiny fraction of global equity and bond markets worth roughly $300 trillion.

He believes tokenized assets could grow by as much as 1,000 times over the next five years as traditional financial instruments move on-chain.

Tokenization, he said, could allow markets to operate around the clock, speed up settlement times, and unlock new financial services such as on-chain lending and collateralization.

Grayscale sees platforms like Ethereum as likely hosts for tokenized assets, while infrastructure providers like Chainlink enable the data and connectivity required for adoption.

Also Read :

U.S. Economy Beats Expectations, But Peter Schiff Warns of a Deeper Financial Crack

,

Volatility Likely to Remain, But Diversification Value Stays

Pandl said crypto’s correlation with equities has increased as the market has grown, but it still behaves more like a commodity than a stock index.

Bitcoin and other large digital assets may move with equities at times, he said, but often follow their own fundamentals, making them useful portfolio diversifiers.

While acknowledging the risks and volatility involved in crypto investing, Pandl said current prices may offer long-term investors a chance to build positions.

“If you’re optimistic about the long-term vision, a lower price is an opportunity,” he said. “From our perspective, this is a good time to begin accumulating the asset class.”

Grayscale remains optimistic about crypto’s long-term outlook, citing continued innovation, growing institutional interest, and steady progress toward regulatory clarity in the United States.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

Subscribe to News

FAQs

How could tokenization impact traditional financial markets?

Tokenization allows traditional assets such as stocks, bonds, and real estate to exist on blockchain networks, which could significantly increase market efficiency. It may reduce settlement times, enable 24/7 trading, and allow new financial products like on-chain lending and collateralization. Over time, this could change how investors access and interact with conventional markets.

Who benefits most from the growth of crypto ETFs?

Institutional and retail investors stand to gain easier, regulated exposure to a broader range of digital assets through ETFs. These products reduce the complexity and custody risks of holding cryptocurrencies directly, while allowing investors to diversify across assets such as Chainlink, Solana, and XRP.

Why might crypto’s volatility remain despite growing adoption?

Crypto assets are still influenced by speculative trading, regulatory developments, and technological shifts, so significant price swings are expected even as adoption increases. However, their fundamental drivers—such as tokenization growth and demand for alternative stores of value—can provide long-term stability and diversification benefits for investors.

Tags

Crypto news

LINK-0.04%

BTC+0.05%

Kurse neu gelisteter Coins auf Bitget

Machi Big Brother's ETH-Long-Position wurde liquidiert, danach eröffnete er erneut eine 25-fache gehebelte Long-Position auf ETH.Kryptowährungen verbreiten sich weltweit rasant – warum bleibt der Markt dennoch schwach?Der offizielle Noble X-Account wurde gehackt und veröffentlichte Phishing-Informationen.XRP-Preis nahe $2,40, während Händler auf kritische Zone achtenGoldman Sachs hält an der Prognose fest, dass der Goldpreis bis Ende nächsten Jahres 4.900 US-Dollar erreichen wird.Daten: Das Handelsvolumen von tokenisierten Aktien auf der Solana-Chain ist von Q2 bis Q3 um das 190-fache gestiegen, wobei Raydium einen Marktanteil von 76,5 % hält.Google verkündet möglichen Neustart des Quantenüberlegenheit, Diskussion über Bedrohung für BitcoinTesla verzeichnet im Q3 durch Veränderungen des beizulegenden Zeitwerts von Bitcoin einen Gewinn von etwa 80 Millionen US-Dollar.Ripple unterstützt milliardenschweres XRP-Treasury-UnternehmenScam Sniffer: Der offizielle X-Account von Noble wurde von Hackern übernommen, bitte seien Sie wachsam.