Since September 24, Aster has outperformed stablecoin firm Circle in the amount of protocol revenue it generated, breaking the recent duopoly between the USDC issuer and Tether.

Aster first overtook Circle in 24-hour revenue, becoming the second biggest protocol by daily earnings, right behind Tether on September 24 when it raked in $12.03M in protocol revenue fees while Circle brought in $7.71M, a figure that is around its usual daily baseline.

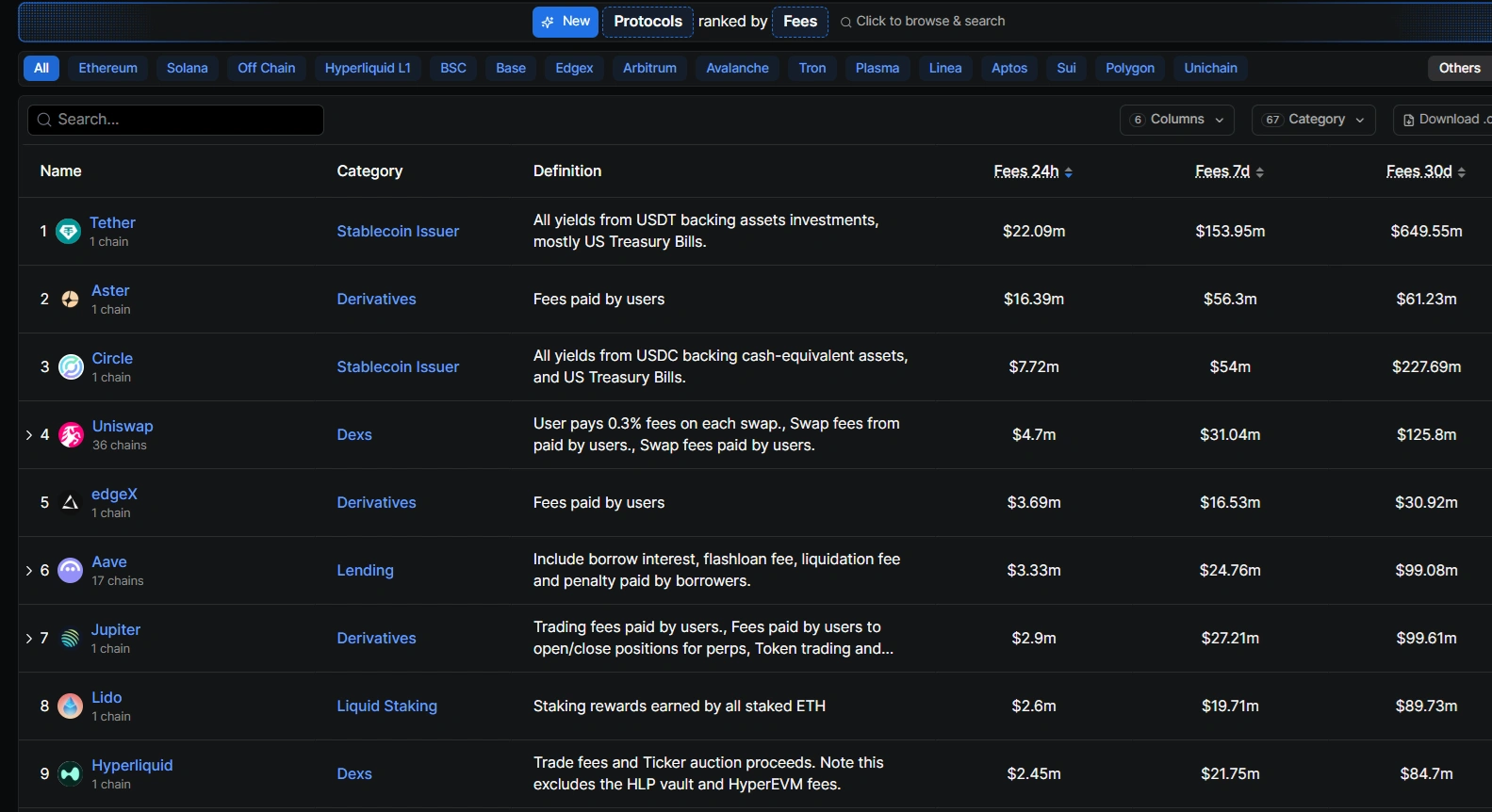

The Aster DEX has stringed together consecutive days of strong revenue generation. Source: DeFiLlama .

The Aster DEX has stringed together consecutive days of strong revenue generation. Source: DeFiLlama .

Aster stays ahead of Circle

Aster , a recently launched perp DEX being positioned to compete with Hyperliquid, is growing pretty fast, attracting the attention of traders and institutions alike.

On September 25, Aster outperformed Circle again, bringing in $16.33M while Circle brought in its usual $7 million. The pattern has persisted since then, with Aster’s revenue increasing each time above the previous mark, while Circle’s has maintained the status quo of around $7M.

Through all of this, Tether has maintained its lead by a few million.

Aster’s hot daily revenue streak highlights its explosive growth, with its 7-day fees being 2.6x higher than those of rival perp DEX Hyperliquid. This strong performance is being driven by whale activity, Aster’s private order book, broader DeFi adoption and a strong endorsement from former Binance CEO Changpeng Zhao (CZ).

Aster is set up as a challenger for Hyperliquid and other existing DEXs in a “perps war” that is now having broader implications on the landscape of crypto revenue.

For the longest time, Tether and Circle dominated the revenue column with stablecoin yields. However, Aster’s breakout confirms DeFi protocols are also getting better at capturing trading fees, potentially drawing more liquidity and innovation away from the centralized players.

Tether remains number one

Stablecoin revenue comes from transaction fees, lending interest and treasury operations. As such, it is no surprise that Tether, whose potential valuation is tied to its dominance in the stablecoin market and interest from investors like SoftBank and Ark Invest, has remained number one in that area.

Still a private company, reports claim that the crypto giant is in talks to raise up to $20 billion in a private placement that could value the El Salvador-based firm at about $500 billion.

One report, citing people familiar with the matter, claims the company is seeking $15 billion to $20 billion for roughly a 3% stake.

However, the figures were top-end targets, and in the end, numbers could be significantly lower, with the valuation of the company depending on the stake offered.

Tether’s chief executive, Paolo Ardoino, has confirmed via a post on X that the company is indeed evaluating a fund raise from a selected group of high-profile key investors, but it is keeping it all hush-hush.

In August, the company tapped former White House crypto policy executive Bo Hines as a strategic adviser to promote its expansion in the United States, a domain that is increasingly being promoted as pro-crypto.

Don’t just read crypto news. Understand it. Subscribe to our newsletter. It's free .