News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 5) | 21Shares Launches 2x Leveraged SUI ETF on Nasdaq; U.S. Treasury Debt Surpasses $30 Trillion; JPMorgan: Strategy’s Resilience May Determine Bitcoin’s Short-Term Trend2Bitcoin looks increasingly like it did in 2022: Can BTC price avoid $68K?3The Chainlink ETF Disappoints Despite $41 Million Inflows — Why?

Ethereum ETFs Post First Weekly Outflows After 3 Months

Ethereum ETFs continue to outperform Bitcoin products, which saw over $1.1 billion in outflows in the same period.

BeInCrypto·2025/08/24 01:27

Ethereum Hits New All-Time High Above $4868 Fueled by Powells Dovish Remarks

TheCryptoUpdates·2025/08/23 23:55

Bitcoin price breakout to $117K liquidates bears, opening door to fresh all-time highs

Cointelegraph·2025/08/23 23:50

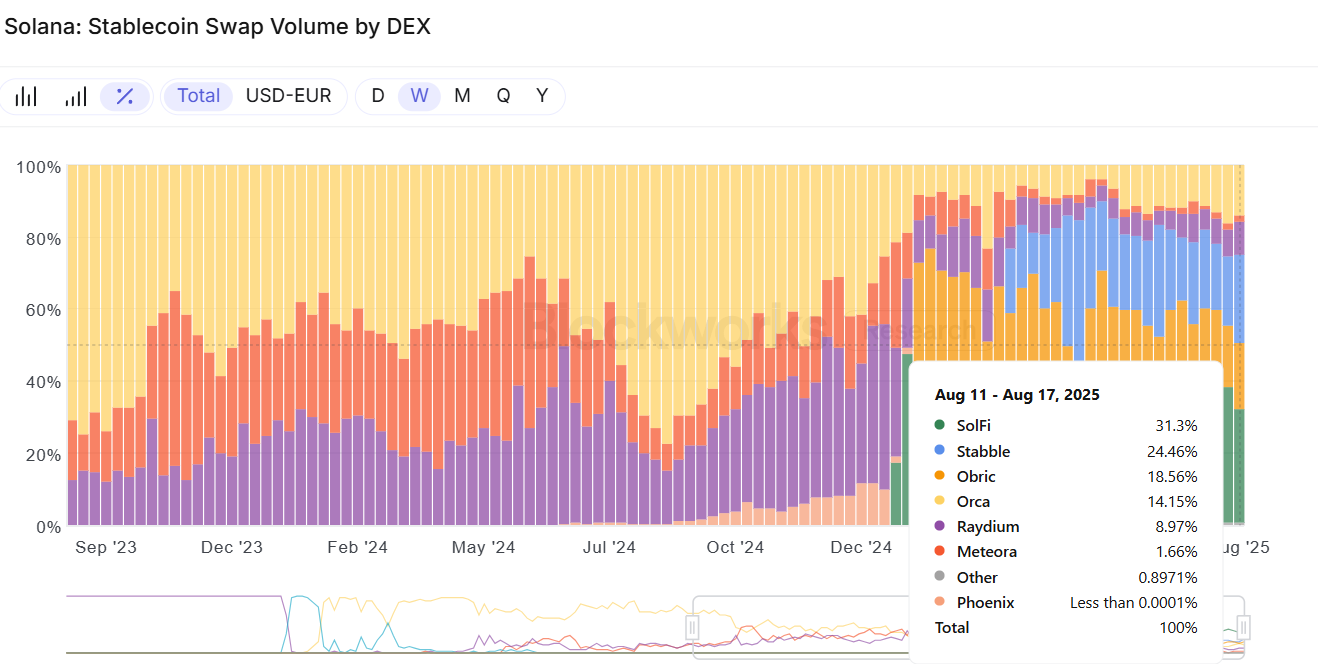

Solana’s proprietary AMMs are reshaping liquid asset markets for users

Prop AMMs like SolFi, HumidFi and Obric are taking over liquid capital markets

Blockworks·2025/08/23 22:55

BlackRock’s Ethereum ETF Shift From Heavy Outflows to Major Inflows May Be Linked to ETH’s New Highs

Coinotag·2025/08/23 20:00

Bitcoin-Led Rally May Push Global Crypto Market Cap Past $4 Trillion Amid Fed Rate Cut Signals

Coinotag·2025/08/23 20:00

Chainlink Could Be Poised for Further Gains After Reclaiming $23, Targets $30–$52

Coinotag·2025/08/23 20:00

Flash

- 02:08Data: Hyperliquid platform whales currently hold $4.244 billions in positions, with a long-short ratio of 0.87According to ChainCatcher, citing Coinglass data, whales on the Hyperliquid platform currently hold positions totaling $4.244 billions, with long positions at $1.971 billions, accounting for 46.44% of the total, and short positions at $2.273 billions, accounting for 53.56%. The profit and loss for long positions is -$162 millions, while for short positions it is $283 millions. Among them, the whale address 0x9eec..ab has taken a 15x leveraged full-position long on ETH at the price of $3,201.03, with an unrealized profit and loss of -$8.3105 millions.

- 01:40A major AAVE whale enters the market again, buying 80,000 tokens within half a monthAccording to Jinse Finance, analyst Yu Jin has monitored that an AAVE whale was liquidated for 32,000 AAVE at a price of $101 during the market crash, but has re-entered the market since November 24. Within half a month, this investor has spent 14 million USDC to purchase 80,900 AAVE at an average price of $173. Currently, through a looping loan strategy, the whale holds a total of 333,000 AAVE (worth approximately $62.59 million), with an average cost of $167 and a liquidation price at $117.7. Over the past two years, this whale has continuously accumulated AAVE tokens through a looping loan strategy.

- 01:26Aztec TGE could take place as early as February 11, 2026, with 19,476 ETH already raised in the public sale.ChainCatcher news, Aztec officially announced that the AZTEC token public sale has now ended, with a total subscription amount of 19,476 ETH. Of these funds, 50% came from the Aztec community, and a total of 16,741 users participated across the network. Users holding more than 200,000 tokens can start receiving block rewards today. The TGE will be triggered by an on-chain governance vote, which could take place as early as February 11, 2026. At the time of the TGE, all tokens (100%) obtained from the token sale will be freely transferable. Only token sale participants and genesis sequencers are eligible to participate in the TGE vote.

News