Crypto stocks, bitcoin in the red as investors grapple with economic data

Crypto stocks including bitcoin miners, Coinbase and MicroStrategy were all lower Monday morning

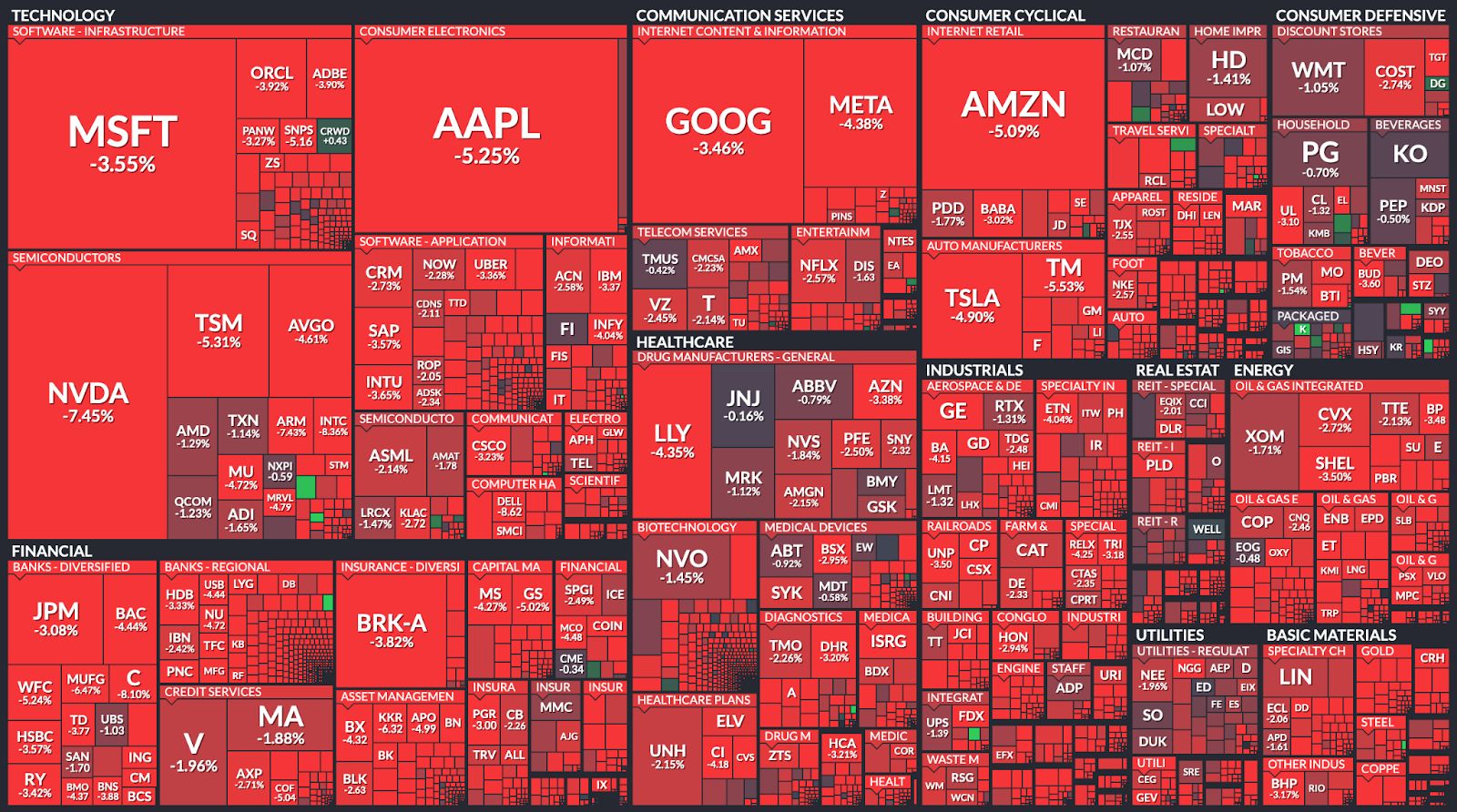

Markets are selling off as investors digest a jobs report from Friday that missed expectations and a Japanese stock crash.

The overall stock market is lower this morning, with the Nasdaq leading the decline.

When the bell rang to open markets this morning, Coinbase was down nearly 20% right as the market opened, roughly $40 dollars lower than its close at $204 a share on Friday. However, it was down less than 10% at time of publication.

MicroStrategy was down over 13%, trading around $1,200 Monday morning.

Read more: Empire Newsletter: A weekend selloff spooks crypto

Miners — including Marathon Digital, CleanSpark, Riot and Core Scientific — are all in the red, with CleanSpark seeing the biggest decline.

Source: Finviz

Source: Finviz

Bitcoin, meanwhile, is just above $53,000 after dipping below $50,000. Back in late June, Ledn’s John Glover told Blockworks to keep an eye on the $49,000 level if bitcoin broke through the mid-$50,000 range.

As rumors of an emergency rate cut from the Federal Reserve circled around social media this morning, Chicago Fed President Austan Goolsbee told CNBC that while the jobs report certainly was weaker than anticipated, it doesn’t look like a recession just yet.

He also noted that everything’s on the table, but didn’t seem to signal that the Fed would even consider such a cut at this time.

Over the weekend, bitcoin and ether tumbled as investors grappled with the aforementioned sell-off in Japan. Ether fell after reports that Jump sent $136 million in ETH to exchanges including OKX and Binance, as noted by Blockworks’ David Canellis.

The overall market, after this weekend’s selloff, is down roughly 14.5%, per data from Coinbase.

Start your day with top crypto insights from David Canellis and Katherine Ross. Subscribe to the Empire newsletter .

Explore the growing intersection between crypto, macroeconomics, policy and finance with Ben Strack, Casey Wagner and Felix Jauvin. Subscribe to the On the Margin newsletter .

The Lightspeed newsletter is all things Solana, in your inbox, every day. Subscribe to daily Solana news from Jack Kubinec and Jeff Albus.

- BTC

- Interest Rates

- Mining

- Stocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Federal Reserve's 400 billions liquidity signal: Bitcoin faces pressure awaiting a breakthrough

Compared to interest rate cuts, the liquidity signal from the Federal Reserve's $400 billions reserve rebuild is the key factor influencing bitcoin's price movement.

Questioning the Necessity of Gas Futures: Does the Ethereum Ecosystem Really Need Them?

On-chain Gas Futures: A brilliant idea by Vitalik, or a false proposition for retail investors?

In the early hours of this Thursday, it is not the rate cut itself that will determine the direction of risk assets.

Interest rate cuts are almost a "given"; the real uncertainty lies elsewhere.

BTC Storm: Institutional Optimism and Easing Expectations Drive Market Frenzy