Bitcoin hashrate dynamics are moving rapidly as the crypto gets ready to enter the next phase of an ever-evasive bull run. The latest data reveals that the BTC hashrate dominance is now shifting towards United States mining companies despite China’s renewed efforts to boost the industry.

The intense competition between the two heavyweights is also brewing a divergence between Bitcoin price and its hashrate. Historically, these divergences have only popped up a few times in the last three years. However, when they do, they often signal a price rally after a local bottom.

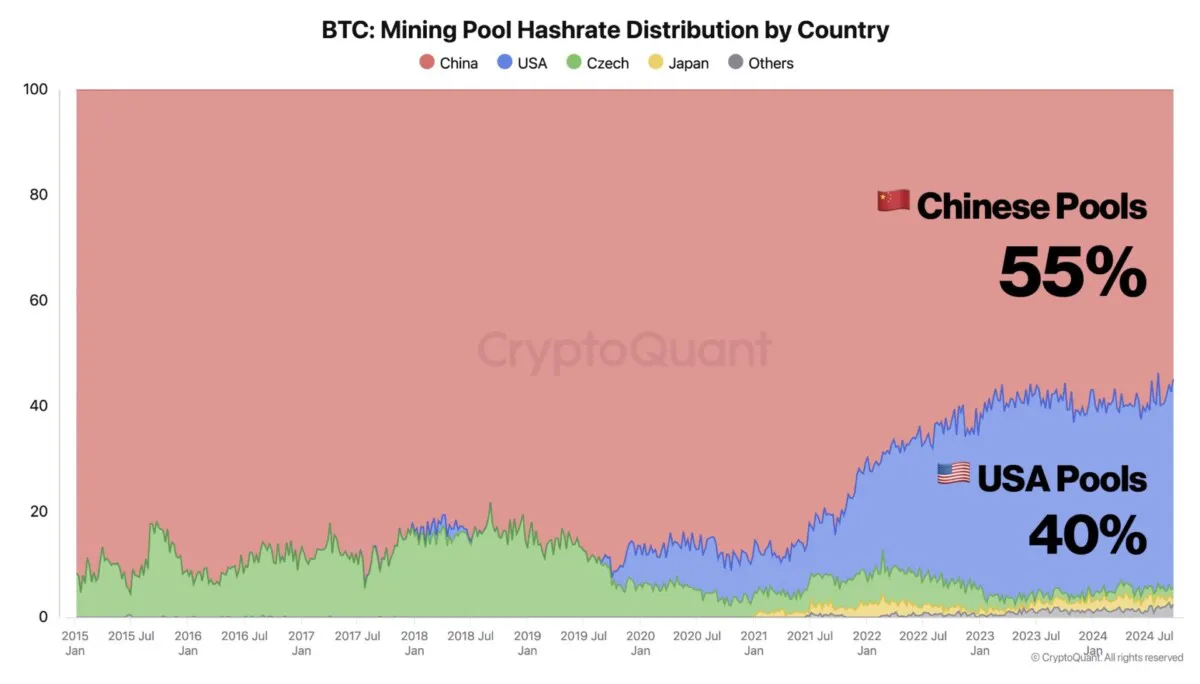

US takes 40% of Bitcoin hashrate

As per the data shared by Ki Young Ju, founder of Cryptoquant, the US has managed to grab a big chunk of the total Bitcoin hashrate generated. Chinese mining pools are now operating 55% of the network, while US-based pools are managing 40%. This is seen as a major shift in the crypto mining industry.

Source: CryptoQuant

Source: CryptoQuant

The pools operating from the US primarily cater to institutional miners in America, on the other hand, Chinese pools support relatively smaller miners in Asia. China has been responsible for most of the mining activity. However, the United States’ efforts to claim BTC mining shares have grown since the middle of 2021.

Miners face revenue squeeze

On September 1, 2024, the Bitcoin network hashrate soared to a staggering 742 exahashes per second (EH/s) and that’s a lot of computing power induced to secure the digital gold. Since 2021, the hashrate has been on a steady climb due to the introduction of cutting-edge application-specific integrated circuits (ASICs).

This suggests that as the hashrate increases, miners face higher costs. They need to upgrade their rigs and boost energy consumption just to keep up.

August 2024 turned out to be a tough month for miners as revenue plummeted to just $827.56 million. It is recorded to be the lowest since last September.

It highlights a revenue squeeze for miners, driven by reduced block subsidies and soaring energy prices. MARA and Riot Platforms are feeling the pinch, with costs per Bitcoin soaring to $55,700 and $62,000 respectively.

BTC price is still down by around 5% in the last 30 days despite recording a gain of 8% over the last 7 days. BTC is trading at an average price of $63,219 as of press time, and it recently tried to regain the $65,000 mark.

Bitcoin’s 24-hour trading volume spiked by 95% on Monday to stand at $29.5 billion.