Date: Tue, February 25, 2025 | 12:10 PM GMT

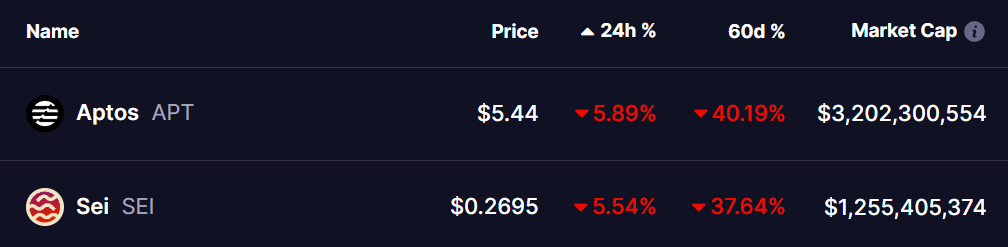

The cryptocurrency market is experiencing a sharp downturn today, as the price of Bitcoin (BTC) has fallen below the key level of $90,000, while Ethereum has plunged 9%. The broader altcoin market has followed suit, with Aptos and Sei both suffering declines of over 5%, extending their 60-day losses to approximately 40%.

Source: Coinmarketcap

Source: Coinmarketcap

However, with these declines, both APT and SEI are now testing major support zones, showing signs of forming a double bottom pattern—a historically bullish reversal setup.

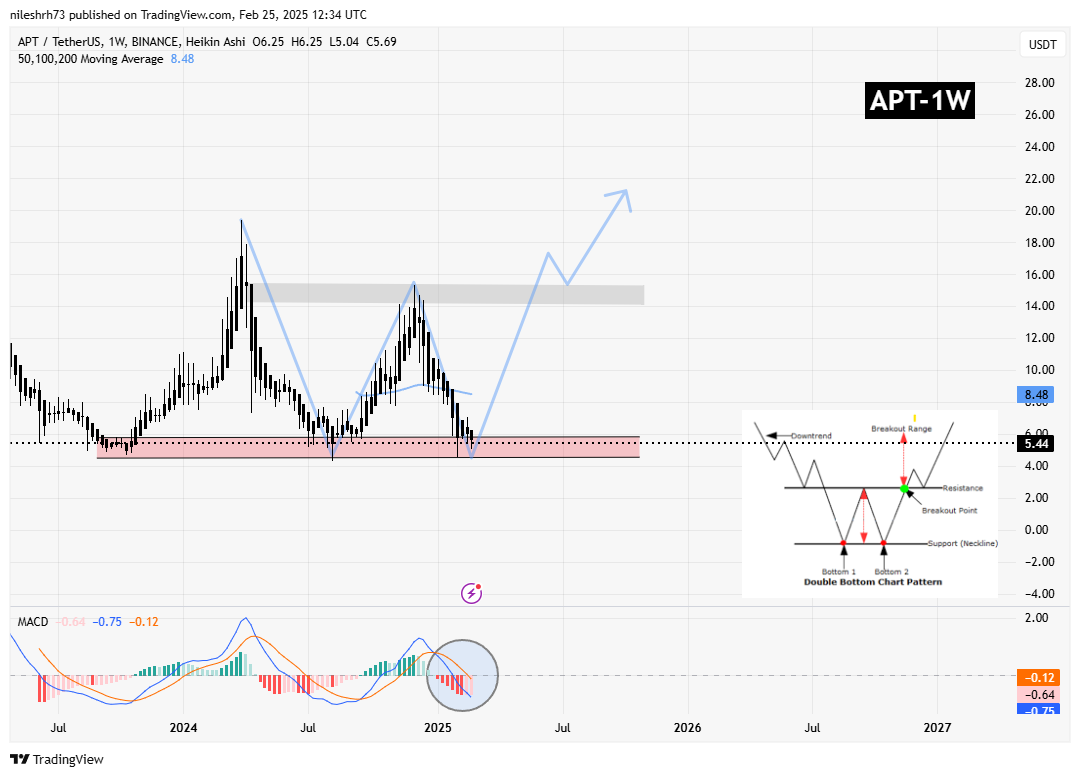

Aptos (APT) Analysis

APT’s price action on the weekly chart suggests the formation of a double bottom pattern after rejecting the $12.06 resistance in early December 2024. The price has now revisited its critical support range of $5.0, a level where buyers previously stepped in, and is currently trading at $5.44.

Aptos (APT) Weekly Chart/Coinsprobe (Source: Tradingview)

Aptos (APT) Weekly Chart/Coinsprobe (Source: Tradingview)

Despite today’s bearish momentum, APT has managed to hold this key support zone, indicating that demand remains strong.

The MACD indicator is also flashing early bullish signs, with selling pressure appearing to weaken. If APT can gain momentum from here, a potential rally toward the $12.06 neckline could be in play, signaling a strong recovery if a breakout occurs.

Sei (SEI) Analysis

SEI’s price action mirrors that of APT, forming a potential double bottom at a crucial support level between $0.19 – $0.24. Initially SEI faced a strong rejection from its $0.7361 resistance in December 2024, causing a steep decline. However, buyers have consistently defended this support zone, hinting at a possible reversal.

Sei (SEI) Weekly Chart/Coinsprobe (Source: Tradingview)

Sei (SEI) Weekly Chart/Coinsprobe (Source: Tradingview)

Like APT, SEI’s MACD indicator suggests that bearish momentum is fading. If SEI maintains its current level and sees increased buying pressure, a move toward the $0.7361 resistance could be on the horizon.

Will This Pattern Lead to a Recovery?

At present, both APT and SEI remain in a critical zone. The double bottom structure suggests that as long as these tokens hold their key support levels, there remains a strong chance for a bounce.

However, the broader market sentiment—especially Bitcoin and Ethereum’s next moves—will be crucial in confirming any bullish reversal. If BTC and ETH stabilize, APT and SEI could see increased buying interest, potentially leading to breakouts above their neckline resistances, which would confirm a trend reversal and trigger a new uptrend.

Final Thoughts

If APT and SEI follows the the double bottom pattern, a strong bullish trend could emerge. If they fail to hold their support zones, further downside could follow. Traders should closely monitor market conditions in the coming weeks before making any moves.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.