Analysis: The recent $82,000 could be a key support level for BTC, which will be seriously affected by macroeconomic factors in the short term

According to Cointelegraph, Iliya Kalchev, a Dispatch analyst at the Digital Asset Investment Platform Nexo, stated that Bitcoin prices will continue to be pressured by macroeconomic developments and global trade issues. Next week everyone's attention will turn to major economic events in the United States, including the Consumer Price Index which is expected to indicate a slowdown in inflation rate. The job vacancy report will be a key indicator of labor market strength and potential for interest rate cuts. Due to disappointing US Bitcoin reserves, Bitcoin faces the risk of closing below $82,000 in a single week. If Bitcoin breaks this critical price support level of $82,000 it could trigger liquidation of leveraged long positions worth $1.13 billion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The US Dollar Index rose by 0.14% on the 14th.

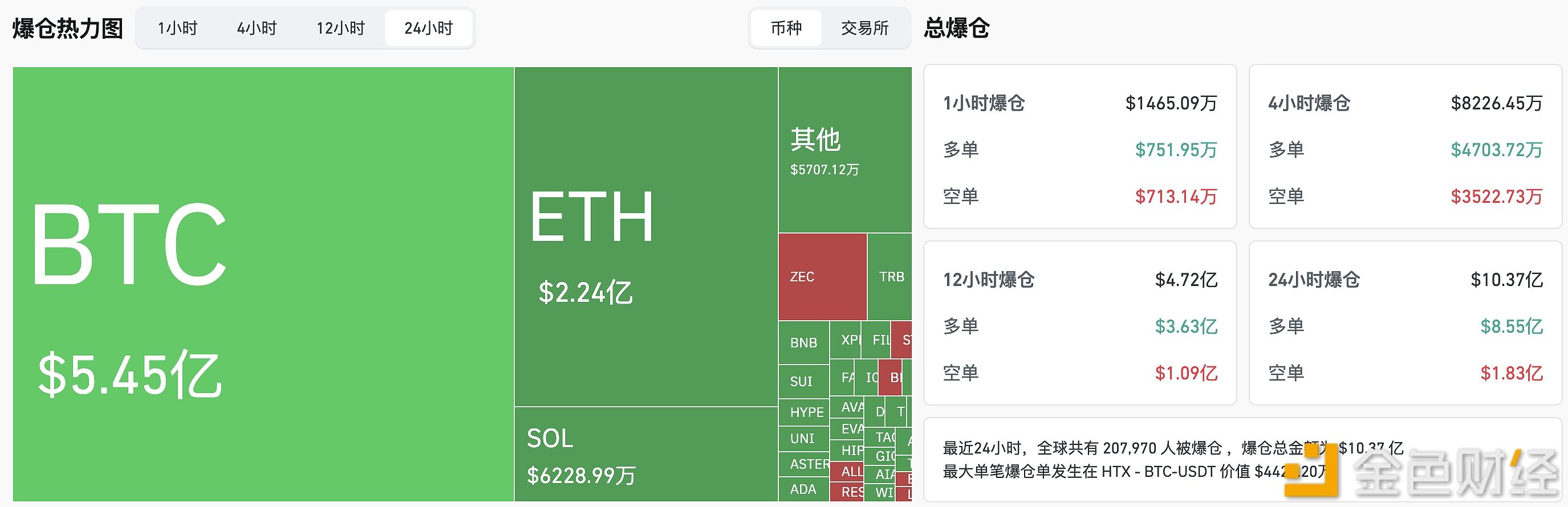

In the past 24 hours, liquidations across the entire network reached $1.037 billion.

Data: 100 WBTC transferred out from Galaxy Digital, worth approximately $9.51 million

Data: 1.927 million ENA flowed into a certain exchange's Prime, worth approximately $5.51 million