U.S. SEC and Dinari Meet to Discuss Details of Multi-Chain Tokenized Securities Trading System Proposal

Odaily Planet Daily reported that the U.S. Securities and Exchange Commission (SEC) has announced a meeting with representatives from blockchain financial firm Dinari and the law firm Wilmer Cutler Pickering Hale and Dorr. The parties discussed approaches to addressing regulatory issues related to crypto assets, including providing more details about their proposal to operate a tokenized securities trading system that supports multiple blockchains, as well as the legal framework under which the system would operate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

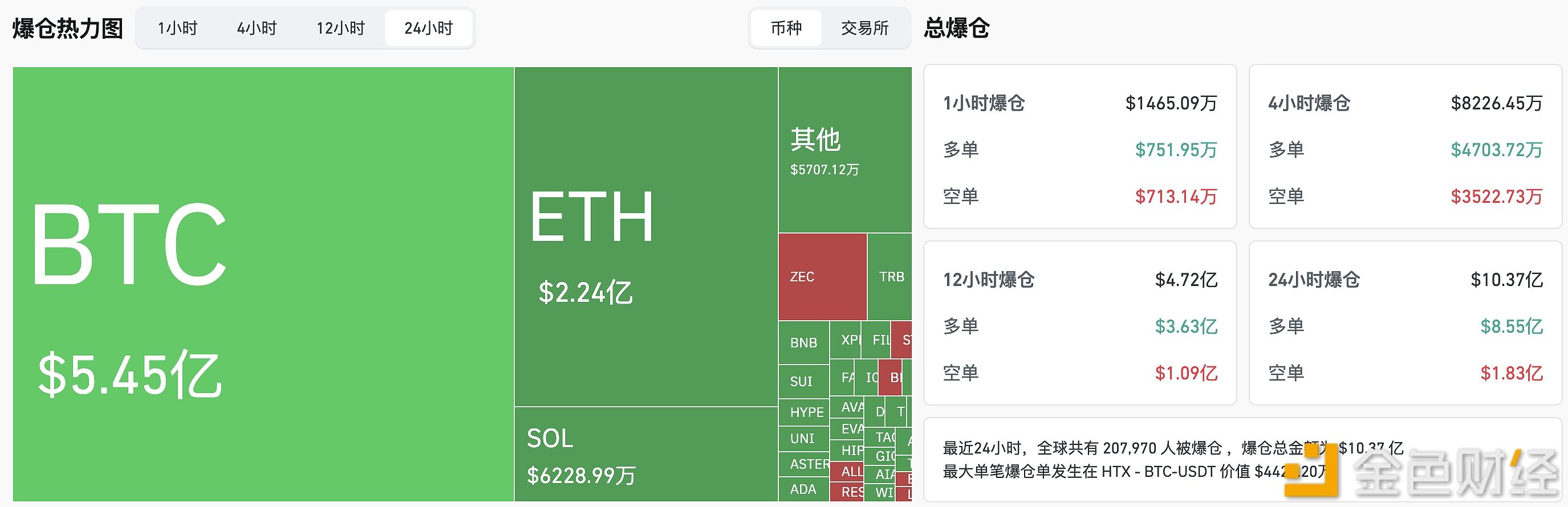

In the past 24 hours, liquidations across the entire network reached $1.037 billion.

Data: 100 WBTC transferred out from Galaxy Digital, worth approximately $9.51 million

Data: 1.927 million ENA flowed into a certain exchange's Prime, worth approximately $5.51 million

Data: If ETH breaks through $3,353, the total short liquidation intensity on major CEXs will reach $1.11 billions.