New TRON-linked leveraged ETF filing joins wave of crypto funds awaiting SEC approval

Quick Take The SEC is weighing dozens of crypto ETF proposals, from ones that track SOL to DOGE. The fund “seeks daily leveraged investment results,” and is significantly different from other ETFs, according to that filing.

A new registration filing has been made for an exchange-traded fund that tracks the daily performance of TRON, adding to the list of funds waiting for the U.S. Securities and Exchange Commission's green light.

ETF Opportunities Trust submitted a filing on Thursday for the "T-REX 2X Long TRON Daily Target ETF," which "seeks daily leveraged investment results" and is significantly different from other ETFs, according to that filing.

"As a result, the Fund may be riskier than alternatives that do not use leverage because the Fund’s objective is to magnify (200%) the daily performance of TRON," according to the filing. "The Fund will utilize total return swaps that provide exposure to exchange-traded funds or other exchange-traded products that invest in spot TRON or TRON derivatives such as swaps or futures contracts."

The fund sponsor is REX Shares, LLC. A custodian is not listed yet. TRON, created by entrepreneur Justin Sun, has a market capitalization of $27.6 billion, according to The Block's price page . Sun has come into the spotlight following his support for President Donald Trump's presidency this past year, and is notably one of the top holders of the TRUMP memecoin.

The SEC is weighing dozens of crypto ETF proposals, from ones that track SOL to DOGE in the face of a friendlier regulatory environment for crypto since Trump took office in January. The first approved "staking ETF," tacking Solana's native SOL token, was launched in early July , an indication the securities watchdog may be more willing to approve more exotic exchange-listed products.

The agency is weighing a framework that would expedite the process for listing ETFs. Standards under discussion may include metrics such as market capitalization, decentralization, and wallet distribution, a source told The Block this week.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Market sentiment in the crypto space remains fragile; even the positive news of the "U.S. government shutdown" ending failed to trigger a meaningful rebound in bitcoin.

After last month's sharp drop, Bitcoin's rebound has been weak. Despite traditional risk assets rising due to the US government reopening, Bitcoin has failed to break through a key resistance level, and ETF inflows have nearly dried up, highlighting a lack of market momentum.

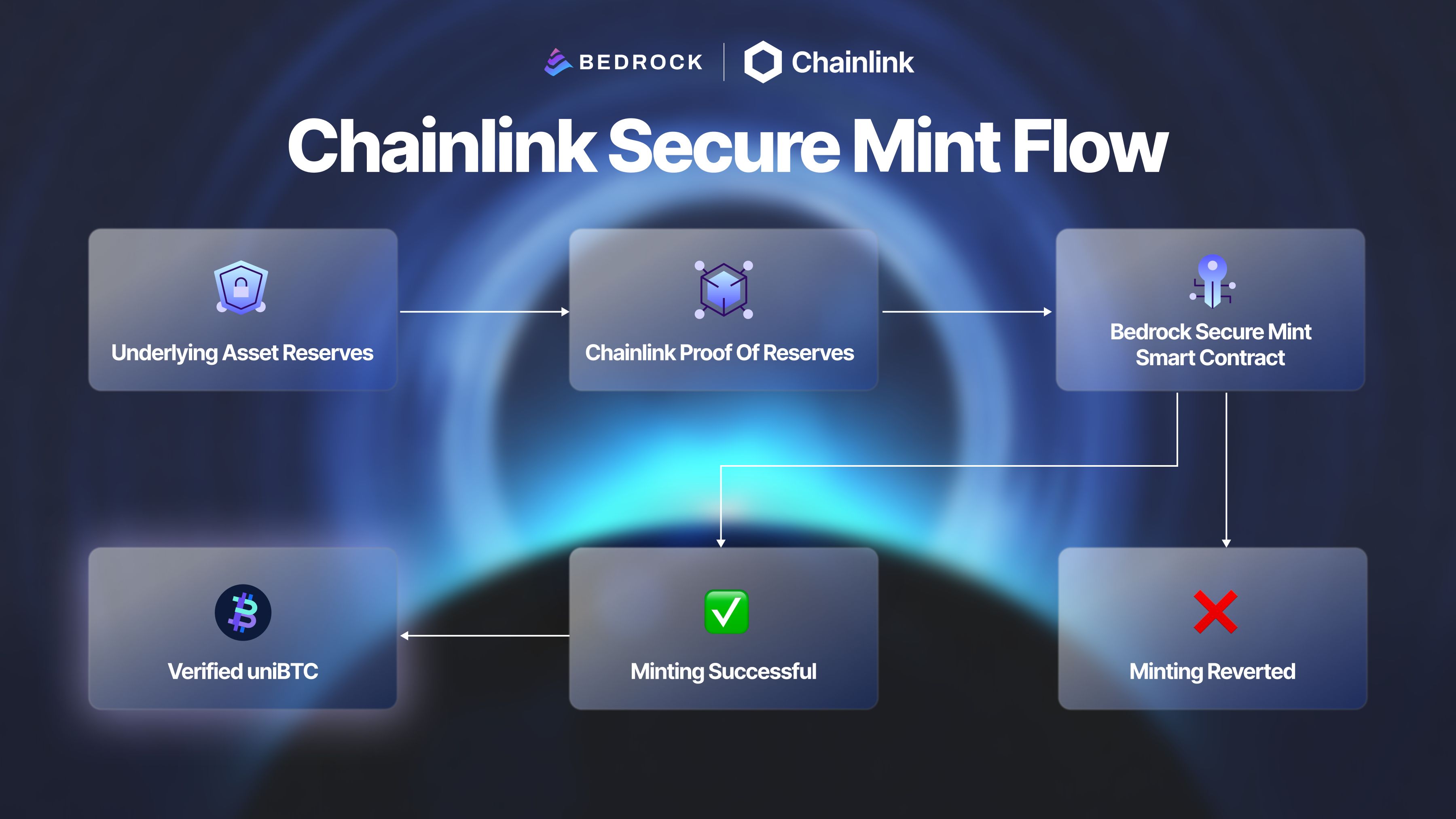

How Bedrock Strengthens BTCFi Security With Chainlink Proof of Reserve and Secure Mint

By winning the championship with Faker, he earned nearly $3 million.

Faker's sixth championship also marks fengdubiying's legendary journey on Polymarket.

Trending news

MoreMarket sentiment in the crypto space remains fragile; even the positive news of the "U.S. government shutdown" ending failed to trigger a meaningful rebound in bitcoin.

Bitget Daily Digest (Nov 12)|Solana financial firm Upexi posts record quarterly results; Nick Timiraos: “Fed increasingly divided over December rate cut”; Injective launches native EVM mainnet, advancing MultiVM roadmap