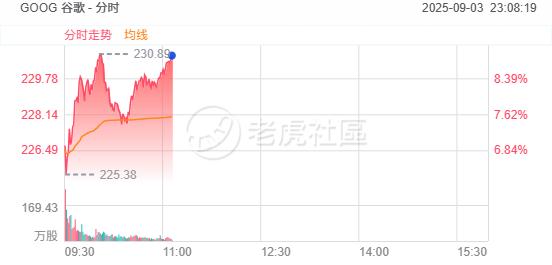

Google rises nearly 9%, hitting a new intraday all-time high

On September 3, Google surged nearly 9%, reaching a new intraday all-time high, following its victory in an antitrust case, allowing Chrome browser to avoid being sold.

In terms of news:

A judge in Washington, D.C. ruled on Tuesday that Google, under Alphabet, must share data with competitors and open up competition in the online search market, while rejecting prosecutors' request for Google to sell its Chrome browser. In addition, Google is not required to divest its Android operating system. Google also plans to appear in court in September to respond to another lawsuit filed by the U.S. Department of Justice, in which the judge has already ruled that Google holds an illegal monopoly in the online advertising technology sector, with remedies to be decided at that time. The two lawsuits brought by the U.S. Department of Justice against Google are part of a broad bipartisan crackdown on major tech companies in the United States, an initiative that began during President Trump's first term and involves Meta Platforms, Amazon, and Apple.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Importance of x402 for Stablecoin Payments

X402+ stablecoins and on-chain crypto infrastructure will gradually and continuously impact the existing payment system. This not only involves the use of stablecoins, but also transfers money, credit, identity, and data into a parallel financial universe.

From "Crime Cycle" to Value Reversion: Four Major Opportunities for the Crypto Market in 2026

We are currently experiencing a "purification" that the market needs, which will make the crypto ecosystem better than ever before, potentially improving it tenfold.

SociFi dream shattered? Farcaster pivots to focus on the wallet track

Past data has shown that the "social-first strategy" is ultimately unsustainable, as Farcaster has consistently failed to find a sustainable growth mechanism for a Twitter-like social network.

Crypto tycoons spend eight-figure annual security fees, just to avoid incidents like Bluezhanfei's experience.

No one understands security better than the crypto industry leaders.