- Aster resolves XPL trading issue with full USDT reimbursement

- Compensation issued to all affected perpetual traders

- Swift action taken to restore user trust and platform integrity

Aster, a decentralized trading platform, has promptly responded to a recent trading incident involving the XPL perpetual pair. Following abnormal price fluctuations, the platform identified affected users and has fully reimbursed them with USDT, ensuring that no trader suffered financial losses due to the glitch.

This move has been welcomed by the community, reflecting Aster’s commitment to user protection and system integrity. Many users praised the swift handling of the issue, which helped avoid wider concerns over market manipulation or system failure.

What Happened with XPL Perpetuals?

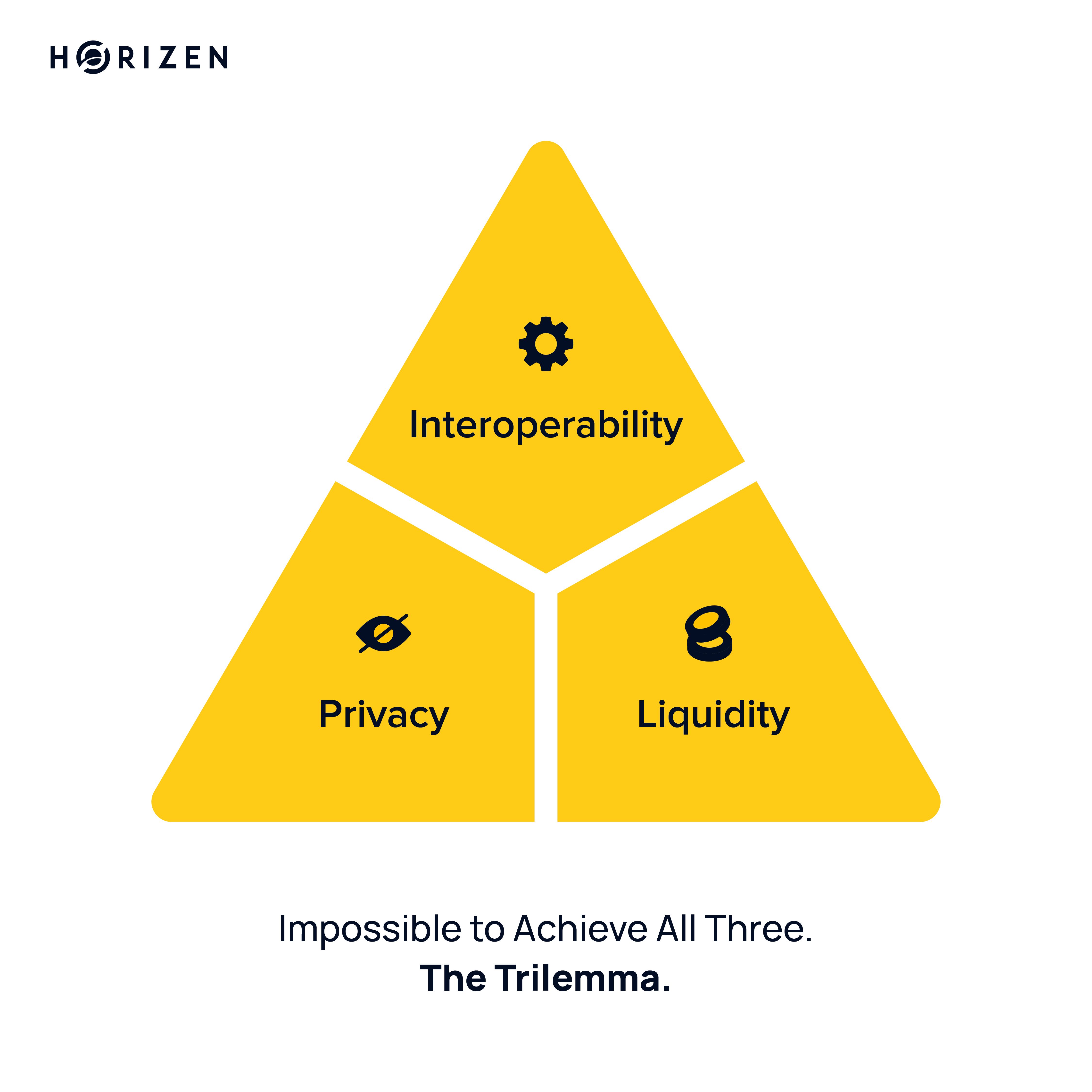

The incident involved unexpected price behavior in the XPL perpetual futures market. Though Aster hasn’t provided full technical details yet, such events typically arise due to liquidity issues, sudden order book imbalances, or bugs in price feed mechanisms.

The team acted quickly to pause affected trading, review all impacted positions, and calculate fair compensation based on users’ losses. The full amount was distributed in USDT, a stablecoin, ensuring stable value reimbursement for all users.

Community Reaction and Trust Rebuilding

Reactions from the trading community have been largely positive. In the fast-paced world of crypto derivatives, how a platform responds to incidents often matters more than the incident itself. Aster’s transparency and speed in processing refunds helped reinforce user confidence.

Moving forward, Aster may implement additional safeguards to prevent similar issues, such as improved monitoring of price feeds, enhanced circuit breakers, and regular audits.

Read also:

- Ethereum Key Levels to Watch This Week

- Why This Could Be Ethereum’s Bottom Zone

- Jeffrey Wilcke Moves $6M in ETH to Kraken

- Aster Compensates Users Affected by XPL Price Glitch

- Bitcoin Drops Below Support: Is the Worst Over?