Crypto Analytics Firm Unveils Two Factors That Could Trigger ‘Historically Bullish Setup’ for Bitcoin – Here’s the Outlook

Crypto analytics platform Swissblock says two factors could combine to trigger a massive rally for Bitcoin ( BTC ).

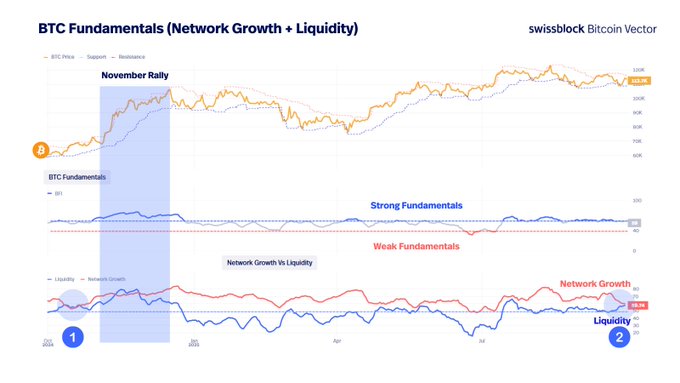

According to Swissblock, an increase in liquidity and the number of Bitcoin users are the ingredients necessary for the formation of a “historically bullish setup.”

“Liquidity remains strong. Unlike true bear markets, liquidity is not collapsing.

Network Growth dipped slightly while liquidity held up (2).

The last time this setup occurred? October 2024 (1), right before the big rally into November.”

Source: Swissblock

Source: Swissblock

According to Swissblock, Bitcoin is in the “process of finding a bottom,” a phenomenon which has historically been marked by the Aggregated Impulse Signal falling to zero.

The Aggregated Impulse Signal, an indicator calibrated from 0 to 100 that gauges market momentum and selling pressure, is used to identify potential bottoms.

“Markets move in cycles of stress and recovery.

When stress peaks, short-term traders are forced to sell at a loss.

Capitulation stress often mark the end of downside phases, setting the stage for recovery…

…At that exact point, the Impulse Signal collapses to zero.

That’s the moment panic exhausts and new buyers step in.

Since early 2024, this reset has only happened 3 times.

Each one marked a cycle bottom.

Each one was followed by a sustained recovery.

We are approaching that setup again.”

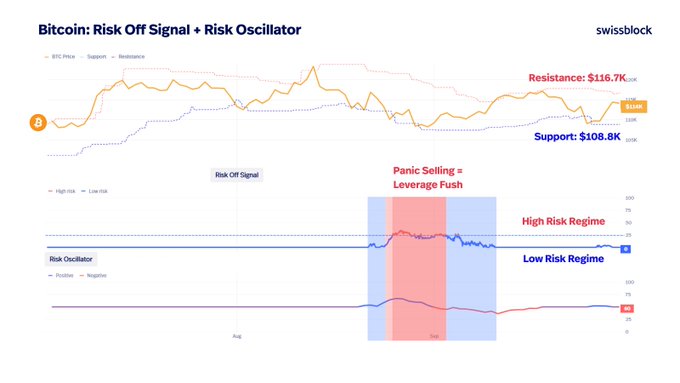

Swissblock further says that Bitcoin experienced the “sharpest wave of panic selling” this cycle from late August to early September.

“That flush cleared excess leverage and reset the market back to cost basis.

This is how bottoms are built.”

Source: Swissblock

Source: Swissblock

Bitcoin is trading at $116,592 at time of writing.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DASH Aster DEX Integration: Strategic Impact on Institutional Cryptocurrency Adoption

- Aster DEX's hybrid AMM-CEX model boosted TVL to $17.35B post-TGE, attracting institutional investors with multi-chain interoperability and dual-income mechanisms. - Binance's CZ purchasing $2M DASH tokens triggered 30% price surge, signaling institutional confidence despite unconfirmed DASH-Aster partnership. - Regulatory risks and October 2025 cybersecurity incident highlight operational challenges, though delayed token unlocks prioritize ecosystem stability. - The listing represents strategic DeFi adop

Dash Coin Value Climbs 4.86% Amid Strategic Growth and Positive Analyst Revisions

- DASH surged 4.86% in 24 hours, driven by strategic expansions and upgraded analyst sentiment. - Partnerships with Coco Robotics and Old Navy expanded delivery services and diversified revenue streams. - Q3 2025 results showed 49.2% gross margin and 0.34 debt/equity ratio, supporting bullish analyst price targets up to $260. - Technical analysis identified $208 breakout and $200 support levels, aligning with positive backtest results showing 28% average gains post-earnings.

Internet Computer (ICP) Experiences a Surge: What Factors Are Fueling the Latest Uptrend?

- Internet Computer (ICP) surged in late 2025 due to blockchain infrastructure upgrades and rising DeFi adoption. - Key innovations like Fission, Protium, and Chain Fusion enhanced scalability, interoperability, and cross-chain integration with Bitcoin , Ethereum , and Solana . - AI-powered Caffeine platform boosted TVL by 22.5% and drove 1.2M active wallets, supported by partnerships with Microsoft and Google Cloud. - Despite record $1.14B trading volume, ICP faces challenges in closing its TVL gap with E

Bitcoin Updates Today: Cardone Blends Real Estate and Bitcoin in a Strategic Move to Navigate Market Fluctuations

- Cardone Capital increased Bitcoin holdings to 888 coins while acquiring a $235M Florida multifamily property. - The hybrid strategy combines real estate stability with crypto growth, reinvesting $10M annual property income into Bitcoin. - Grant Cardone emphasized using real estate profits to hedge volatility, with 935 new Bitcoin purchases funded by cash flows. - Institutional Bitcoin adoption grows as Harvard allocates $443M to crypto ETFs, mirroring Cardone's diversified approach. - The model contrasts