Key Market Information Discrepancy on October 15th - A Must-Read! | Alpha Morning Report

1.Top新闻:鲍威尔暗示支持进一步降息,因美国就业市场降温 2.代币解锁:$SEI

Top News

1.Powell Suggests Support for Further Rate Cuts as U.S. Job Market Cools

2.BNB Chain and Four.Meme's First Batch of "Rebirth Support" Airdrop Has Been Successfully Distributed

3.Farcaster Announces Suspension of Deposit Bonus Event Registration

4.Binance Denies Allegations of Charging Listing Fees and Dumping Tokens

5.Over $697 Million Liquidated Across the Network in the Past 24 Hours, Over 200,000 People Liquidated

Articles & Threads

1. "The Enrichment of Those Who Quietly Get Rich Through Arbitrage on Polymarket"

After receiving a $2 billion investment, Polymarket is valued at $9 billion, one of the highest funding amounts a project in the Crypto space has received in recent years. For those who know how to truly make money on Polymarket, this is a golden age. While most people treat Polymarket as a gambling den, smart money sees it as an arbitrage tool. In the following in-depth article, BlockBeats interviewed three seasoned Polymarket players to dissect their money-making strategies.

2. "Can We Still Call the Coins We Are Speculating on Meme Coins?"

The "1011" flash crash came so suddenly that upon waking up, everyone's attention followed the market's bloodbath. Nevertheless, despite this, with the market quickly recovering, especially with $BNB hitting an all-time high, the BSC meme market remains very active. The various discussions about the BSC meme coin market, although no longer the top hot topic where "gods are fighting", are still worth further consideration.

Market Data

Daily Market Overall Capital Heat (reflected by funding rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

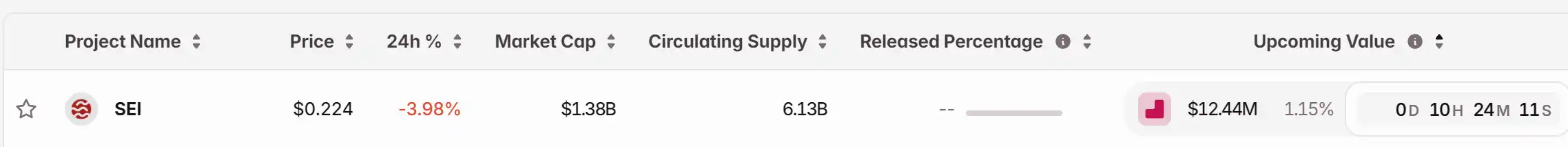

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dash's Price Soars 150%: Temporary Volatility or the Start of a Lasting Rally?

- Dash (DASH) surged 150% in June 2025, driven by Platform 2.0 upgrades, institutional adoption, and pro-crypto policies. - Institutional inflows ($780M+), cross-chain interoperability, and retail payment integrations boosted DASH's utility and speculative demand. - Privacy features and 0.80 Bitcoin correlation fueled gains, but 77% PrivateSend opacity and regulatory risks question sustainability. - DASH's future hinges on balancing privacy-transparency trade-offs, macroeconomic clarity, and expanding merc

Investing in Educational Technology as Demand for AI and STEM Expertise Grows

- Global EdTech market valued at $277.2B in 2025 is projected to surge to $907.7B by 2034, driven by AI integration in personalized learning and VR/AR tools. - Investors prioritize platforms aligning academic programs with AI/STEM workforce needs, achieving 20-75% higher ROI through systemic AI adoption across institutions. - Case studies like MIT's $350M AI college and OpenClassrooms' 43,000 career-advancing learners demonstrate scalable ROI from workforce-aligned education models. - Despite uneven AI int

Zcash’s Unpredictable Rise: Immediate Drivers and Future Outlook for Privacy

- Zcash (ZEC) rebounded 20% after a 55% drop, testing $375 as liquidity events and technical indicators fueled short-term optimism. - RSI/MACD signals suggest potential $475 breakout if bulls reclaim $375, though ZEC remains 57% below its 2025 peak. - Institutional adoption grows with Grayscale Zcash Trust assets surging 228%, driven by optional privacy tech attracting both retail and institutional users. - Regulatory scrutiny under MiCA and FinCen rules, plus Zcash's hybrid privacy model vs. Monero/Dash,

Zcash Halving and Its Impact on the Cryptocurrency Market

- Zcash’s 2028 halving will reduce block rewards by 50%, mirroring Bitcoin’s scarcity-driven model. - Historical data shows pre-halving price surges, fueled by FOMO and social media-driven hype cycles. - Behavioral economics highlight crypto markets’ reliance on narratives over fundamentals, with sentiment driving 30% of short-term price swings. - Zcash faces adoption challenges despite robust privacy tech, as regulatory uncertainty and competition limit its market share growth. - The 2028 event tests whet